Crypto Trading Psychology: Why Taking 184% Profit on AGIX Was a Strategic Mistake

Key Takeaways:

- Exiting a profitable position too early can limit your potential gains in crypto trading

- Trading against your own system rules creates unnecessary taxable events and missed opportunities

- Using a trading journal helps identify and learn from your psychological trading errors

- During altcoin seasons, the wave and pullback strategy maximizes profits on winning positions

- Spot positions provide more flexibility and less stress than leveraged trading for long-term gains

Hey crypto traders! Today I’m breaking down a real trade from our system—one where I made a substantial profit but actually violated my own trading rules in the process.

I recently closed a trade for 184% profit,

but according to my trading system, taking profits at that time was a strategic error.

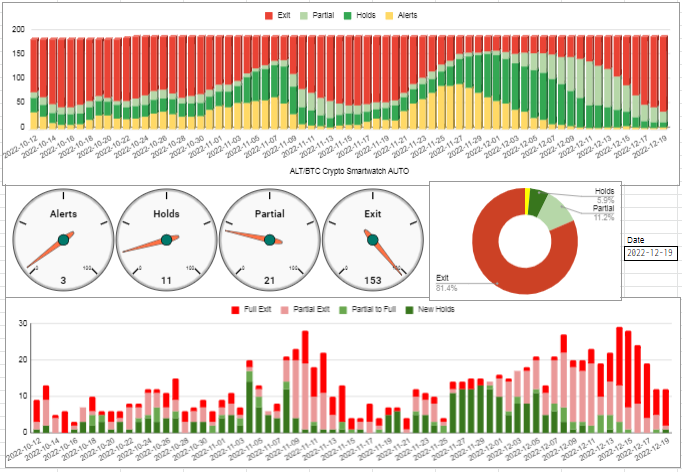

