Here’s a solution for Canadian Crypto enthusiasts who may suffer from the Canadian Ban on Leveraged Crypto Trading

Following recent massive frauds and business failures in the crypto industry, regulators around the world have been blatantly caught with their pants down. Indecision and political foot-dragging left customers unprotected. Billions in customer funds have been lost and regulative bodies are ’embarrassed’.

Now the Canadian Securities Administrators (CSA) is finally taking crypto seriously by expanding existing requirements for crypto exchanges operating in Canada (listed below).

This is a very good development for the crypto industry and the benefits will become clear in the next few years.

Regulation will bring the biggest boom in crypto history and yet another chance for a new generation of Crypto Millionaires in 2023!

We can see it coming and we are preparing like a Canadian Grizzly Bear.

What is Grizzly Bear Crypto Trading?

Let me explain why we call this grizzly bear trading.

The grizzly bear knows about salmon run and they know what season to expect it. They position them selves where they know salmon are going to be jumping.

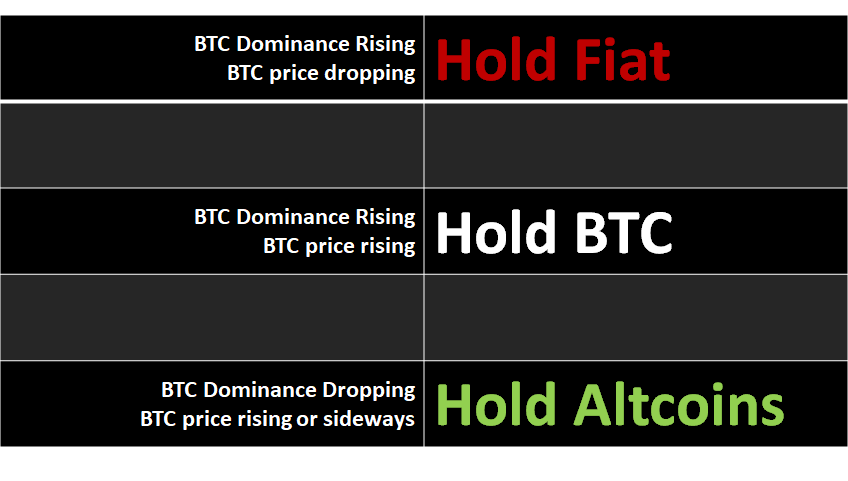

Grizzly bear trading is a similar philosophy that selects the right time to find the lowest risk way to speculate on the ebb and flow of Altcoin Seasons in the Cryptocurrency financial sector without using leveraged crypto trading.

