Understanding how Bitcoin Dominance affects altcoin season can provide insight into profit opportunities in the overall trends of the cryptocurrency market. Bitcoin dominance, bitcoin price, and altcoin season are all interconnected with Stable Coin Dominance.

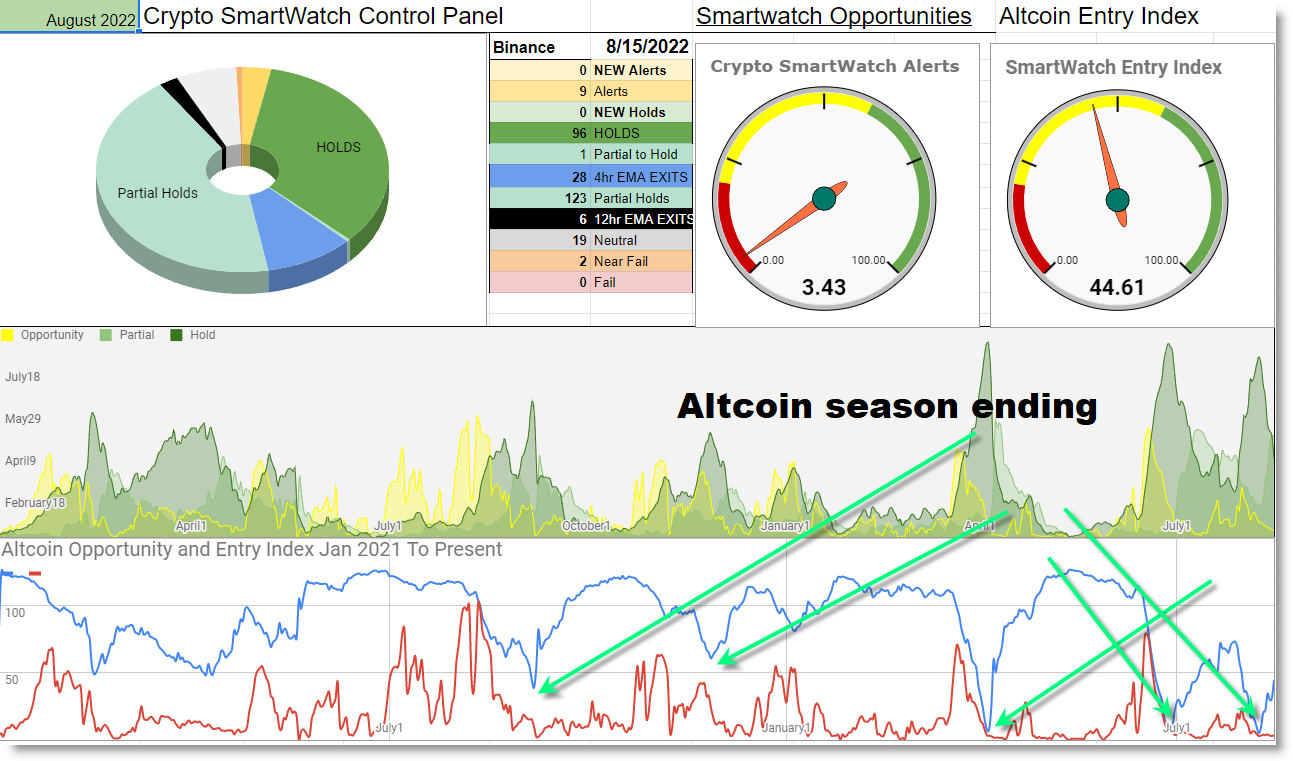

The Crypto SmartWatch breaks down the effects on Altcoin Seasons caused by Bitcoin Dominance and Stable Coin Dominance and provides a daily action matrix that new DIY traders can learn and actually follow.

What is Bitcoin Dominance?

Bitcoin dominance refers to the percentage of the total cryptocurrency market capitalization that is held by Bitcoin. It is a measure of how much of the market is controlled by the leading cryptocurrency. When Bitcoin’s dominance is high, it means that it is a major player in the market and that other cryptocurrencies, known as altcoins, are not gaining as much traction. On the other hand, when Bitcoin’s dominance is low, it means that altcoins are taking a larger share of the market and potentially outperforming Bitcoin.

