Crypto Portfolio Rebalancing Tool with an objective trend following strategy that anyone can actually use! Diversify into the next Altcoin Season at the right time.

Diversification is a key strategy for low time-maintenance crypto investing. One way to achieve diversification in the crypto market is by using a crypto rebalancing tool, which can help to manage and optimize a crypto portfolio with the current phase of the Altcoin Season.

A crypto portfolio rebalancing strategy can enhance performance and outperform the average by using the filtering technique of a moving average crossover to flag the first moving coins when Altcoin Season conditions are right.

Is it altcoin season yet?

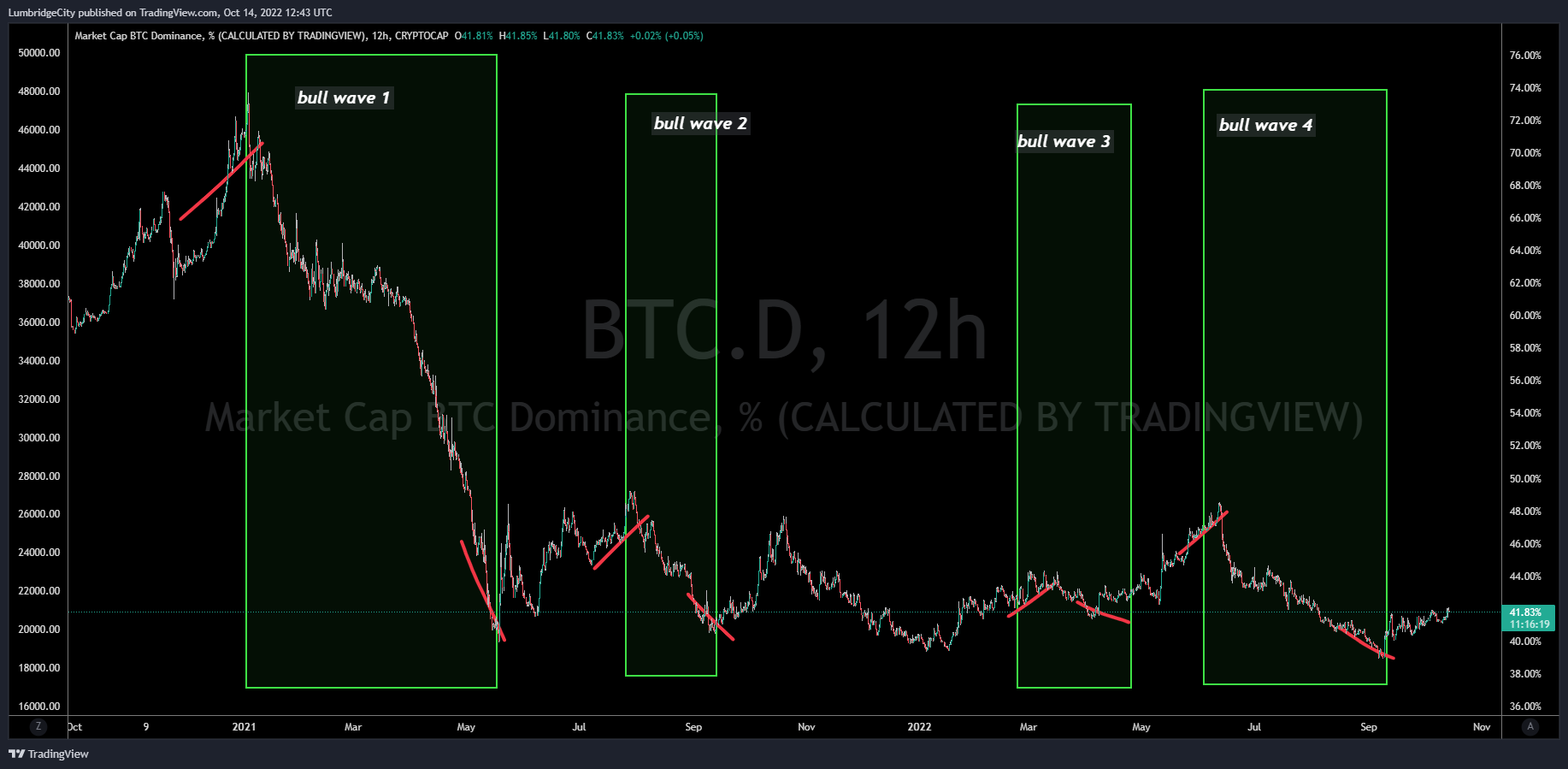

It used to be tricky to pinpoint the next altcoin season with Bitcoin Dominance.