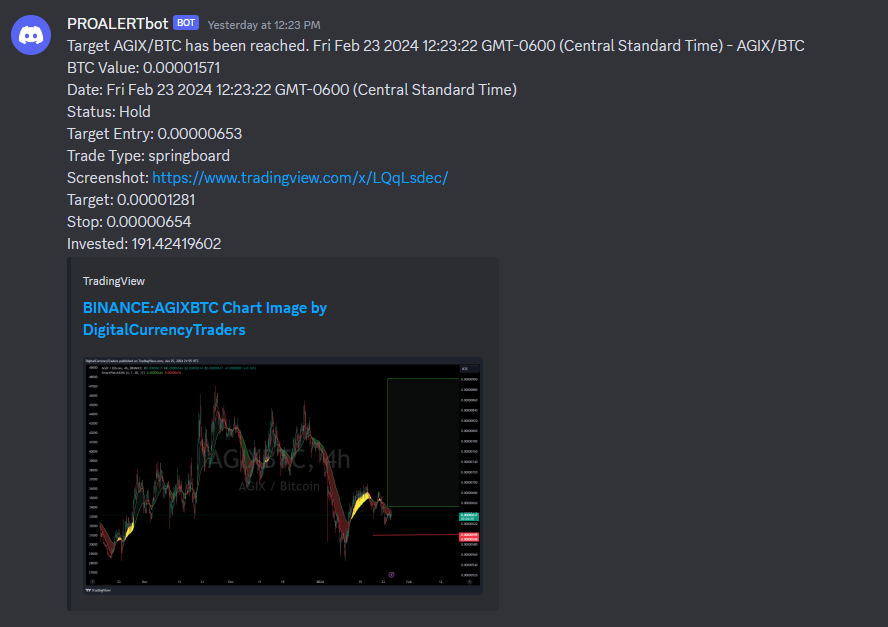

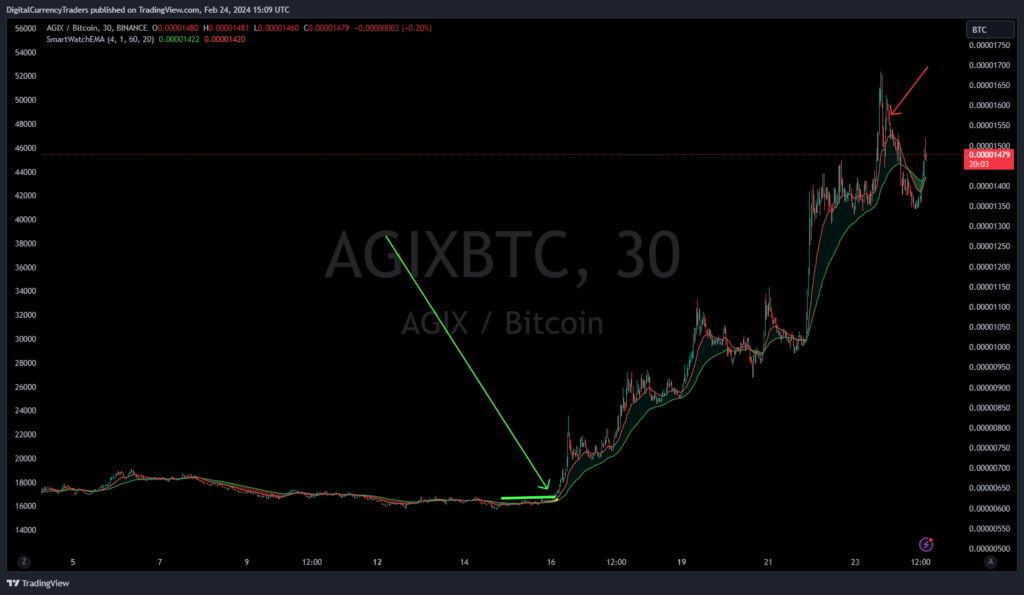

In this analysis, I’ll examine our AGIX trading signal that triggered on February 3rd. Yesterday, when prices formed a top pattern, I decided to exit the position—but I’ll explain why this premature exit contradicted our established trading strategy.

I secured profits,

but I took them far too early.

This case study will demonstrate how I traded against my own system rules and the valuable lessons this provides for all crypto traders.

First, I’ll walk you through the exact entry signal that got me into this AGIX position, as it’s crucial context for understanding my exit mistake.

Then I’ll dissect why I exited when I did, acknowledging the psychological factors that led me to make this decision despite knowing it went against my trading plan.

Finally, I’ll outline what the correct approach would have been according to our proven trading system.

