- If you want to skip the complex tech of cryptocurrency

- If you have no idea when to position for altcoin season

- And you want to invest in crypto without watch the charts

Then this guide is for you.

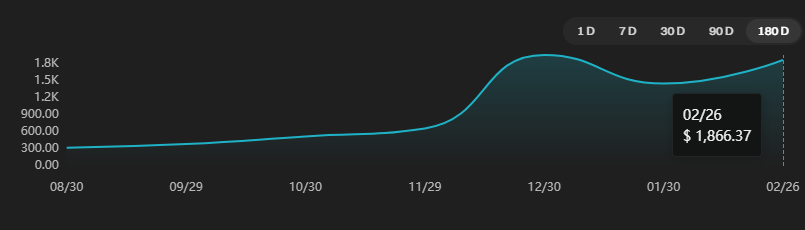

I’ll share the exact pattern I used with a live copy trading account to grow a small crypto portfolio by over 450% in the past 149 days.

No leverage. No day trading.

My Money Works For Me

Today I’ll share one of the four legs of our financial chair that will help ensure that you reach your financial goals sooner.

The approach I’ll share today actually has the power to…

entirely transform your crypto investing experience.

You can go from

- stressed

- uncertain

- addicted to the charts…

…to

ツ calmly managing all your positions in just 20 minutes per day.

How I Made $352 For Free

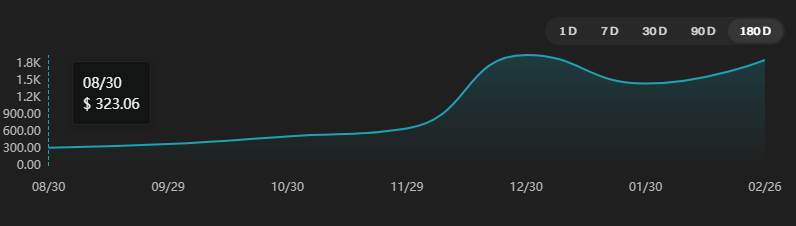

This profit story actually began in September 2023 when I discovered that my referral earnings had accumulated over three hundred fifty dollars.

After searching through the charts at the time, I selected BAKE and I put the free money into the token and left it sit for more than two months before the big price breakout. (watch the video)

Throughout January, the BAKE holding profits were taken and the equity was dedicated to a Copy Trading account.

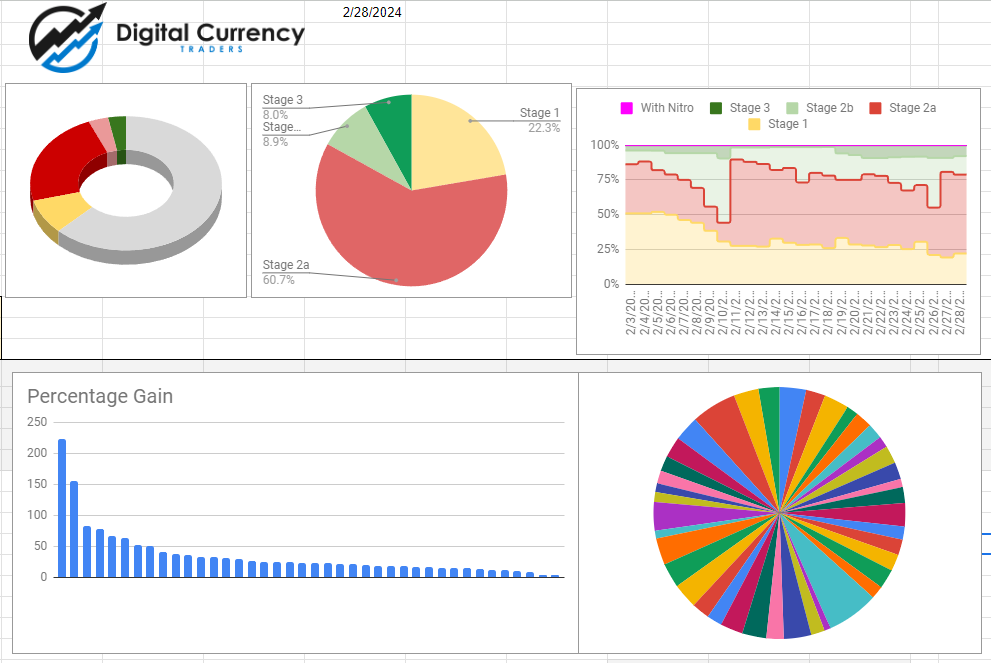

The Copy Trading account has been connected to our PRO ALERTS trade tracking spreadsheet.