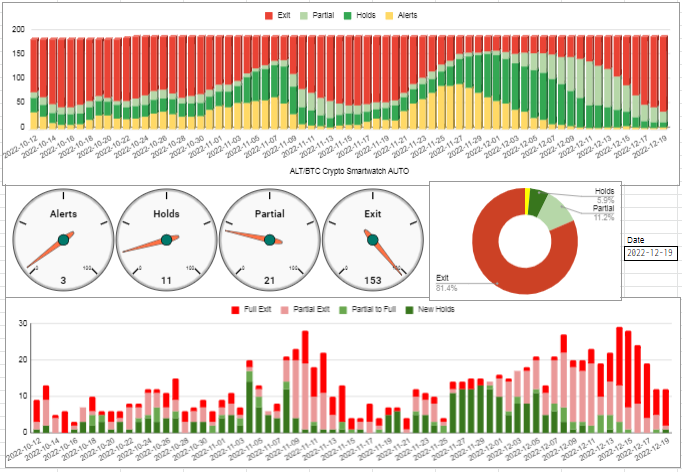

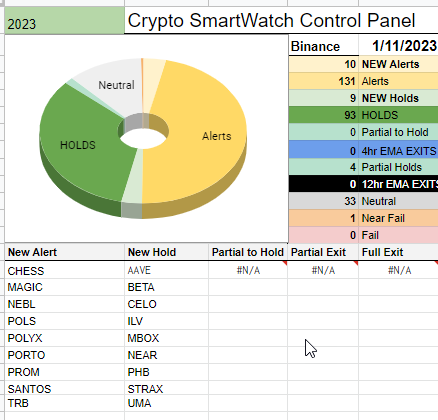

This is why we created the Crypto SmartWatch color coded spreadsheet. We now have an objective, clear visual tool for looking inside Bitcoin Dominance data and get specific about timing the start of each Altcoin Season.

when to expect the next Altcoin Season

The Crypto SmartWatch can boost the the performance of a portfolio by filtering a large number of digital assets to help to catch the earliest moving assets. Diversifying into this early-mover group will dramatically increase the likelihood that at least some of the coins in the group will out-perform the average.

What triggers Altseason?

Some of the known factors that can trigger ‘Altcoin Season’, or bull markets in cryptocurrencies include:

- Positive regulatory developments: Clarity and favorable regulations on the use and trade of cryptocurrencies can increase investor confidence and lead to more mainstream adoption, which can drive up prices.

- Institutional adoption: With better regulatory oversight, institutional investors, such as hedge funds manager and banks, will finally have the green light to move into the cryptocurrency market. This may increase demand and begin a sustained bullish trend.

- Increasing mainstream adoption: As institutional business can begin to take advantage of cryptocurrency transaction efficiencies, better solutions make crypto easy and a bonus for the customer to use… demand will naturally rise for these assets, leading to higher prices.

- Economic Factors: Global economic factors such as interest rates, currency valuations, and inflation always have an impact on the prevailing price trends of cryptocurrencies.

- Innovation in blockchain technology: The advancement of a blockchain technology can also lead to a bull market in specific cryptocurrencies or tokens. As more people get excited about the benefits and potential use cases of the technology, prices may surge and fall back in dramatic and unpredictable ways known as Popcorn Moves.

