If you’re interested in learning how to trade cryptocurrency, you’re not alone. The market for digital currencies has exploded in recent years, with many people looking to get in on the action. However, crypto trading can be risky and it’s important to approach it with a solid understanding of the market and a well-thought-out strategy. Here are some tips for teaching yourself how to trade cryptocurrency.

- Start by learning the basics.

Before you start trading, it’s important to have a solid understanding of how the price discovery market works. This includes learning about the different types of cryptocurrencies, how they are created and traded, and the factors that can influence their value. Get prepared to track all your trades so you can improve your skills and report your taxes correctly. You can learn how to trade through online courses, books, quality bitcoin trading tutorials on youtube as a way to complement your own research with resources like CoinMarketCap.com

- Choose the right exchange.

There are many different exchanges where you can buy and sell cryptocurrencies. It’s important to choose one that is reputable and secure. Look for an exchange that is regulated in your country and has a good track record of protecting its users’ assets. You should also consider the fees associated with different exchanges and choose one that offers competitive pricing. Consider the following proven crypto exchanges BitGet and SimpleFX as you compare against Binance and Bitfinex.

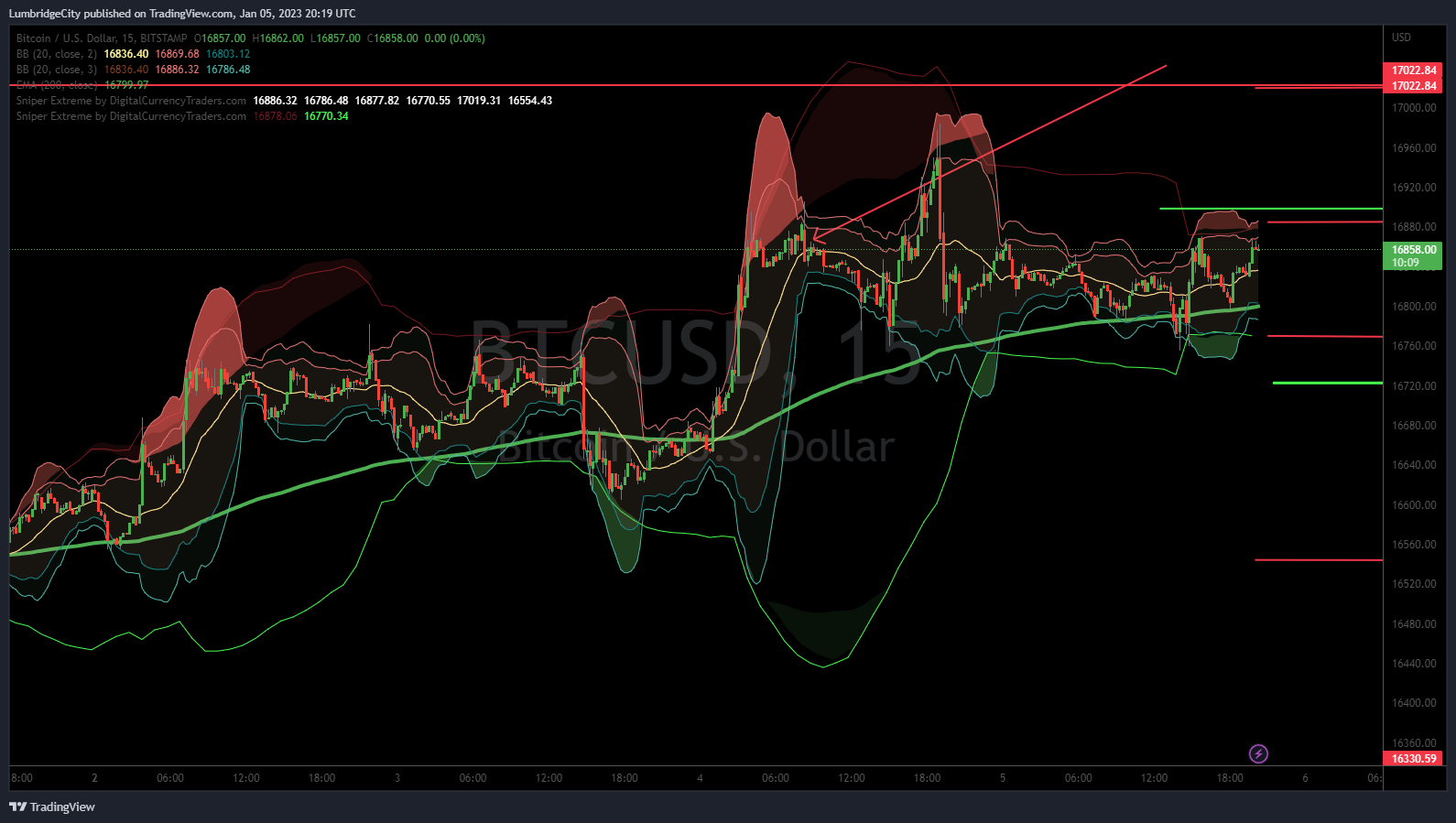

- Find a proven crypto trading strategy.

Once you have a basic understanding of the market and have chosen an exchange, it’s time to start working with someone who has developed a proven long-term crypto trading strategy. Look for a clear written strategy on PDF and video tutorials provided as well. They should help you in setting clear goals, determining specific rules for anticipating risks, and also provide a clear methodology for when to choose the right assets to trade. It’s also a good idea to work with a service that also provides an active community that keeps up with market news and analysis – this will help you to stay informed about what’s happening in the world of cryptocurrency. Remember, if they have a proven strategy – the coach you want to follow has already been doing this for years… they trade full time and youtube views are not a source of income for them.

- Practice with a demo account.

Many exchanges offer demo accounts that allow you to start teaching yourself how to trade cryptocurrency with virtual money without risking any of your own capital. This is a great way to practice and get a feel for how their trading platform works for setting up trades and stops… without risking any of your own money. You can create a simple spreadsheet on google sheets but it is better to actually use a demo account to practice your trading strategies on many markets in order to build the chart pattern recognition and daily habits of a successful trader BEFORE you are risking real money.