Altcoins Trend Together

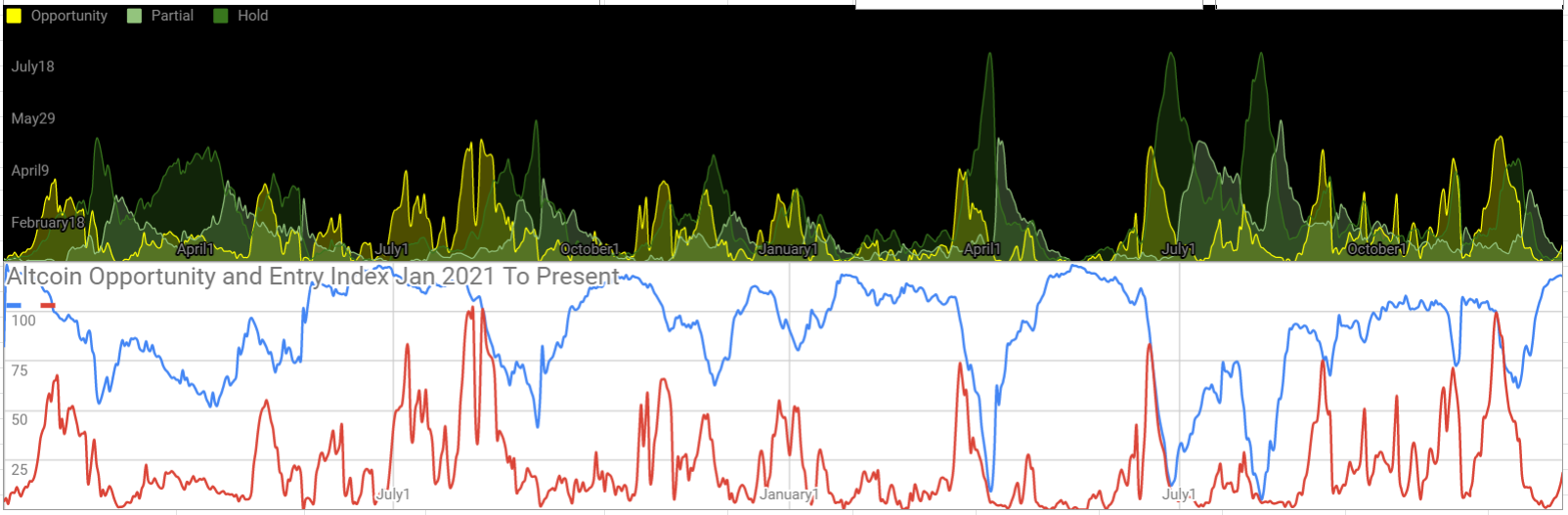

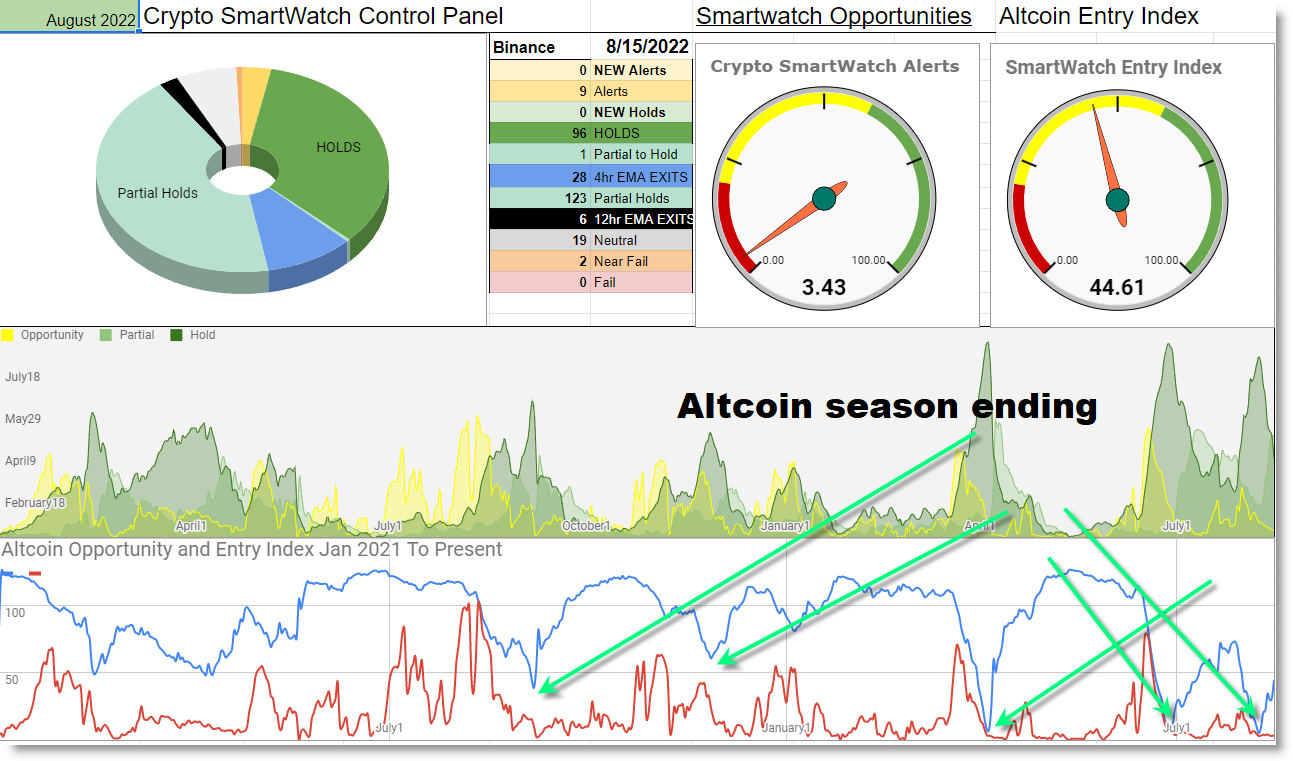

We know from past experience that the altcoin price patterns come and go in waves over and over again – know as Altcoin Season. We also know that the entire sector moves together as prices top out after a bull run and as prices make bottom formations after a bear run.

Price levels MUST pass a specific place in ‘the stream’… that is, price levels must make specific technical price patterns as the trend changes direction.

We can identify the best opportunity seasons where a crypto trader in Canada can position for the explosive potential moves in crypto, while enjoying the lowest risk.

This diversified trend following approach will take fewer trades per year in any crypto market – keeping the tax and trading fee exposures lower.

Yes. We can take advantage of the opportunities in crypto, without struggling against the reasons why leveraged crypto trading is banned in Canada.

Make Your Money Do The Work

Just like the Canadian Grizzly Bear, we can identify the correct season to sit in waiting for the next altcoin boom and bust wave.

More importantly, with our strategy we can task our money with the job to sit in the waiting, while we do other things!

All we need is this objective and diversified trend following approach that I like to call ‘grizzly bear trading’.

