The next big cryptocurrency that could triple your money in 2023 is not the exotic shitcoin – but the big, stable, proven cryptos that have business use already.

Even as bearish momentum from 2022 haunts the markets in early 2023, investors are constantly on the lookout for timing the next surge in crypto markets. While no one can predict with certainty which individual coins will perform the very best, a diversified crypto portfolio strategy will like include the following projects that have the potential to deliver significant returns in 2023 and even more in the coming years.

As we consider which crypto might give the best returns,

we must consider when to buy them.

Watching the US Dollar Index and understanding the changes in global money supply can help us prepare for the effects of inflation and rising interest rates and better time when coins might moon as we plan and anticipate when the next altcoin season will begin in 2023.

How Does The US Dollar Index Affect Crypto Prices?

The US dollar index (USDX) is a measure of the value of the US dollar relative to a basket of foreign currencies. When the USDX strengthens, it means that the US dollar is worth more compared to other currencies, and when it weakens, it means that the US dollar is worth less. This can affect the price of bitcoin and other cryptocurrencies because bitcoin is often considered as a hedge against fiat currencies like the US dollar.

When the USDX strengthens, it adds bearish pressure the price of bitcoin. On the other hand, when the USDX weakens, it may add pressure for the price of bitcoin to rise.

How Does Global Money Supply Affect Crypto Prices?

Global money supply refers to the total amount of money in circulation in the global economy.

When the global money supply increased after COVID it has lead to inflation, which can erode the purchasing power of money. This resulted in bitcoin and crypto currencies moving in a huge bull run as they were more attractive as a store of value. When more people start buying bitcoin with the low-cost liquid money supply, the demand for bitcoin increased, causing its price to rise.

On the other hand, as we are heading into 2023 the global money supply is tightening with the intention to slow inflation – but may even lead to deflation, which can increase the purchasing power of the US Dollar.

This can make bitcoin, precious metals and real estate prices fall more in 2023.

It’s important to note that the US Dollar Index and World Money Supply are just some of the factors, along with Bitcoin Dominance and Stable Coin Dominance that can affect the price of cryptocurrencies in 2023.