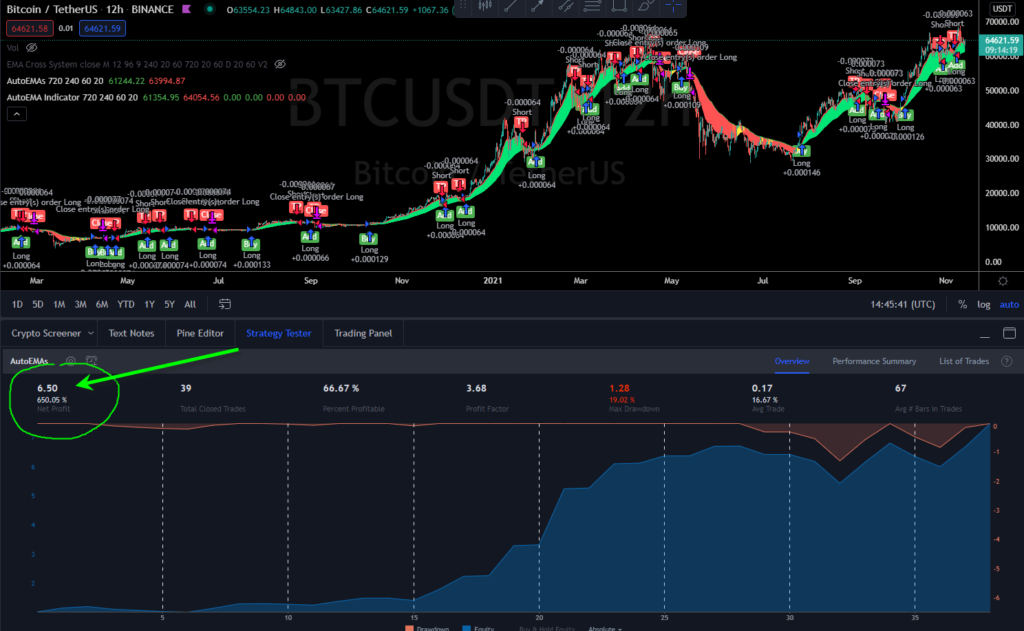

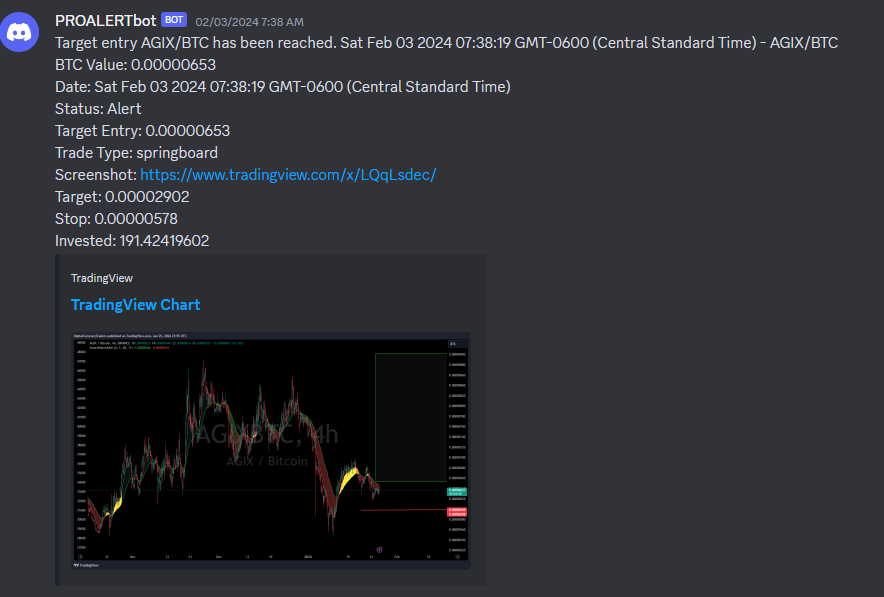

The AGIX Entry Signal (Early February 2024)

⟁ The AGIX/Bitcoin price chart formed a clear 123 consolidation pattern that triggered our entry signal, and

➜ our systematic approach executed the buy through our copy trading account on BitGet.

It’s important to note that our trading system hadn’t yet generated an exit signal,

but I still closed the position yesterday, locking in approximately 184% profit.

Why I Took Profits Too Soon!

I exited this position for two psychological reasons that directly violated my trading plan:

First was ego-driven decision making; I wanted the satisfaction of being “right” and securing this substantial profit rather than risking it.

This represents my second biggest trading mistake, which I’ll analyze in depth below.

I prioritized impressive copy trading statistics over adhering to my proven trading methodology.

The second reason was purely cosmetic—I wanted to showcase this 184% gain in my copy trading account statistics.

While capturing triple-digit profits certainly looks impressive in your trading history, this decision contradicted the systematic approach that generated the profit opportunity in the first place.

By acting against my own trading rules, I potentially sacrificed even greater gains that might have come from following the system’s exit signals.

The Critical Importance of Trading Journals for Psychological Improvement

If you’ve ever written a detailed trading plan but then acted contrary to those guidelines, documenting this process becomes absolutely essential for your development as a trader.

I strongly recommend maintaining a comprehensive trading journal for every position you take in the crypto markets.

Identifying Psychological Trading Patterns

Journal entries allow you to recognize recurring psychological errors, giving you the self-awareness to make better decisions when similar situations arise in future trades.

Understanding the Two Categories of Trading Errors

As cryptocurrency traders, we must recognize that our mistakes generally fall into two distinct categories, each requiring different remediation approaches.

The first category includes errors that result in immediate financial losses—these quickly become self-correcting through negative reinforcement.

You either adjust your approach to eliminate these mistakes or eventually deplete your trading capital.