Recently the original investment profits were reallocated into a range of 40 different coins and tokens at minimum trade size.

How it began:

$323 Value on September 30 2023

$1866 Value on February 26 2024

WHY This Strategy Is Amazing

Bitcoin gained an astonishing 90% during this time, yet our portfolio did better.

Here’s why:

This 20-minute-per-day crypto strategy combines three components to time the market entries and exits:

- AltSeason CoPilot market trends

- Small diversified positions

- Timing each market with the 1-2-3 pattern

Over the past 149 days this strategy has provided us with yet another fantastic case study to share and study here today.

Trade the pattern, not the market.

Are You Trading or Positioning?

➟ Before –

Trading cryptocurrency can be a daunting task.

First you have to learn…. how to find the trades that you’ve supposed to take.

And if you’re trading hasn’t been successful in the past couple years…

Most traders work harder… spending countless hours researching.

Only to face high volatility, changes in regulations, and unexpected price swings.

Even with the most diligent efforts, many traders end up with minimal returns or even losses.

You feel like you have been wasting time and money on small time frame trading patterns that don’t pay off – its discouraging and frustrating.

➟ After –

Spend only minutes each day to position a portfolio with dozens of coins and tokens.

That was all I did for this account to grow.

With the right strategy, you need only spend a few minutes each day to position your equity at the times and places where substantial growth is possible.

No More Chart Watching?!

➞ What would happen if you could take your mind off the charts?

➞ What if your money worked for you while you were doing something else?

➞ What if you no longer put hours per day into news and research?

➞ What are the things you love – that you have been putting off until after your trading is successful?

Pro Tip:

I’m so excited to illustrate the patterns that I use to position my own crypto.

Here are three keys:

☲ ➀ ☲

Time my investments around the AltSeason CoPilot

☲ ➁ ☲

Focus on the pattern and not the market

☲ ➂ ☲

Diversify the portfolio a little each day

I didn’t know in advance which coins might achieve these returns.

I diversified into many coin and tokens and for this post I’m highlighting two of the best performers.

I share these strategies so you gain belief in your ability to make money work for you.

Lets start with two charts that our copy trading profile is now showing greater than 100% profits.

I’ll show you the exact pattern that was my signal to get in.

You will immediately begin to spot this pattern in other crypto markets.

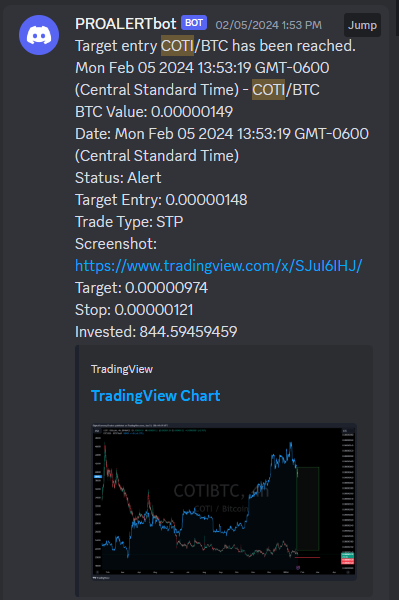

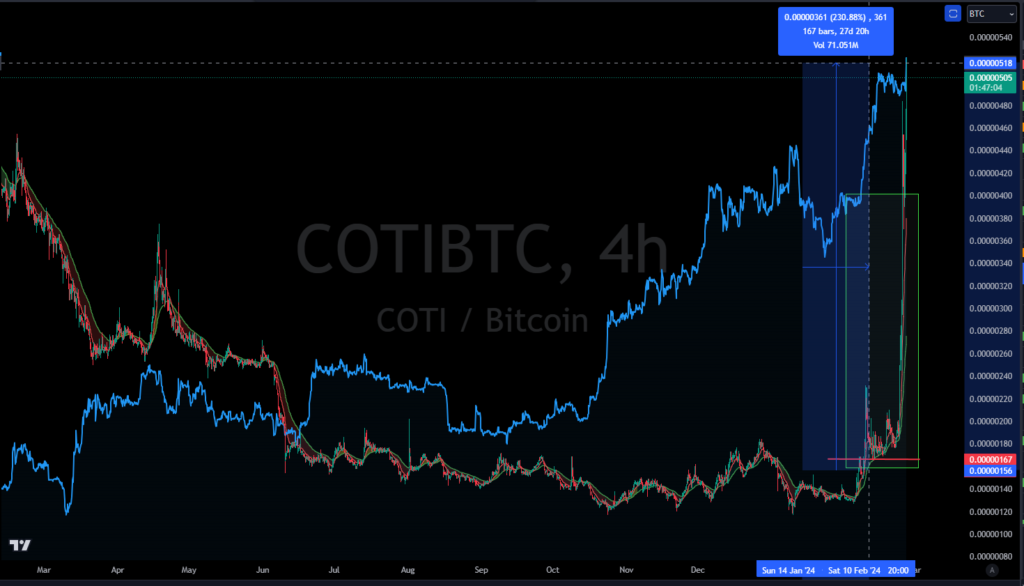

Case Study One

COTI Chart:

The ALERT for this trade was published on January 23.

