Optimized WordPress Block Content

Key Takeaways:

- AltSeason CoPilot provides daily manual chart analysis to identify the most profitable altcoin opportunities

- Trading ALT/BTC price spreads is a strategic approach to maximize cryptocurrency profits during altcoin cycles

- Portfolio diversification across multiple cryptocurrencies significantly reduces risk while capturing market upswings

- Declining Bitcoin dominance typically signals prime opportunities for altcoin investments

- Effective risk management strategies are essential for sustainable cryptocurrency trading success

Join the AltSeason CoPilot today — the ultimate cryptocurrency portfolio rebalancing tool designed specifically for both beginners and experienced traders in 2025.

Our expert team conducts comprehensive daily analyses of each altcoin/BTC chart, updating trade statuses in real-time as we optimize our model portfolio based on market movements and technical indicators.

Essential Cryptocurrency Trading Strategies for 2025

This comprehensive guide builds on our proprietary trading methodology that has delivered consistent results since 2015. Download our proven crypto trading plan PDF that thousands of successful traders have implemented to capitalize on market trends while minimizing downside risks.

Altcoin season represents specific market periods when alternative cryptocurrencies experience accelerated value growth compared to Bitcoin. These cycles occur regardless of Bitcoin’s price action—whether it’s rising, falling, or consolidating. Strategic traders leverage ALT/BTC spread trading during these seasons to capture significant profit opportunities by capitalizing on the performance differential between altcoins and Bitcoin.

The AltSeason CoPilot implements a battle-tested cryptocurrency trading framework with robust risk management protocols at its core. The system is specifically engineered to identify high-probability altcoin season opportunities while protecting your capital. Our methodology focuses on systematically finding cryptocurrencies that consistently outperform Bitcoin during favorable market conditions, giving you a strategic edge in volatile market environments.

The AltSeason CoPilot delivers precise trading signals and indicators that help traders

identify optimal altcoin season entry points.

Our comprehensive risk management tools empower traders to

control exposure and minimize potential losses while maximizing upside potential.

A reliable indicator of altcoin season emergence is declining Bitcoin dominance – when Bitcoin’s market capitalization percentage relative to the total cryptocurrency market decreases. Stablecoins play a critical role in this ecosystem as liquidity vehicles. Rising stablecoin dominance typically signals bearish sentiment for altcoins, indicating capital preservation and risk-off positioning. Conversely, decreasing stablecoin dominance often precedes bullish altcoin momentum as investors redeploy capital from sidelines into cryptocurrency markets with greater risk appetite.

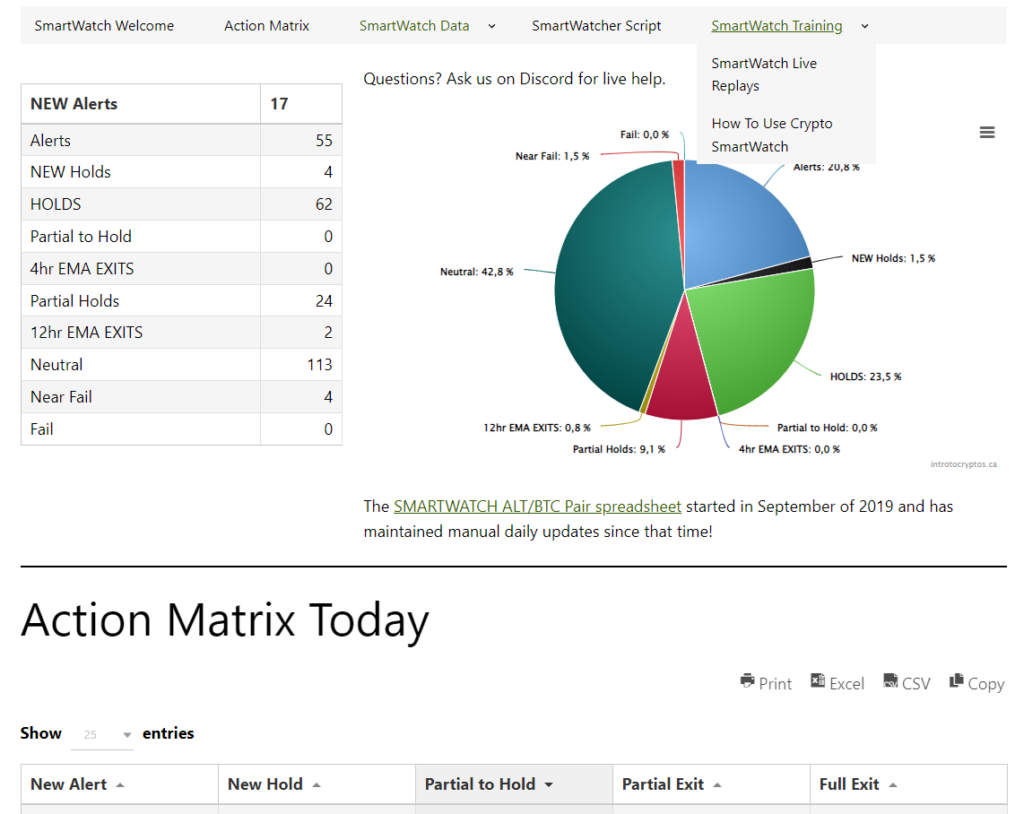

While Bitcoin dominance provides a valuable macro view, it represents an aggregate market measure that doesn’t highlight specific outperforming assets. Some altcoins surge dramatically while others remain stagnant within the same market environment. This is precisely where the AltSeason Copilot’s daily action matrix delivers exceptional value by identifying specific cryptocurrencies poised for significant upside potential.