The second and more dangerous category includes mistakes like my premature AGIX exit—errors that don’t immediately appear harmful and might even seem beneficial until someone points out the opportunity cost or strategic trading mistake you’ve made.

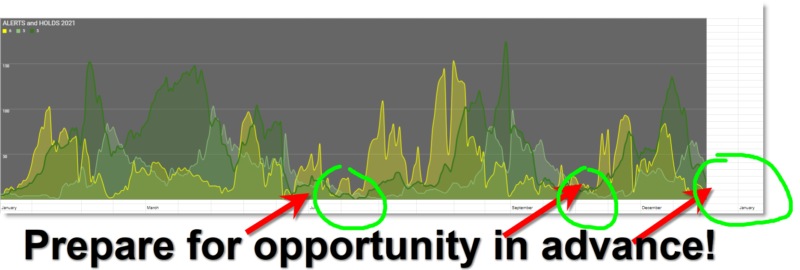

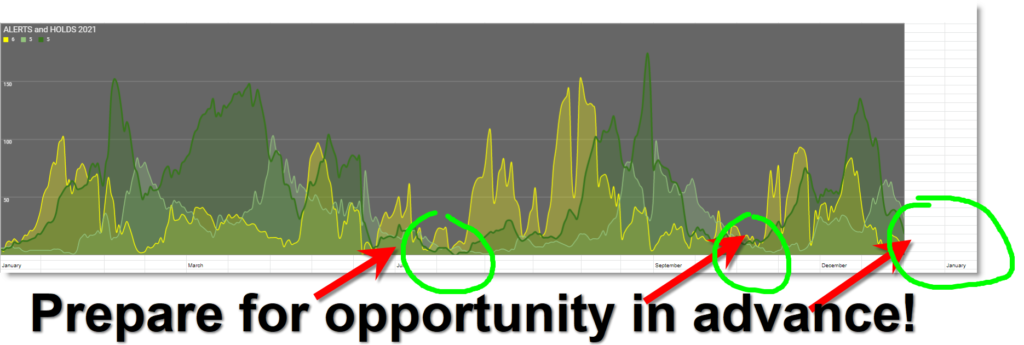

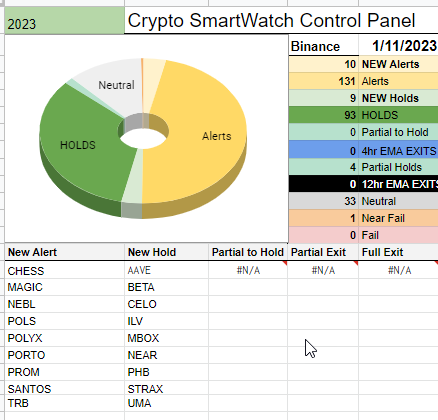

Altcoin Season Secrets – The Wave and Pullback Strategy!

Let me now explain stage four of successful crypto trades, and afterward, I’ll share where you can learn these strategies for free during a seven-day trial period.

Stage four represents the consolidation phase after an initial price increase—this is precisely when you should consider adding to your position rather than exiting. This approach maximizes exposure to high-performing assets during the most significant market moves.