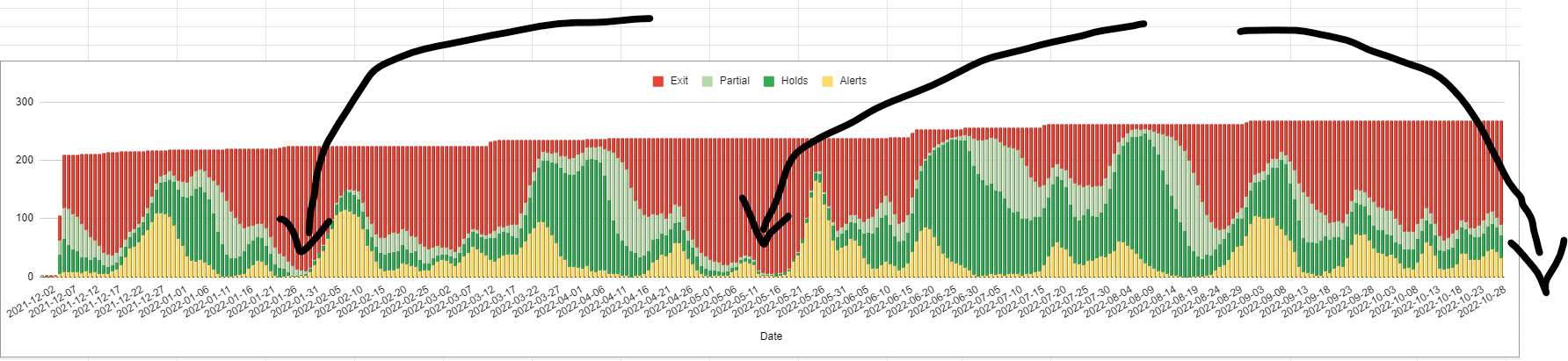

How Do You Measure Altcoin Season?

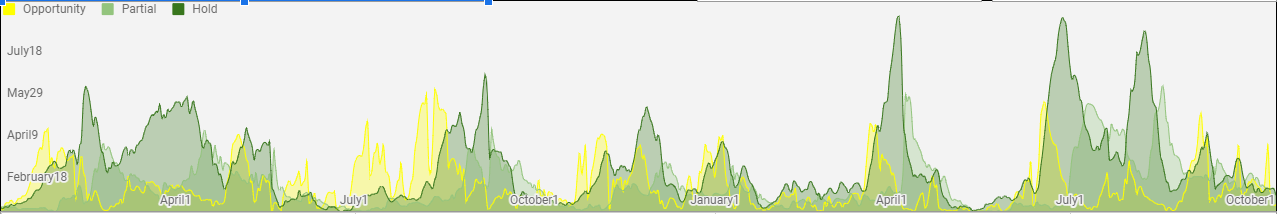

- We begin our measure altcoin season by reviewing each coin against a standard trading signal.

- Then we count the number of coins in each stage of the trade to get our Daily Action Matrix and

- we plot the daily totals over time and get a birds eye view of the altcoin season trends as they come and go.

Our Crypto Portfolio Rebalancing Tools

In a simple example, consider a moving average crossover that compares the movement of two different moving averages to identify buy or sell signals. A buy signal is generated when a short-term moving average (such as a 20-period moving average) crosses above a long-term moving average (such as a 60-period moving average), and a sell signal is generated when the short-term moving average crosses below the long-term moving average.

Check Out This Before And After Example

By filtering out the assets that are not passing the crossover, you can focus on the assets that are currently proving their uptrend may have started and avoid assets that have not yet crossed the threshold.

Remember, moving average crossovers above are just a simple example.

The Crypto SmartWatch portfolio rebalancing tool is based on a transparent trading plan that our team uses with trendlines, chart technical patterns and our custom Exponential Moving Average crossover indicator to manually review and identify buy and sell signals for each crypto asset we are tracking.

Altcoin Signals You Can Actually Use

How long does altcoin season last?

If we review 2021 and 2022 we can see that each of the altcoin seasons lasted between two weeks and eight weeks.

It’s important to note that past performance is not an indicator of future performance, and no investment strategy can guarantee a profit or eliminate the risk of loss… yet we simply must project how long it would take us to become a crypto millionaire if we could trade the next big waves altcoin seasons in 2023 and beyond.

Historical Altcoin Season Data

The Crypto SmartWatch historical Altcoin Season data identifies a number of false starts in the past. We must be ready to deal with the fakeout altseasons if we are to remain prepared to catch the best performing altcoins in the next bull markets.

The Crypto SmartWatch crypto rebalancer is a low time-maintenance crypto investing tool that can save you hours of time trying time the altcoin seasons and increase the performance of your crypto portfolio year after year.

By using the SmartWatch to diversify into the best-potential assets at the start of altseason, investors can focus their attention on positioning managing risk for growth and success.

Our advanced three week intensive course and crypto trade alerts may also combine an oscillator like the RSI, momentum indicator like the MACD, trend following tools like the Ichimoku Cloud and reversal indicators like the Bollinger Bands – with multiple timeframes – to fine tune and layer together our portfolio strategies.

However, it is important to remember that no single strategy or indicator can guarantee success in the uncertain crypto markets of 2023. Risk control strategies that protect your equity from the dangers of trading should be your first priority no matter which tools we might use to make informed investment decisions. Our job as traders is to position our money and to manage the risk and if we are correct, then the markets will naturally take care of the results.

Try our Crypto Portfolio Rebalancing Tool with an objective trend following strategy that anyone can actually use to diversify into Altcoin Seasons.