Understanding Bitcoin Dominance Cycles and Market Correlations

Market relationships evolve continuously, requiring traders to adapt their strategies accordingly while implementing proper risk control measures in cryptocurrency trading. Declining Bitcoin dominance doesn’t automatically guarantee altcoin season momentum. During broader market corrections, both Bitcoin and altcoin capitalizations may decrease simultaneously. Similarly, increased stablecoin usage sometimes reflects broader cryptocurrency adoption rather than bearish sentiment. Successful traders constantly monitor these shifting correlations to maintain strategic positioning.

Many cryptocurrency traders exclusively focus on altcoin/USD pairs, overlooking the significant opportunities that ALT/BTC price spread trading offers. This alternative approach opens additional profit avenues that USD-focused traders frequently miss.

Strategic Portfolio Diversification for Maximum Risk-Adjusted Returns

Our ALT/BTC spread trading methodology emphasizes smaller position sizing across multiple cryptocurrencies as a core risk management principle. This strategic diversification approach allows traders to capture explosive upside in high-momentum markets while minimizing exposure to underperforming assets. By implementing proven risk management techniques, you can avoid the common pitfalls that lead to trading failures.

This balanced approach enables traders to capitalize on diverse market opportunities while maintaining strict risk parameters. Profitable altcoin season trading depends on identifying long-term trends, implementing portfolio diversification, and maintaining disciplined position management throughout market cycles.

Beyond the AltSeason CoPilot, traders can enhance their market edge with complementary tools. Quality crypto trading signals provide timely, actionable intelligence for informed decision-making. Additionally, automating your cryptocurrency trading strategy allows you to capitalize on market opportunities 24/7 without constant manual monitoring.

Strategic portfolio rebalancing is essential for capitalizing on altcoin season opportunities. Whether performed manually or using the AltSeason Portfolio Rebalancing Tool, this approach optimizes your holdings to reflect current market conditions, improving potential returns while reducing downside risk.

The 2025 altcoin season presents exceptional profit potential for well-prepared traders. By implementing the strategies and tools outlined in this guide, you can maximize your returns while protecting your capital during these dynamic cryptocurrency market cycles.

Frequently Asked Questions About Cryptocurrency Trading in 2025

Q: What defines an altcoin season in 2025’s cryptocurrency market?

A: Altcoin season in 2025 specifically refers to market periods when alternative cryptocurrencies demonstrate accelerated value growth compared to Bitcoin. During these cycles, strategic traders implement long and short positions to capitalize on ALT/BTC price spreads. This approach consistently generates superior returns since select altcoins can deliver 3-5x Bitcoin’s performance during favorable market conditions. The current market structure enables these opportunities through increased institutional adoption and improved market liquidity.

Q: What are the most effective strategies for ALT/BTC spread trading in today’s market?

A: Successful ALT/BTC spread trading involves several strategic approaches tailored to 2025’s market dynamics. Traders utilize margin and futures markets to establish both long and short positions, effectively capturing price differentials. Exchange selection is crucial – platforms offering diverse altcoin trading pairs provide more opportunities to identify and capitalize on emerging trends. Position sizing, entry timing, and technical analysis also play critical roles in optimizing spread trading performance.

Q: Which risk management strategies are essential for altcoin trading success?

A: Effective risk management is non-negotiable in altcoin trading due to their inherently higher volatility compared to Bitcoin. Successful traders implement strict stop-loss protocols, maintain appropriate position sizing (typically 1-3% of total portfolio per position), and adhere to pre-determined risk-reward ratios (minimum 2:1). Understanding the specific risks associated with margin trading, futures contracts, and liquidation scenarios is equally important. The most successful traders prioritize capital preservation above all else.

Q: Why do certain altcoins consistently outperform Bitcoin during altcoin seasons?

A: Altcoins outperform Bitcoin during specific market cycles due to several factors: lower market capitalization allowing for more dramatic price movements, increased trading activity and capital inflows targeting specific sectors, enhanced technological developments, and strategic project partnerships. Additionally, derivative markets enable sophisticated traders to establish leveraged long and short positions, amplifying price movements. Smaller-cap altcoins with strong fundamentals often deliver the most impressive returns during these periods.

Q: What reliable indicators signal the beginning of an altcoin season?

A: The most reliable indicators of an emerging altcoin season include: significantly increased altcoin trading volumes relative to Bitcoin, rising open interest on altcoin futures markets, declining Bitcoin dominance metrics, decreasing stablecoin market share, positive funding rates on perpetual futures contracts, and heightened social media sentiment toward specific altcoin projects. Additionally, major protocol upgrades, institutional adoption announcements, and positive regulatory developments often precede altcoin market momentum shifts.