Strategic Positioning for Altcoin Season in 2025: A Stress-Free Investment Approach

Key Takeaways

- Pattern-Based Investing: Learn a specific 1-2-3 pattern that generated 450%+ returns in under 5 months without day trading

- Time-Efficient Strategy: Manage a diverse crypto portfolio in just 20 minutes per day

- Risk Management: Implement a systematic approach to positioning for altcoin season with minimal stress

- Chart-Free Method: Stop watching price fluctuations constantly while still capturing significant market movements

- Real Results: Two case studies showing 100%+ gains using this methodical approach to crypto investing

- Tired of trying to understand complex cryptocurrency technologies and terminology

- Uncertain about optimal timing for altcoin season investment opportunities

- Looking for a crypto investment strategy that doesn’t require constant chart monitoring

This comprehensive guide is specifically designed for you.

I’m going to reveal the exact pattern I’ve implemented with a verified copy trading account to grow a modest cryptocurrency portfolio by over 450% in just 149 days – documented with real-time results.

No leverage. No day trading. Just strategic positioning.

Let Your Cryptocurrency Work For You

Today I’m sharing one of the four essential strategies in our financial framework that will accelerate your path toward achieving your crypto investment goals.

The methodology I’m about to share can completely transform how you approach cryptocurrency investing.

You can transition from feeling:

- overwhelmed by market volatility

- anxious about investment decisions

- chained to price charts 24/7

…to

ツ confidently managing your entire portfolio in just 20 minutes daily.

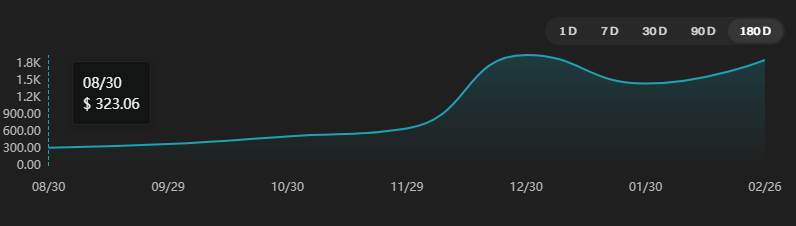

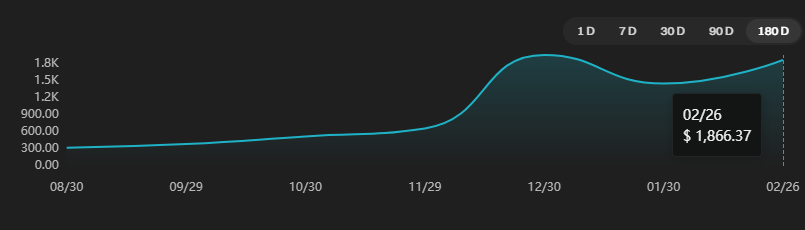

From Free Referral Earnings to $1866: A 477% Growth Case Study

This investment journey began in September 2023 when I discovered accumulated referral earnings totaling $352 USDT in my exchange account.

After conducting thorough market analysis, I identified BAKE as a promising token and invested the funds. I patiently held this position for over two months before a significant price breakout materialized. For detailed analysis, you can watch the complete video breakdown.

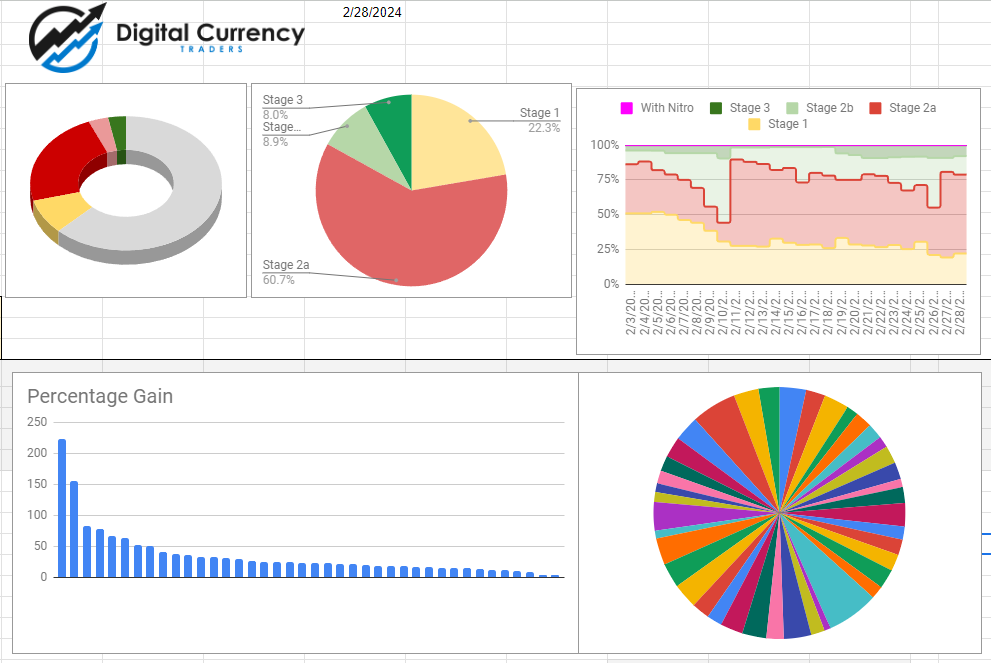

Throughout January, I strategically took profits from the BAKE position and allocated this capital to a systematic Copy Trading account connected to our PRO ALERTS trade tracking system.