The Best Overview of Crypto Trends

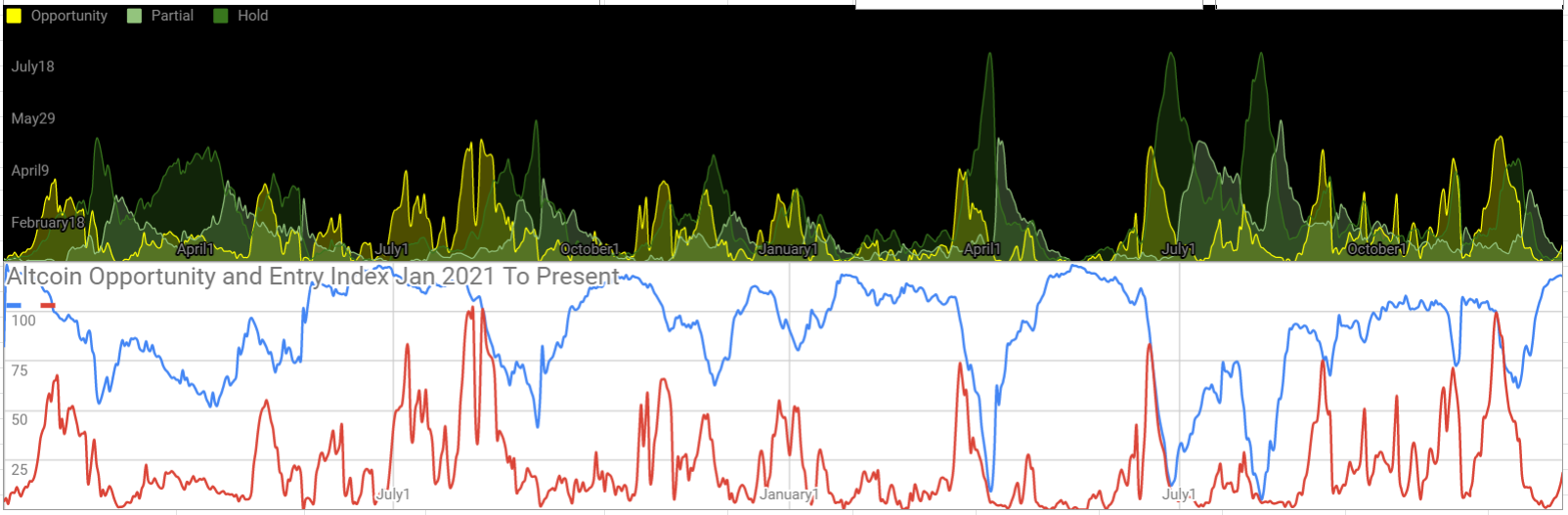

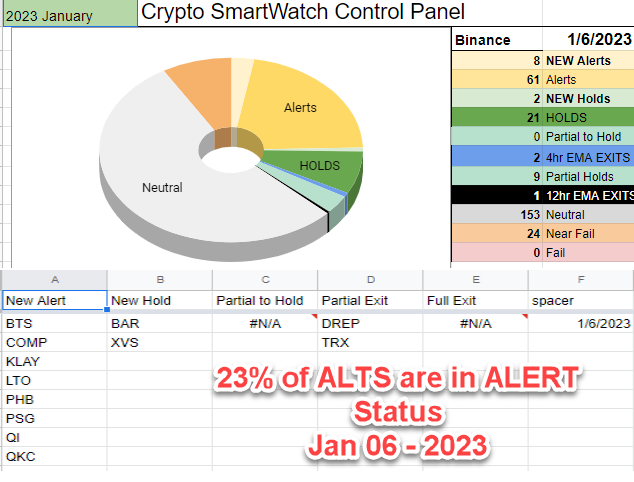

In order to get the best overview of altcoin season start and end, keep in mind that price trends move together for all of the cryptos. We keep an eye on the industry as an average with a tool that manually rates and monitors hundreds of cryptocurrencies each day – we call it the Crypto SmartWatch.

Here are four cryptocurrencies from the overall list of 300+ coins that we are actively monitoring for bottom formations to confirm in the early part of 2023 – because we believe these coins could potentially triple your money or more!

Where To Buy Crypto Easy

- Bitcoin (BTC)

It’s difficult to discuss cryptocurrencies without mentioning the granddaddy of them all: Bitcoin. The world’s first and most well-known cryptocurrency. It has a strong track record of functional stability and has been one of the top performing assets in the world, until 2022 that is…

One of the key factors that makes Bitcoin so appealing is its decentralized nature. It is not controlled by any government or financial institution, which gives it a level of independence and freedom not found in traditional currencies. Its decentralized nature also makes it resistant to censorship and fraud, which has helped to increase its popularity and adoption.

In recent years, Bitcoin has gained significant mainstream attention and adoption. Major companies and even countries have all made significant investments in bitcoin, and more and more merchants are beginning to accept it as a form of payment.

- Ethereum (ETH)

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of downtime, fraud, or third-party interference… although censorship on the Ethereum network transactions now exists. These smart contracts are powered by the Ethereum network, which is fueled by its native cryptocurrency, Ether (ETH).

Ethereum is unique in that it was the first platform to allow developers to build and deploy decentralized applications (DApps). This has led to the creation of a vast ecosystem of DApps and has helped to establish Ethereum as a leader in the crypto space.

In addition to its role as a platform for DApps, Ethereum is also a popular choice for initial coin offerings (ICOs) and has played a key role in the development of decentralized finance (DeFi). As the DeFi market continues to grow and gain mainstream attention, Ethereum is likely to benefit from increased adoption and usage.

- Cardano (ADA)

Cardano is a decentralized, open-source blockchain platform that is built on a proof-of-stake (PoS) consensus algorithm. It was created by Charles Hoskinson, co-founder of Ethereum, and is designed to be a more secure and scalable alternative to other blockchain platforms.

One of the key features of Cardano is its focus on sustainability and scalability. It uses a unique PoS algorithm called Ouroboros that is more energy-efficient than proof-of-work (PoW) algorithms used by other cryptocurrencies. This makes it a more environmentally friendly option, which is becoming increasingly important as the crypto industry grows.

Cardano is also designed to be highly scalable, with the ability to handle high transaction volumes without sacrificing security or decentralization. This makes it well-suited for use in large-scale applications and could make it an attractive option for businesses looking to integrate blockchain technology into their operations.

- Chainlink: A Cryptocurrency Project with Longevity

Chainlink is a decentralized oracle network that provides secure and reliable data to smart contracts on the blockchain. It has been active in the cryptocurrency space since 2014 and has consistently ranked as one of the top performing assets in the market.

One of the key factors that has contributed to Chainlink’s longevity is its strong focus on security and reliability. The oracle network uses a decentralized network of nodes to provide data to smart contracts, ensuring that the information being used is accurate and tamper-proof.

In addition to its strong track record of stability, Chainlink also offers a unique business solution that sets it apart from other projects in the space. By providing secure and reliable data to smart contracts, Chainlink enables businesses to automate and streamline various processes, such as supply chain management, insurance, and financial transactions. This makes it an attractive option for companies looking to integrate blockchain technology into their operations.

Get ready for these coins to triple your money in 2023. These Layer 1 protocols are a no-brainer, and here’s why:https://t.co/oMLKDplXIh#altcoins2023 #AltCoinSeason #cryptocurrency

— introtocryptos.ca (@introtocryptos) January 18, 2023

Wait For Altcoin Season To Begin

Even the best crypto projects have a good time to hold and a good time to stand aside. It is a mistake to dollar cost average without regard to the overall trends of the markets and this is especially try in crypto currency trading.