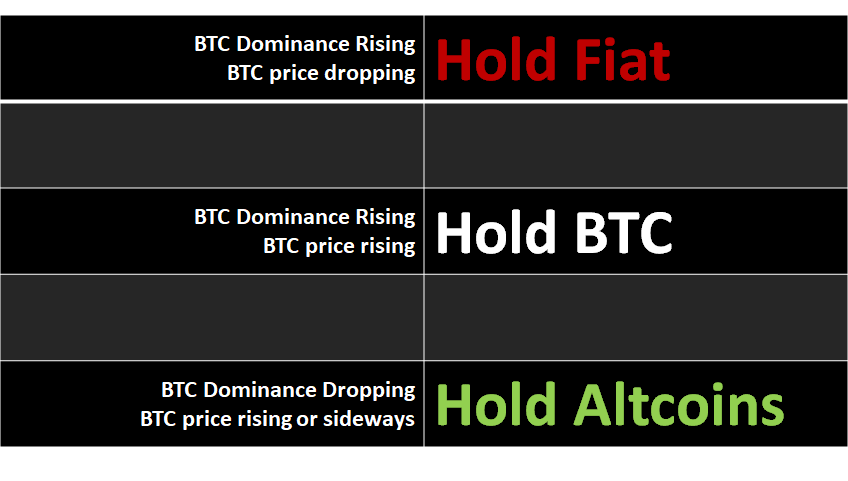

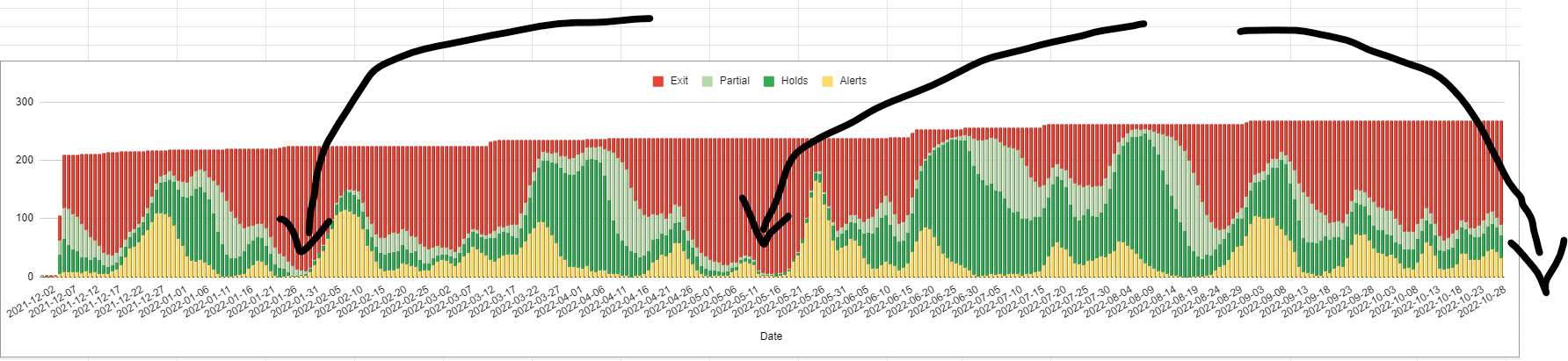

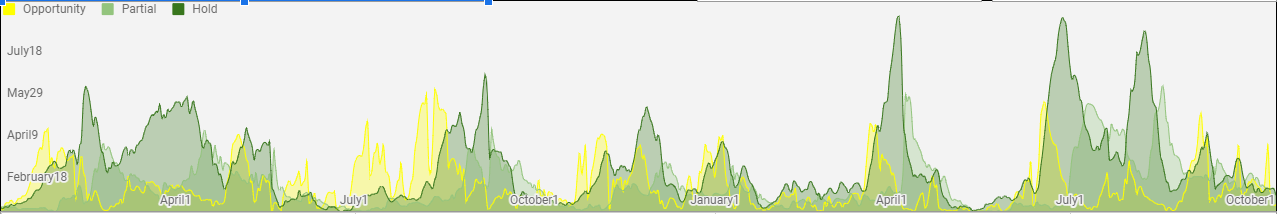

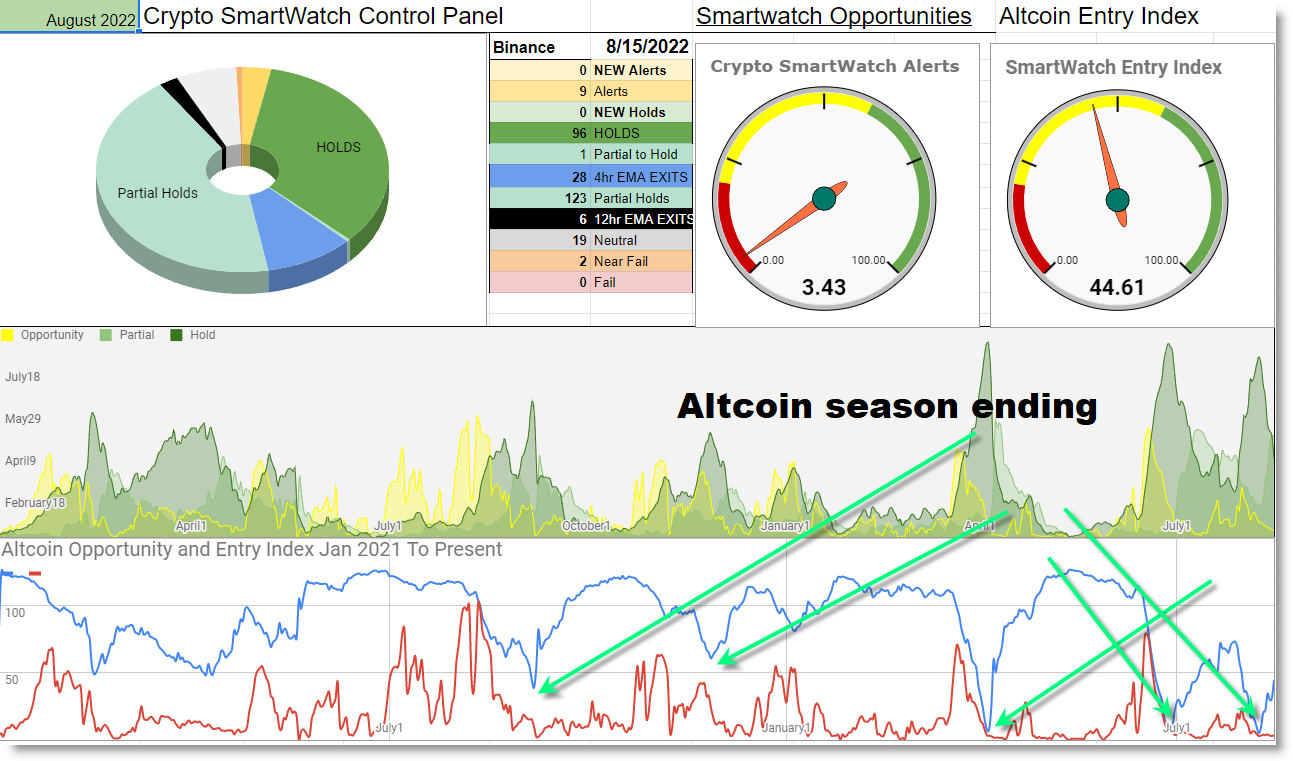

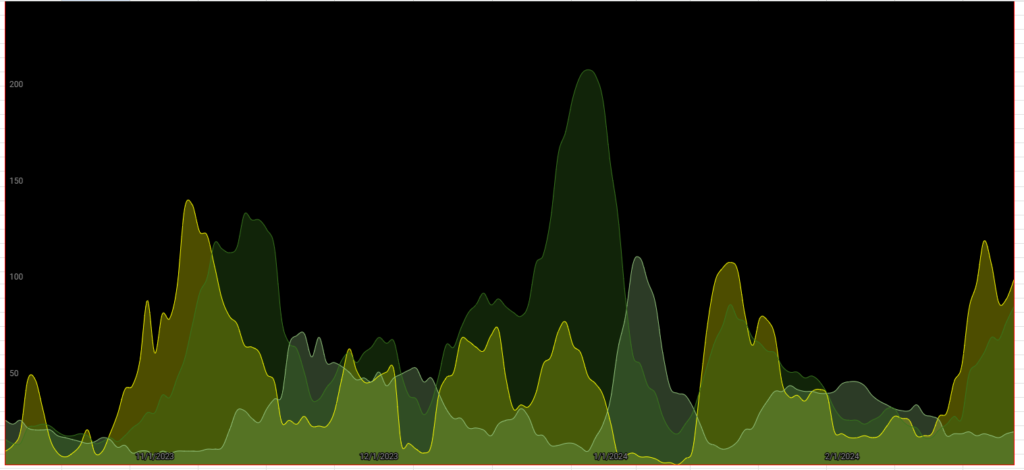

➤ The current market conditions suggest we’re entering the early phases of a substantial three to five-wave movement in the altcoin market, making position building particularly strategic right now.