Recently, I redistributed the initial investment profits across 40 carefully selected cryptocurrencies, maintaining minimum position sizes to optimize the risk-reward ratio.

This diversification strategy has been instrumental in generating significant portfolio growth while minimizing individual asset risk.

Let’s examine the progression:

Starting Point: $323 Initial Capital (September 30, 2023)

Current Valuation: $1,866 (February 26, 2024)

WHY This Positioning Strategy Outperforms Traditional Approaches

During this same period, Bitcoin appreciated by approximately 90% – impressive by traditional investment standards. However, our strategically positioned portfolio significantly outperformed this benchmark with a 477% return.

Here’s the methodology behind these results:

Our time-efficient crypto positioning strategy integrates three critical components for optimal market entry and exit timing:

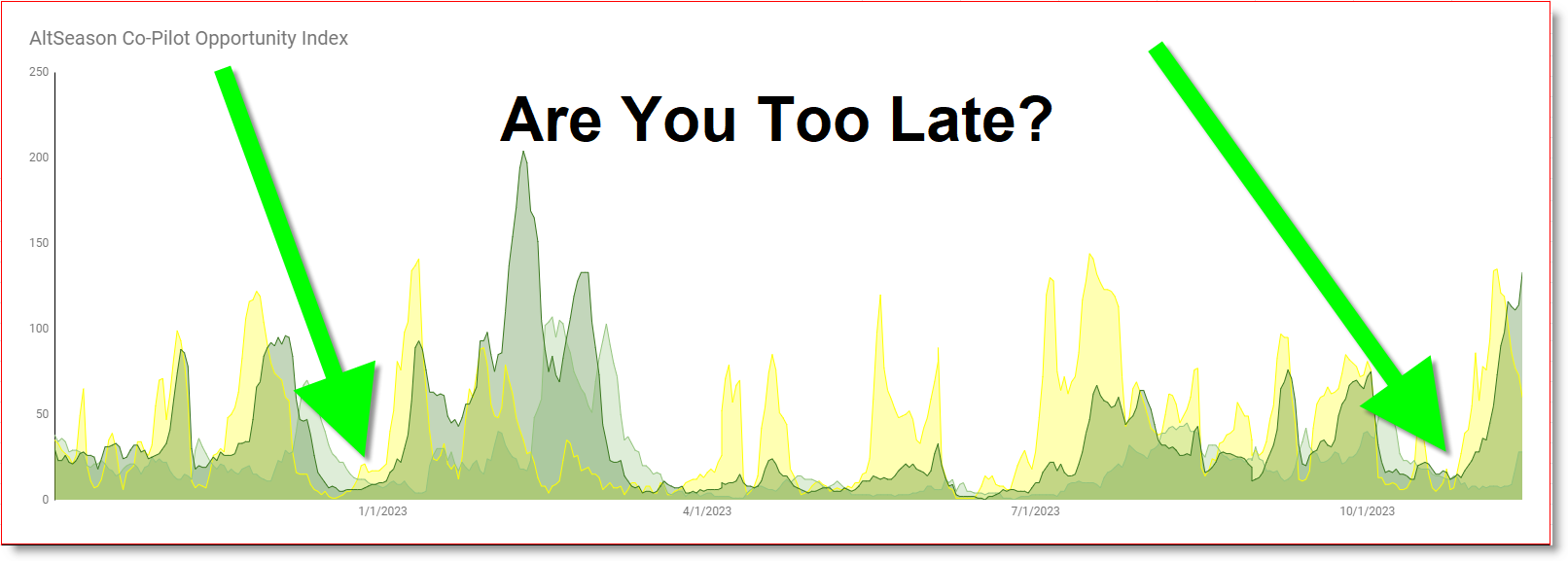

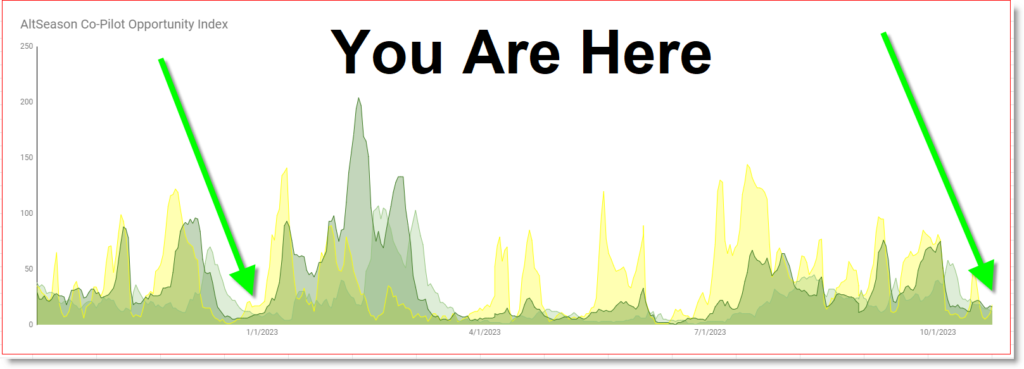

- AltSeason CoPilot market cycle identification

- Strategic diversification across small positions

- Specific 1-2-3 pattern recognition for precise timing

Over these 149 days, this methodology has provided another compelling case study demonstrating the effectiveness of pattern-based positioning versus reactive trading.

Trade the pattern, not the market. This fundamental principle separates successful investors from constant chart-watchers.

Positioning vs. Trading: A Critical Distinction

➟ The Traditional Approach –

Traditional cryptocurrency trading presents significant challenges for most investors.

First, you must develop the skill to identify potentially profitable trade setups among thousands of options.

When past trading attempts haven’t yielded desired results, many investors respond by increasing their research time and effort.

This leads to exhaustion as you navigate extreme volatility, regulatory changes, and unpredictable market movements.

Despite diligent research and constant monitoring, many traders achieve minimal returns or experience losses.

The frustration compounds when countless hours spent analyzing short-term charts produce disappointing results, creating a discouraging cycle.