Five important principles for risk control and keeping profits:

- Diversify your portfolio.

One of the keys to successful crypto trading is to diversify your portfolio. Don’t put all of your eggs in one basket by investing heavily in just one or two cryptocurrencies. Instead, plan a strategy for spreading your investments out over a variety of different coins when altcoin season is about to begin.

- Plan your position size first.

The best way to keep your losses small is to start with a small trade size. Wait until your trade is well in profit before you establish your full position and you will dramatically shift the odds into your favor in the long term.

- Use stop-loss orders.

Stop-loss orders are an essential tool for managing risk in crypto trading. Just like the breaks in a car, we need to know how to use them BEFORE we start driving. The stop loss order is based on technical price levels which may have an effect on the position size that fits your account equity levels for every specific trade. Thus it is important to plan our stop order in advance if we are to set a maximum loss that is not painful for equity size. If the price of the asset falls below the stop-loss level, the trade will be automatically closed to limit your losses.

- Know your take profits signal in advance.

While it can be tempting to hold onto a winning position in the hopes that it will continue to rise in value, it’s important to remember that the crypto market is volatile and can turn on a dime. Even before you’ve made a profit, plan out exactly the conditions for taking profit and closing the trade. Our job as traders is to manage risk and to be prepared for the market to take a turn for the worse – while at the same time surrendering the results of our trade to the market.

- Stay up-to-date on market news and analysis.

Crypto markets and profit opportunities can be influenced by a wide range of factors, including government regulations, hacking, and the overall state of the global economy. To protect our trades from the unexpected it’s important to keep up our risk control rules in play for every trade. To take advantage and press our correct positions, we can increase our profits with current market news and analysis. This can help you make informed decisions about when to add on to correct positions and when to take profits.

In conclusion, remember that 80% of new traders lose money and quit trading so teaching yourself how to trade cryptocurrency requires a combination of research, practice and persistence. Just as learning any complicated skill, you should seek out an experienced coach with a proven trading approach. Start by modeling their approach.

Five tips for teaching yourself how to trade cryptocurrency with five important principles for risk control and keeping profits!https://t.co/C6qL80HIWh#cryptotrader #cryptotrading #CryptoInvestor

— introtocryptos.ca (@introtocryptos) January 16, 2023

Practice, take notes, track your trades and journal your thinking on every trade – and soon you’ll pinpoint your own trading mistakes and gain more trading mastery.