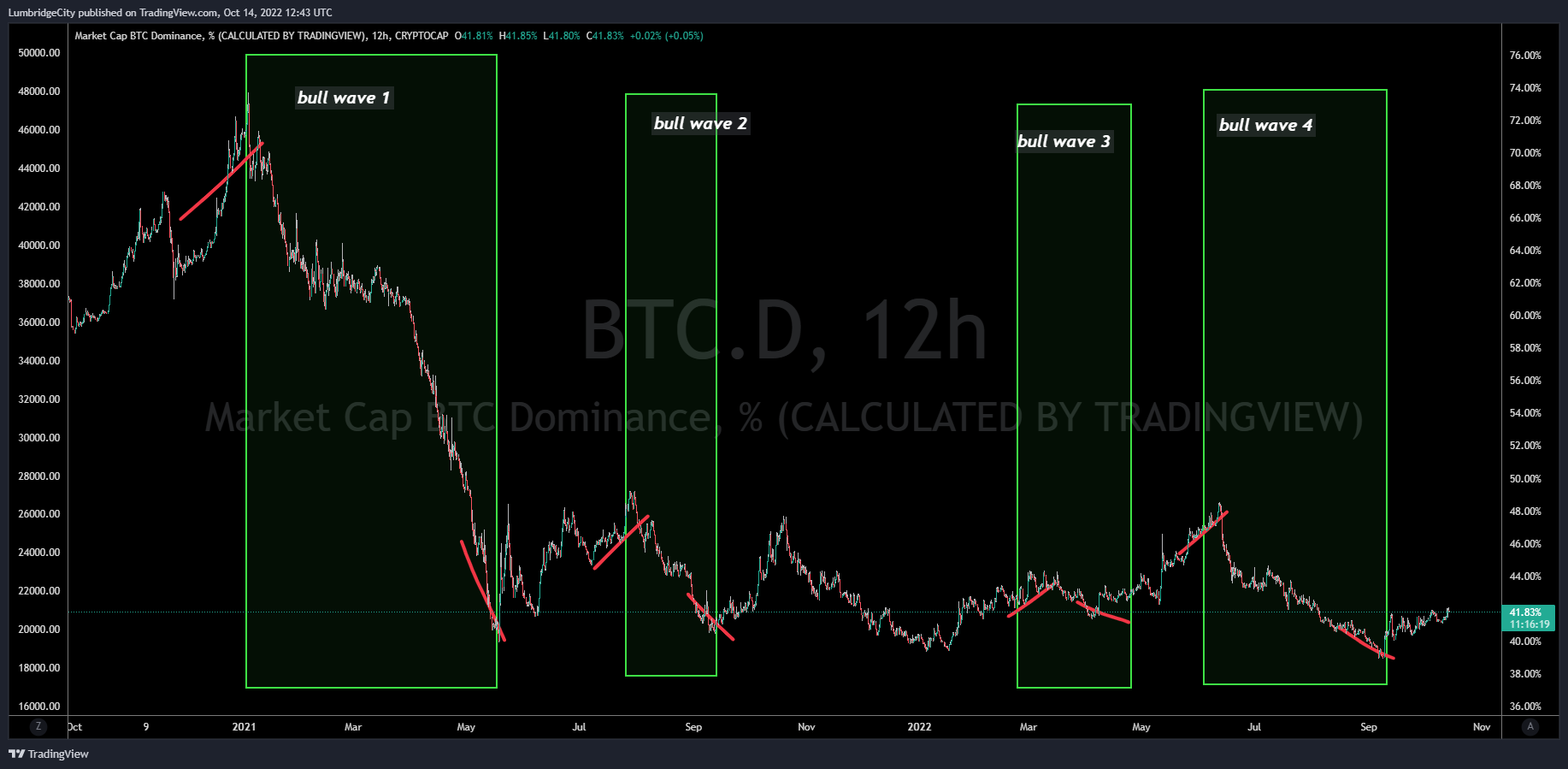

Elliott Wave Theory and Current Altcoin Market Structure

Elliott Wave enthusiasts should be particularly attentive to current market conditions, as we’re witnessing textbook patterns emerging in the altcoin markets.

