Bitcoin Dominance and Altcoin Seasons: The Complete 2025 Guide to Maximizing Profits

Key Takeaways

- Bitcoin Dominance is the percentage of total crypto market cap controlled by Bitcoin

- When Bitcoin Dominance falls, altcoin seasons typically begin

- Stable Coin Dominance increases signal bearish altcoin markets

- Decreasing Stable Coin Dominance suggests renewed market confidence

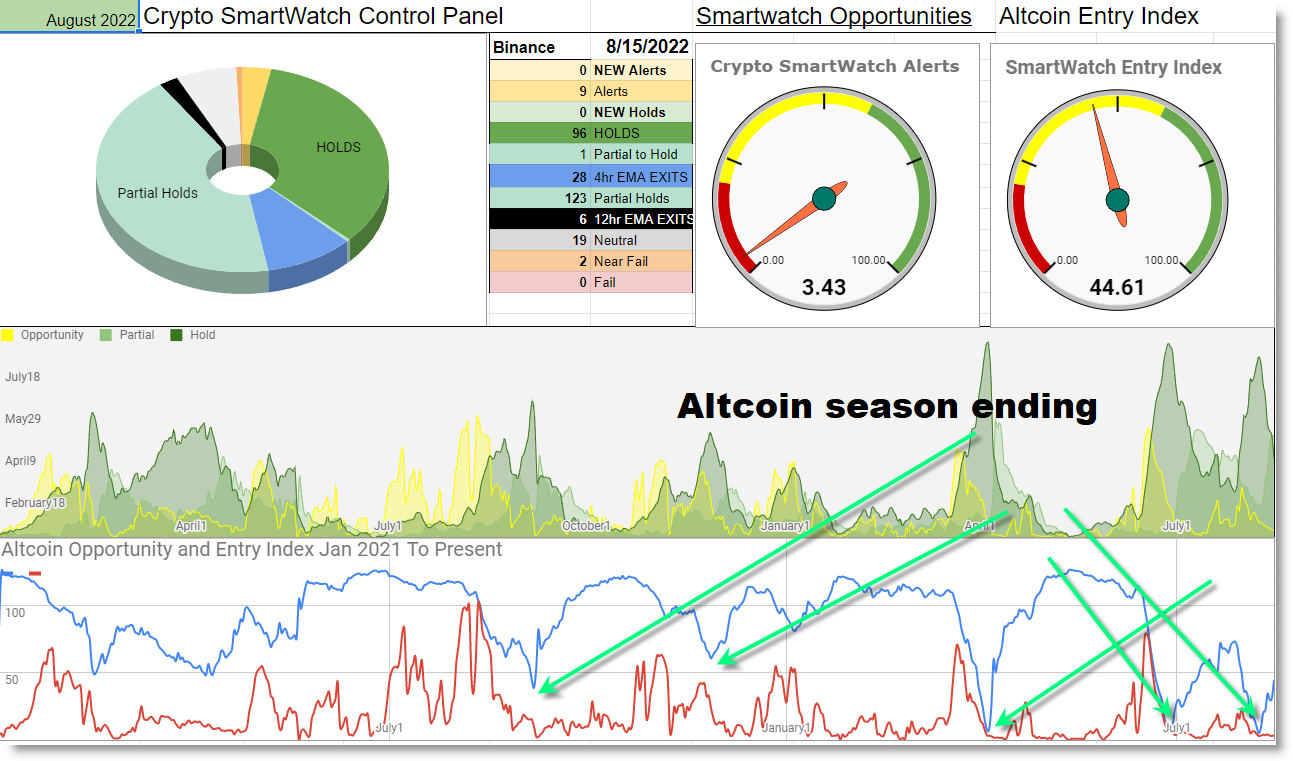

- The Crypto SmartWatch provides actionable insights for timing altcoin investments

- Understanding these patterns helps traders build diversified crypto portfolios

Understanding how Bitcoin Dominance affects altcoin season provides crucial insights for identifying profit opportunities in cryptocurrency market cycles. The relationship between Bitcoin dominance, price movements, and Stable Coin Dominance creates predictable patterns that smart traders can leverage for strategic portfolio management.

The Crypto SmartWatch breaks down these complex market dynamics into actionable intelligence, offering a daily action matrix that beginner crypto traders can easily implement for consistent results. This systematic approach eliminates guesswork from altcoin season timing.

What is Bitcoin Dominance?

Bitcoin dominance represents the percentage of total cryptocurrency market capitalization held by Bitcoin. This metric serves as a barometer for Bitcoin’s influence relative to alternative cryptocurrencies. High Bitcoin dominance (above 60%) indicates Bitcoin’s market control, while altcoins struggle for traction. Conversely, when dominance falls below key thresholds, it signals altcoins are capturing larger market share and potentially delivering superior returns compared to Bitcoin.