The spreadsheet monitored prices and the Signal was fired on February 5.

Where is it now?

Currently the trade stands over 200% open profits:

The stop loss is way behind price to give this market lots of room consolidate. This is in Stage 3 of The Trade.

We have managed risk and we have been proven correct on this entry.

Nothing for us to do here – even if prices retrace…

Results/benefits:

This trade has proven correct and we are in profit.

In addition to watching a range of exit strategies to select from as time continues and the price pattern fills out, we are also watching for opportunities to add on to the successful trades that have proven correct.

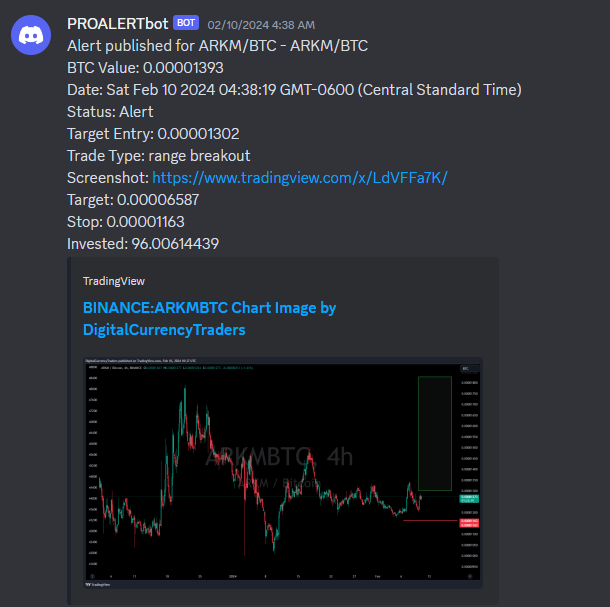

Case Study Two

ARKM Chart:

The ALERT for this trade was published on early morning February 10

and the Signal was fired soon after on the same morning, Feb 10:

currently the open trade stands at

and the stop loss is way behind in order to let the market have room to be wild.

Benefits of This Approach:

These are fantastic example trades that have proven correct and we are in profit.

We are in Stage 3 of the trade. Stop is above the entry and risk is managed.

Now we review potential for adding on to the trade on the correct style of pull back – and also be ready for different exit strategies.

We’ll select which Stage of the Trade matches the current market conditions…

Prepare to add on with Stage 4

Prepare to exit to Stage 5

How it Works

Step 1: Keep an eye on AltSeason CoPilot data which historically identifies trends of significant price movements.

Step 2: Focus on cryptocurrencies that match our trading pattern, to spread opportunity to capitalize on various market sectors.

Step 3: Manage risk for each trade in the portfolio by investing in small initial positions.

Step 4: Rebalance your portfolio in 20 minutes per day as each coin achieves signal for the next stage of the trade.

Step 5: Stop watching the charts.

Build Healthier Trading Habits

- Can you see the benefit of positioning instead of trading?

- Would you rather save time and stress, instead of day trading the volatile crypto market on leverage?

- Imagine if your portfolio grew by 450% in just minutes per day. How much more freedom would you have?

- If you could change the way you trade so that you don’t have to watch the charts, how do you see that your life would be different than it is now?

We want our crypto to grow while we’re doing something else.

In other words if your system is set up correctly it will not take time from you through the day. You will not have to watch the charts.

The Value of a Proven Approach

Myself and my team put in years research, countless hours of the stress, of trial and error, and hundreds of thousands of dollars invested to develop and refine this strategy.

Yet all that means nothing for you – if you keep doing things the old way.

The Cost of Old Habits

What if you don’t do anything about this and you keep addicted to the charts and jumping in and out of trades too often?

Well, I want to save you all of that… and give you free access to my course and all my data – for 7 days.

The value this strategy can be fully unlocked simply with your commitment to learn.

The value this strategy can be fully unlocked simply with your commitment to practice these principles.

This can transform your your daily route, and just maybe your financial future as well.