➟ The Strategic Positioning Approach –

Invest just minutes daily to strategically position a diversified portfolio of dozens of cryptocurrencies based on proven patterns.

This minimal time investment was all that was required to achieve the 477% growth demonstrated in this case study.

With a properly implemented positioning strategy, you’ll spend minutes—not hours—allocating capital to opportunities with substantial growth potential based on historical market cycles.

Breaking Free From Chart Addiction: The Mental Freedom Strategy

➞ How would your life improve if you weren’t constantly checking cryptocurrency charts?

➞ What if your cryptocurrency investments generated returns while you focused on other priorities?

➞ What could you accomplish with the hours currently spent on market research and news analysis?

➞ What activities and relationships have you postponed until your trading becomes consistently profitable?

Insider Strategy:

I’m sharing the exact positioning patterns that have consistently generated returns in my personal portfolio.

The three fundamental principles are:

☲ ➀ ☲

Align investments with AltSeason CoPilot market cycle indicators

☲ ➁ ☲

Concentrate on repeatable patterns rather than specific assets

☲ ➂ ☲

Methodically diversify your portfolio through incremental position building

It’s important to understand that I didn’t predict in advance which specific cryptocurrencies would deliver the highest returns.

The strategy’s effectiveness comes from strategic diversification across multiple assets while highlighting two exceptional performers for this case study.

I’m sharing these tested strategies to help you develop confidence in your ability to make cryptocurrencies work for you rather than constantly working for them.

Let’s examine two specific cryptocurrencies from our copy trading portfolio that have generated over 100% returns.

I’ll demonstrate the precise pattern that signaled entry points for each position.

Once you understand this pattern, you’ll begin identifying similar setups across numerous cryptocurrency markets.