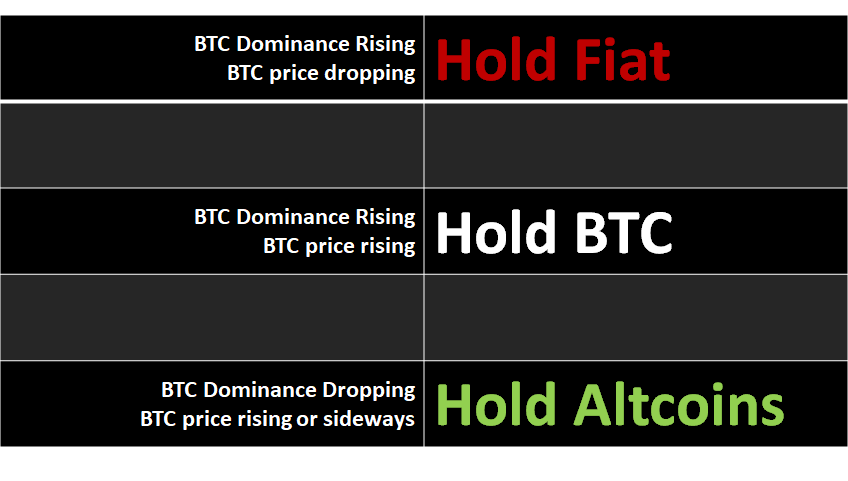

Here’s a practical framework for understanding how Bitcoin Dominance directly impacts Altcoin Seasons:

Bitcoin’s price movements significantly influence its market dominance. During strong Bitcoin rallies, its market capitalization expands rapidly, increasing dominance. However, once Bitcoin stabilizes after significant gains, investors typically rotate profits into altcoins, causing Bitcoin dominance to decline while triggering altcoin rallies. Tracking these rotation patterns provides predictable entry and exit points for maximizing returns.

Identifying Altcoin Season: Key Indicators and Timing Signals

Altcoin season refers to periods when alternative cryptocurrencies outperform Bitcoin in USD value and market capitalization growth. During these cycles, select altcoins can deliver 2-10X greater returns than Bitcoin over compressed timeframes. Recognizing altcoin season indicators early gives traders a significant advantage.

Several factors trigger altcoin seasons, including institutional adoption, technological breakthroughs, improved scalability solutions, and favorable macroeconomic conditions. The most reliable indicator remains declining Bitcoin dominance accompanied by steady or rising overall crypto market capitalization. When investors rotate Bitcoin profits into altcoin opportunities, market dominance shifts create predictable profit cycles.

Stable Coin Dominance: The Hidden Market Sentiment Indicator

Stable coins like USDT, USDC and DAI serve as essential capital repositories within the cryptocurrency ecosystem. Their dominance patterns provide valuable insights into market sentiment and capital flow direction that savvy traders monitor closely.

These dollar-pegged assets function as capital storage and transition vehicles, allowing investors to quickly move between fiat and cryptocurrency positions without exiting the crypto ecosystem. This flexibility creates visible patterns in market structure.

Rising stable coin dominance signals bearish altcoin sentiment, indicating investors are reducing risk exposure and securing profits. This capital preservation behavior typically precedes market corrections or consolidation phases.

Conversely, decreasing stable coin dominance reflects bullish market confidence as investors deploy capital from sidelines into cryptocurrency positions. This liquidity injection often fuels sustainable market rallies and marks the early stages of altcoin seasons. Strategic altcoin portfolio construction during these periods can significantly outperform Bitcoin-only strategies.

While these relationships provide valuable insights, market dynamics remain complex and require nuanced interpretation. Successful traders consistently implement risk management protocols and avoid common pitfalls that derail new market participants. False signals can occur during market dislocations, where Bitcoin dominance decreases during broad market downturns rather than healthy rotation. Similarly, stable coin usage patterns evolve with market maturation, requiring ongoing analytical adjustment.

Optimizing Altcoin Season Profits in 2025

The 2025 cryptocurrency landscape features increasingly sophisticated relationships between market dominance metrics. While traditional indicators provide general direction, the Crypto SmartWatch platform delivers precision market timing by synthesizing multiple data points into actionable portfolio management strategies that identify both entry and exit positions for altcoin cycles.

How Bitcoin Dominance Transforms Altcoin Season Profitability:

Bitcoin Dominance patterns reveal critical insights into cryptocurrency market maturation cycles. The Crypto SmartWatch transforms these complex relationships into straightforward daily action steps for systematically building, balancing, and optimizing diversified crypto portfolios through complete altcoin season cycles. This structured approach eliminates emotional decision-making while maximizing compound growth potential.

Bitcoin dominance, bitcoin price and Stable Coin Dominance are all interconnected with #AltCoinSeason but we need the #CryptoSmartWatch to see when is altcoin season objectively.https://t.co/pHBBkdRAe7#cryptobull #CryptoInvestor

— introtocryptos.ca (@introtocryptos) January 16, 2023