We’re emerging from an exceptionally extended Wyckoff Accumulation Pattern across numerous altcoin charts, creating ideal conditions for substantial upward movements.

The market structure suggests we’re building toward a significant wave-pullback-wave sequence that could define the upcoming altcoin season.

The Two Critical Mistakes in My AGIX Trading Decision

My decision to take profit on the AGIX position was flawed for two specific reasons that illustrate common crypto trading pitfalls:

➥ First, I succumbed to fear during a time when market conditions called for calculated aggression, and

➥ Second, I created an unnecessary taxable event that would increase my costs if I decide to re-enter the position to capture the continued upward movement.

The optimal approach would have been maintaining my position according to my trading system,

but I exited prematurely for two non-strategic reasons:

- Securing immediate profits over potential larger gains

- Enhancing my copy trading account statistics for marketing purposes

My Next Strategic Trading Move

With my realized profits, I’ve reallocated my entire position—transforming approximately 17 units into 52 units through this trade.

I’ve now deployed this capital into another cryptocurrency displaying the identical chart pattern that AGIX exhibited one month ago, applying pattern recognition to identify potential repeat opportunities.

While there’s no guarantee this new position will perform similarly to AGIX, I’m applying the pattern recognition principles that form the foundation of our trading methodology.

The key difference? This time I’ll adhere strictly to my system’s exit signals rather than making emotion-based decisions.

When analyzing specific cryptocurrencies like AGIX, remember that altcoins typically demonstrate high correlation in their movements—they rarely pump in isolation.

This market characteristic creates an opportunity to reduce risk by diversifying across multiple coins with smaller position sizes, focusing on spot positions that eliminate the ongoing costs associated with maintaining leveraged trades.

The Hidden Costs of Leveraged Crypto Trading

Even when using modest leverage ratios in futures trading, traders must account for the continuous funding fees and other costs associated with maintaining these positions over extended periods.

Spot positions, by contrast, allow greater psychological flexibility since you own the actual cryptocurrency and can withstand volatility without the pressure of liquidation risks or ongoing fees.

This approach also ensures you remain positioned in assets that make unexpected, outsized moves that no technical analysis could have predicted with certainty.

Exposing Trading Industry Secrets – How Exchanges Profit From Your Trading Behavior

A crucial perspective often overlooked by new traders: cryptocurrency exchanges and many YouTube influencers generate revenue directly from your trading frequency and volume, not your profitability.

I’ve been approached by exchanges offering sponsorship deals based exclusively on the trading activity I generate through my audience—the more frequently my viewers trade, the more I would earn as a content creator.

This creates a direct financial incentive for influencers to encourage excessive trading frequency and account turnover.

The uncomfortable truth is that exchanges benefit when you actively churn your portfolio rather than holding strategic positions through market cycles.

This incentive structure encourages content that promotes day trading, frequent profit-taking, and constant portfolio adjustment—behaviors that statistically reduce most traders’ long-term performance.

Unlike exchange-sponsored content creators, my advice isn’t influenced by how frequently you trade.

My priority is helping you develop the discipline to maintain positions through complete market cycles to capture those life-changing gains that come from strategic patience.

These are the success stories I want to hear—not how many trades you executed this month.

Trade With Purpose – Liberate Yourself From Short-Term Chart Fixation

I encourage all crypto traders to disconnect from the 15-minute charts—your daily chart analysis should require no more than 20-30 minutes for optimal decision-making.

Spending hours watching price movements typically leads to overtrading and emotional decision-making that contradicts your strategic trading plan.

Develop a trading approach that allows your capital to monitor the markets while you enjoy your life—this is the true freedom that successful crypto trading can provide.

Thank you for your attention and engagement with this analysis.

Always trade with risk management as your priority and maintain the discipline to keep losses small.