An automated crypto portfolio is better for a busy person because it ensures your money is working for you while you are doing other things!

If you can set specific rules for buying and selling assets and then have those rules automatically traded based on market conditions… then your money is doing the job of watching the price charts and you can fully focus on your life.

Automation, along with a good crypto portfolio tracker,

can eliminate the need for you to watch the charts.

Your money is watching the charts on your behalf!

The best crypto portfolio manager does everything for you allowing you to focus on building more revenue streams!

While some automated crypto portfolio services may also provide advanced tools for risk management and portfolio rebalancing – it is vital to fully understand the market conditions when these might optimize returns and when they might maximize losses instead!

A Good Portfolio Tracker

Tracking your crypto gains and losses is crucial for managing your portfolio and making informed investment decisions. Not only is it important for tax purposes, but it also allows you to see the performance of your investments over time and make adjustments as needed.

One of the best ways to track your crypto gains and losses is by using a crypto portfolio service. These services allow you to easily import transaction data from multiple exchanges and generate accurate and comprehensive reports on your portfolio performance. They also provide tools for portfolio management, risk management, and rebalancing, which can help to optimize returns and minimize losses.

Scams and Warning Flags

However, not all crypto portfolio services are created equal. Some services may make claims of providing secret trading signals or guaranteeing high returns, but it is important to be wary of these claims. These services may be nothing more than scams designed to take your money and provide you with little to no value in return.

When looking for a reputable crypto portfolio service, it is important to look for warning flags. These may include:

- Unusually high returns that are guaranteed or promised

- High frequency trading approach to short term price moves

- Lack of transparency or information about the service’s trading strategies

- Pressure to invest large sums of money quickly

- Lack of contact information or a physical address

- Unusually low fees or commissions

It is also a good idea to research the service and read reviews from other users. A reputable service will have a history of satisfied customers and positive reviews.

Finding Quality Automated Crypto Portfolio Services

Using a reputable crypto portfolio service can save you time, help you find the best altcoin opportunities and improve your trading success.

By automating your trades with tools for risk management, you can focus on the important parts of your life while your money does the work of watch price charts all day.

- Cointracking: Cointracking is a portfolio management and tracking tool that allows users to track their crypto assets across multiple exchanges and generate tax reports.

Automated Crypto Portfolio

Automatic crypto portfolio tracker there are many other crypto portfolio automation services available, some other examples include:

well known crypto portfolio automation services

- Shrimpy: Shrimpy is a portfolio management and trading automation platform that allows users to create custom trading strategies and automate trades across multiple exchanges.

- BitGetCopyTrader.com: Copy the trades of those with a proven record.

- 3commas: Find managed crypto portfolios to follow or set up your own automated strategy.

- TokenFolio: TokenFolio is a portfolio management and trading automation platform that allows users to track and manage their crypto assets and automate trades.

- Kryll: Kryll is a platform that allows users to create and automate trading strategies using a visual strategy builder and backtesting tools.

- Autonio: Autonio is a decentralized trading automation platform that uses AI and machine learning to execute trades on behalf of users.

- AlgoTrader: AlgoTrader is a platform that allows users to automate their trading strategies across multiple asset classes, including cryptocurrencies.

- Coinrule: Coinrule is a platform that allows users to automate their trading strategies using a simple rule-based system.

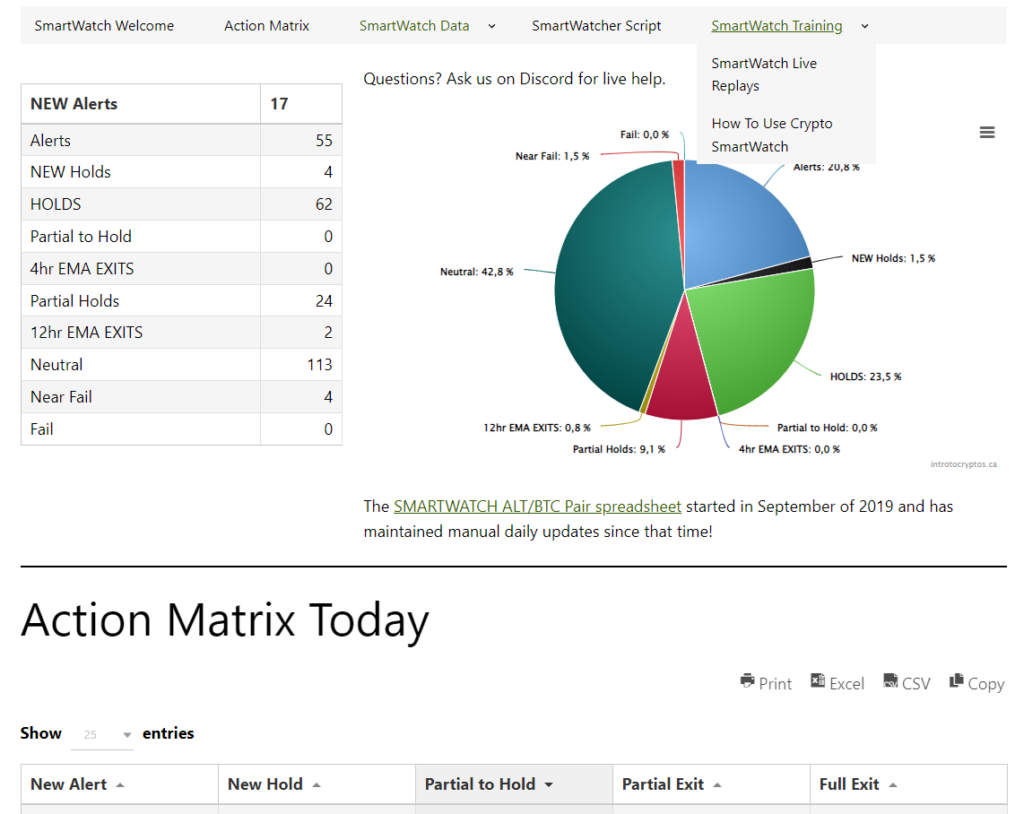

- Crypto SmartWatch: A transparent portfolio rebalancing tool focused on spot trading ALT/BTC pair spreads as a low risk, long term approach to profit from diversifying through the ongoing price trends of altcoin seasons.

Crypto SmartWatch Control Panel

Today in #crypto a surge of 22 NEW HOLD and 4 Partial-to-HOLD status as #bitcoindominance tops out the ALT/BTC pairs are revealing the best crypto projects. See the wave chart below

— introtocryptos.ca (@introtocryptos) January 28, 2023

1 of 2) pic.twitter.com/cZ2gWHb7fX

Automated Crypto Portfolio

It is important to be cautious when choosing a service. Look for warning flags, research the service and read reviews, and choose a service that has

- a long term approach,

- a transparent trading plan and has

- a history of performance

- with satisfied customers.

In summary, tracking your crypto gains and losses is an essential part of managing your portfolio and making informed investment decisions.

Our recent video on how to build crypto portfolio can be an excellent starting place

as you prepare for the next altcoin season.

By reviewing a reputable crypto portfolio performance,

you can save time and improve your trading success.

Make your money work for you while you focus on the important parts of life.