Rewritten WordPress Content with SEO Optimization

Are you struggling with cryptocurrency trading profitability? In 2025, I discovered that my crypto portfolio wasn’t growing because I was making critical trading mistakes on both losing and winning positions. Despite having a well-researched trading plan, consistent profitability remained elusive until I addressed these fundamental errors in my trading psychology.

This comprehensive guide offers a transformative perspective shift for cryptocurrency traders making two common but devastating mistakes: cutting losses too late (losing more than necessary) and taking profits too early (earning less than possible). By understanding the psychology behind these errors, you’ll develop the mindset needed for sustainable crypto trading success in today’s volatile market.

Building Wealth Through Effective Money Management Skills

Did you know that just ten minutes of daily financial education can transform your wealth trajectory? By applying proven money principles consistently, you can develop the skills needed for crypto trading success.

Wealth building follows three fundamental steps: earning money efficiently, preserving capital intelligently, and growing investments strategically. These principles apply equally to cryptocurrency markets and traditional finance.

Even with modest income sources, financial independence becomes attainable through disciplined habits. By consistently setting aside just $20 weekly and leveraging the power of compound interest, you create a foundation for significant wealth accumulation that will support your cryptocurrency trading journey.

RELATED: A Simple Plan To Become A Millionaire Through Strategic Cryptocurrency Investing

The primary obstacle preventing most aspiring crypto traders from achieving financial freedom isn’t lack of knowledge—it’s psychological resistance to capital preservation and growth. Many traders haven’t developed positive emotional associations with saving and investment growth.

Instead, immediate gratification drives spending behavior, making traders vulnerable to predatory lending tactics that promise instant satisfaction through “easy payments.” This consumer mindset creates a wealth-draining cycle where you inadvertently fund others’ financial growth through interest payments rather than building your own cryptocurrency portfolio.

Explore our complete video series on trading psychology to rewire your emotional responses around money retention and growth—essential mindset shifts before addressing specific trading mistakes that limit your profitability.

Overcoming common crypto trading errors requires both intellectual understanding and practical application. Let’s examine the psychological patterns undermining your trading performance and develop actionable solutions to transform your results.

Loss-Magnifying Mistake: The Dollar-Cost Averaging Trap

The first category involves punishing mistakes that increase losses unnecessarily. These errors provide immediate negative feedback through financial pain, often leading traders to either develop better risk management or abandon trading entirely. While losses are inevitable in trading, implementing proper risk control strategies can significantly minimize their impact. The most destructive pattern in this category is the dollar-cost averaging mistake, where traders irrationally increase position sizes as prices move against them.

Profit-Limiting Mistake: The Premature Exit

The second category encompasses opportunity-cost mistakes that go unnoticed. These errors don’t trigger immediate pain but silently erode potential profits. Without clear indicators highlighting missed opportunities, many traders remain unaware of how significantly these mistakes impact their bottom line. Later in this series, we’ll reveal professional tactics to maximize winning trades through strategic position management—turning modest winners into significant profit generators.

When both error types operate simultaneously in your trading—magnifying losses while limiting gains—even breaking even becomes a struggle. This creates a frustrating cycle where your trading knowledge doesn’t translate into financial results. Fortunately, these patterns can be systematically corrected through proper education and consistent implementation of proven risk management techniques.

With dedicated practice and the right strategic approach, you can overcome these destructive trading patterns and develop the discipline needed for consistent cryptocurrency trading success in 2025 and beyond.

The Psychology Behind Crypto Trading Mistakes: Understanding Fear and Greed

The root cause of most cryptocurrency trading errors stems from two primal emotions: fear and greed. These powerful psychological forces influence decision-making for both novice and experienced traders.

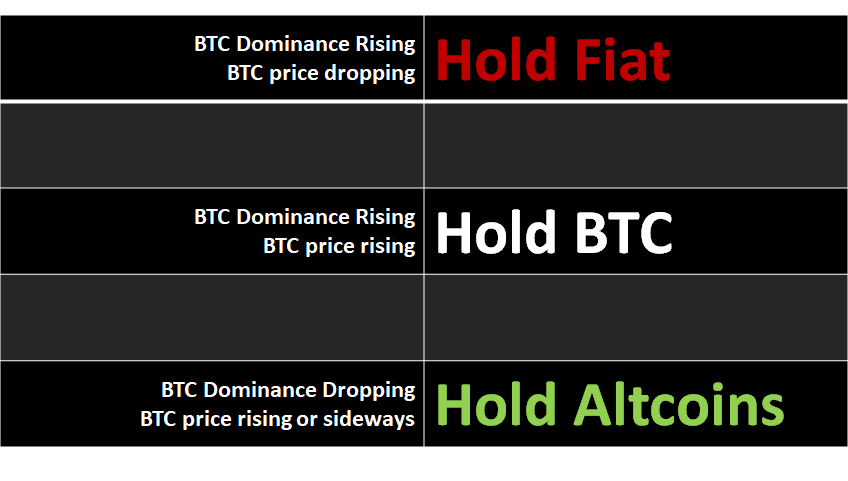

What differentiates profitable traders from struggling ones isn’t the absence of these emotions—it’s when and how they experience them. Successful cryptocurrency traders experience fear and greed at precisely opposite moments compared to unsuccessful traders, creating dramatically different trading outcomes from identical market conditions.