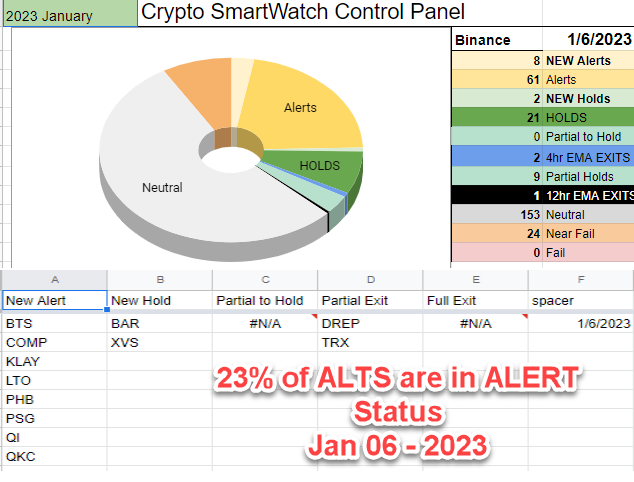

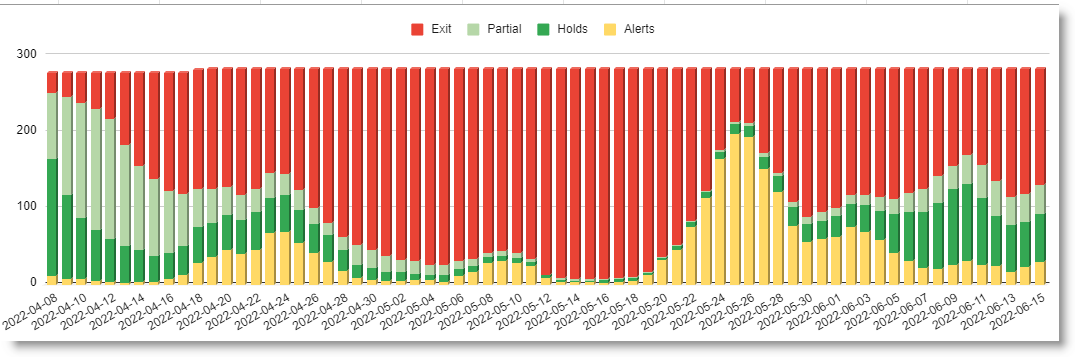

Our proprietary Crypto SmartWatch model portfolio provides us with a clear visual of when the next Altcoin Season is approaching and when it is finishing.

Our trading plan identifies the specific zone of the trend change, and we manually scan all the crypto markets to identify the charts passing that specific zone! Then we can be like the grizzly bear, and take a bite of all of those that are passing our trading signal, or ‘that spot in the river’.

The grizzly trading strategy isn’t simply about the knowledge, it’s about the consistent daily process of taking action on it.

The Trading Plan is totally transparent. We’ve been using it successfully and taught it to thousands of people since 2015… and now we are automating the entire portfolio through 3commas so that you can simply allocate funds from within your exchange account, and copytrade!

It works like a flow chart so you can see and understand how we manage risk and how we capture profits when the season is right.

The Grizzly Bear Crypto Trading Bot.

The Grizzly Trading puts together the knowledge and the perspective on the seasonality of crypto prices and exactly where a grizzly bear should stand to get the best meal every time this season passes.

More about Why Regulations Will Bring A New Boom To Crypto

Crypto Exchanges in Canada

Recent regulations help assure the safety of investor funds – crypto exchanges in Canada must hold Canadian clients’ assets with a custodian and segregate customer assets and exchanges may NOT provide margin or leverage for any Canadian client. A grey area is that exchanges are prohibited from permitting Canadian clients to trade, or obtain exposure to, any crypto asset that is itself a security and/or a derivative (while the CSA still refusing to define exactly what that is).

Crypto Trading Platforms Authorized to Do Business with Canadians

Perhaps in the years to come we will enjoy more advanced and trusted financial products for leveraged trading in crypto – yet the opportunity setting up is going to dwarf any crypto season in the past.

- Bitbuy Technologies Inc.

- Bitvo Inc.

- Coinberry Limited

- Coinsquare

- Capital Markets Limited

- Fidelity Clearing Canada

- ULC Netcoins Inc.

- Newton Crypto Ltd.

- CoinSmart (Simply Digital Technologies Inc. )

- VirgoCX

- Wealthsimple Digital Assets Inc.

Here is the official list of Crypto Exchanges Authorized in Canada:

The Crypto SmartWatch is an solution for Canadian Crypto enthusiasts who may be worried about the Canadian Ban on Leveraged Crypto Trading. Crypto trading is still legal in Canada and opportunities in altcoins will certainly abound in 2023.

A solution for Canadian Crypto enthusiasts who may suffer from the Canadian Ban on Leveraged Crypto Trading #grizzlybeartrading

— introtocryptos.ca (@introtocryptos) January 16, 2023

Grizzly Bear approach to feasting from #altcoinseason2023https://t.co/PCVoxVRowI#cryptocanada #canada #canadiancrypto