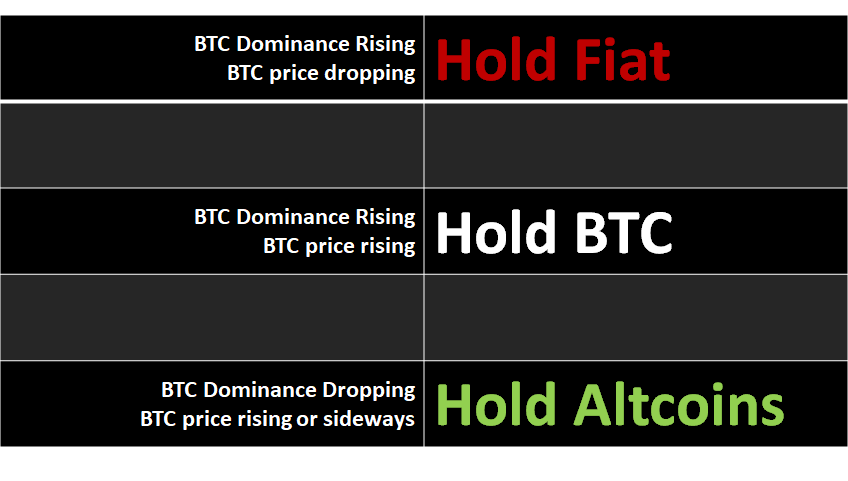

Here is a handy way to think of how Bitcoin Dominance affects Altcoin Seasons:

Bitcoin price, or the value of a single bitcoin, can also affect the market dominance of Bitcoin. When the price of Bitcoin is high, it can increase the market capitalization of the cryptocurrency and therefore increase its dominance. Conversely, when the price of Bitcoin is low, it can decrease the market capitalization and reduce its dominance.

When Is It Altcoin Season?

Altcoin season refers to a period of time when the US Dollar value of altcoins, or cryptocurrencies other than Bitcoin, experience a surge in value and market capitalization at a faster pace than bitcoin price.

This can be caused by a variety of factors, such as increased adoption, new development, or favorable world economic market conditions. During altcoin season, the market dominance of Bitcoin may decrease as investors flock to altcoins in search of potential gains.

Does Stable Coin Dominance Matter?

Stable coins, which are cryptocurrencies that are pegged to a stable asset such as the US dollar, can also provide insight into the flow of money into and out of the total cryptocurrency market capitalization.

Stable coins are often used as a way to store value and move money in and out of the market while remaining in a monetary for that is easy to convert back into other cryptocurrencies.

When stable coin dominance increases it is bearish for altcoins, it may indicate that investors are seeking to move money out of the market or to protect their investments from volatility.

On the other hand, a decrease in stable coin dominance is bullish because it may suggest that investors are feeling more confident in the market and are willing to take on more risk by investing into crypto again.

It is important to note that these relationships are not always straightforward and can change over time and we must always manage our risk exposure and be aware of common trading mistakes. For example, a decrease in Bitcoin’s dominance may not always mean that altcoin season is upon us. It could also be caused by a decrease in the overall market capitalization, as has been seen during market downturns. Similarly, an increase in the use of stable coins may not always indicate a lack of confidence in the market. It could also be a sign of increased adoption and demand for stable coins as a store of value.

Trading Altcoin Seasons in 2023

In 2023, the relationship between bitcoin dominance, bitcoin price, and altcoin season is even more complex and multifaceted. Stable coin dominance can provide insight into the flow of money into and out of the crypto markets but we need the Crypto SmartWatch to view the start and end of each altcoin season with improved clarity.

How Bitcoin Dominance affects Altcoin Seasons:

Understanding how Bitcoin Dominance affects Altcoin Seasons can provide insight into the overall health and maturity of the cryptocurrency market – but the Crypto SmartWatch breaks down that overall data into a simple daily action plan for building, balancing and releasing a diversified crypto portfolio as altcoin seasons come and go.

Bitcoin dominance, bitcoin price and Stable Coin Dominance are all interconnected with #AltCoinSeason but we need the #CryptoSmartWatch to see when is altcoin season objectively.https://t.co/pHBBkdRAe7#cryptobull #CryptoInvestor

— introtocryptos.ca (@introtocryptos) January 16, 2023