Let’s examine this psychological contrast through real-world trading scenarios that reveal why some traders consistently profit while others struggle with the same market opportunities.

The Psychology of Loss Management: Fear vs. Opportunity

Imagine two traders entering identical cryptocurrency positions that immediately move against them. Their psychological responses to this adversity create vastly different financial outcomes.

The successful trader immediately experiences protective fear—a rational response that triggers quick action to preserve capital. This leads to promptly exiting the position, accepting a small loss, and preserving capital for future opportunities. Meanwhile, the struggling trader interprets price decline as an enhanced buying opportunity, experiencing misplaced greed at precisely the wrong moment.

This second trader often rationalizes through flawed averaging logic: “If I bought 100 coins at 100 satoshi and now they’re 80 satoshi, buying another 100 gives me 200 coins at a 90 satoshi average—I’m only down 10 satoshi per coin!” This mathematical sleight-of-hand masks the reality of poor risk management and creates dangerous psychological comfort while increasing exposure to a failing position.

This fundamental risk management failure compounds losses unnecessarily.

As prices continue declining, the position size grows disproportionately large until emotional pain forces an exit at maximum loss. This traumatic experience creates anxiety that negatively impacts future trading decisions, beginning a destructive psychological cycle that’s difficult to break without proper education.

Successful cryptocurrency trading requires emotional alignment with effective risk management principles.

Approach each trade with confidence built on preparation, not hope—using clear entry criteria, predetermined stop-loss levels, and position sizing appropriate to your portfolio’s risk tolerance.

The Psychology of Profit Maximization: Greed vs. Premature Satisfaction

In our second scenario, both traders enter positions that move favorably, creating profitable opportunities with dramatically different outcomes based on psychological responses.

The profitable trader experiences strategic greed when proven correct—a positive response that leads to increasing position size in a validated trend. This calculated risk amplifies profits in positions already demonstrating their validity through market action. Conversely, the struggling trader feels premature satisfaction and fear of losing accumulated profits, triggering an early exit that severely limits potential gains.

As the price continues its favorable trajectory, the trader who exited prematurely experiences increasing anxiety and FOMO (fear of missing out), creating psychological baggage that impairs decision-making in subsequent trades. This creates a self-reinforcing cycle of underperformance despite having correctly identified profitable opportunities.

Most aspiring cryptocurrency traders fail not by misidentifying market opportunities but by mismanaging positions through poor emotional responses. They experience larger losses and smaller profits than necessary, creating a challenging environment where even breaking even becomes difficult.

Transform Your Trading Psychology Through Community Support

Accelerate your cryptocurrency trading development by joining our exclusive trader community at DigitalCurrencyTraders. Daily interaction with experienced crypto traders helps rewire your emotional responses to market conditions—you’ll develop both the technical knowledge and psychological habits essential for consistent profitability in today’s volatile cryptocurrency markets.

While building your cryptocurrency savings foundation, develop proper trading psychology by studying market behavior without pressure. The emotional management skills required for successful trading can be systematically developed through proper education and practice.

When you consistently limit losses through disciplined exits while maximizing profits through strategic position management, you create a powerful compounding effect on your cryptocurrency portfolio. This virtuous cycle enables larger position sizes with controlled risk, dramatically accelerating your wealth-building potential in the crypto market!

Begin with paper trading and backtesting to develop technical skills without financial risk. While these simulation methods provide valuable strategy insights, they don’t replicate the crucial emotional components of live trading. Understanding how fear and greed influence your decision-making is essential for implementing even the most technically sound cryptocurrency trading strategies.

Armed with this understanding of how typical traders sabotage their results through psychological responses, you’re ready to implement systematic solutions that transform your trading performance. By consciously managing emotional responses, you’ll make decisions that consistently preserve capital during drawdowns while maximizing profits during favorable market conditions.

Two Mistakes all crypto traders make:

— introtocryptos.ca (@introtocryptos) January 15, 2023

Most new traders believe they are responsible for making money in their trading… but this is not our job at all. Successful traders know their job is all about managing risk.https://t.co/EnN6sqM6ca#CryptoTwitter #cryptotrader

Subscribe to our channel and enable notifications to receive our upcoming video on advanced psychological techniques for cryptocurrency traders. You’ll discover additional ways fear and greed may be undermining your trading performance and learn proven strategies to transform these emotions into powerful allies for consistent profitability!