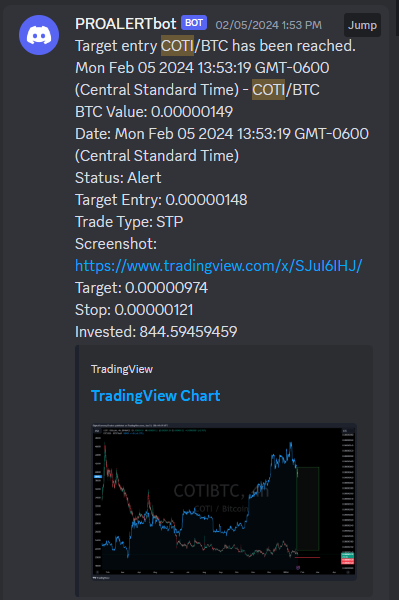

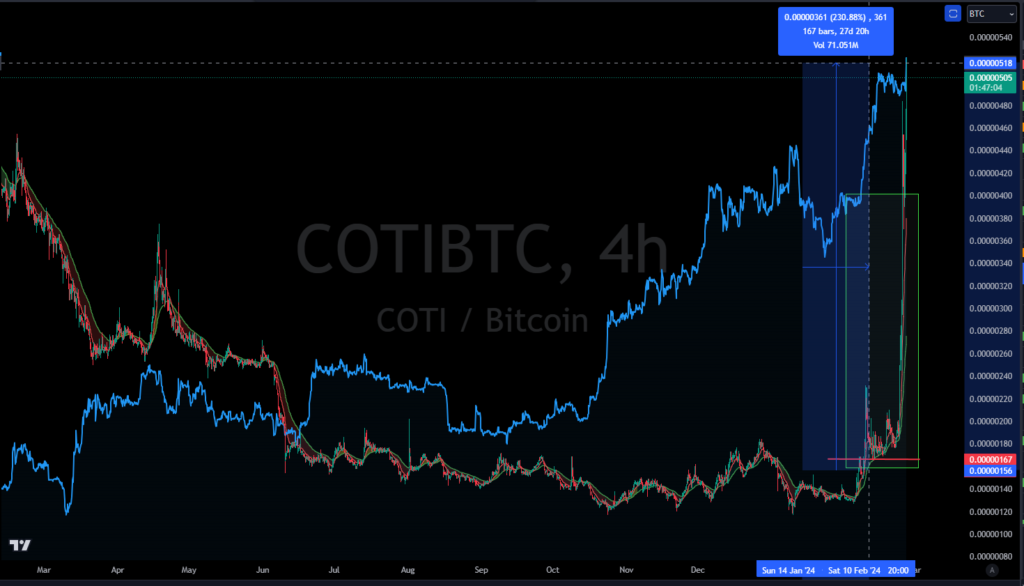

Case Study One: COTI Pattern Recognition and Position Management

COTI Entry Analysis:

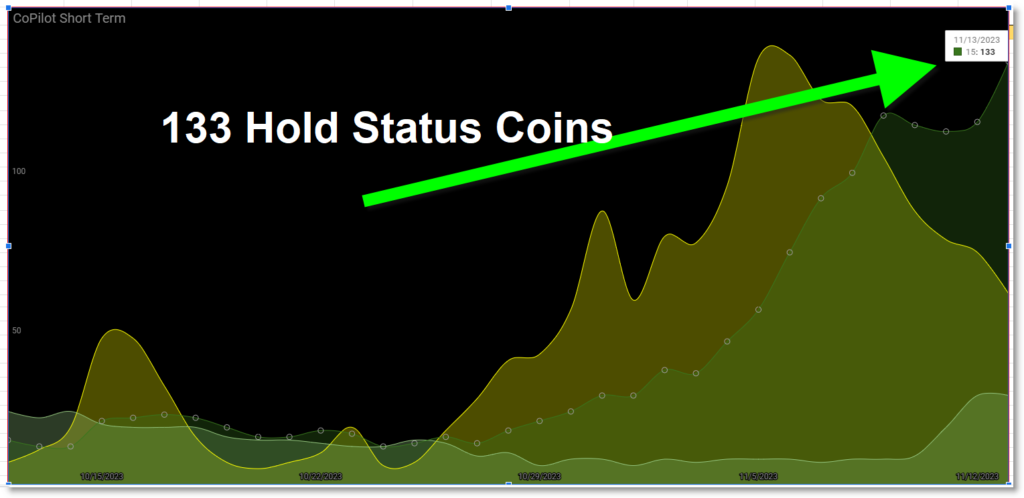

Our system identified and published the initial COTI alert on January 23.

Our tracking spreadsheet continuously monitored price action, triggering the formal entry signal on February 5 when the pattern confirmed.

Current Position Performance Analysis

As of this writing, the COTI position has generated over 200% in open profits:

The protective stop loss has been strategically placed well below current price levels to accommodate natural market consolidation. This position has now entered Stage 3 of our position management framework.

We’ve successfully managed risk parameters and validated our entry thesis.

No immediate action is required even if temporary price retracement occurs.

Position Strategy Analysis:

This position has validated our entry thesis and maintains a substantial profit buffer.

Beyond monitoring potential exit strategies as the price pattern matures, we’re also evaluating opportunities to increase position size during strategic pullbacks, implementing our full-cycle position management system.

Case Study Two: ARKM Pattern Recognition and Position Execution

ARKM Entry Analysis:

Our system identified and published the ARKM opportunity alert early on February 10

The entry signal triggered shortly afterward on the same morning, confirming optimal timing:

Current position performance:

The protective stop loss has been placed strategically below support levels to accommodate typical market volatility while protecting capital.

Key Advantages of Pattern-Based Positioning:

These case studies demonstrate the effectiveness of our positioning methodology.

Both positions have entered Stage 3 of our framework, with protective stops placed above entry levels to ensure risk management remains paramount.

We continuously monitor for opportunities to increase position size during strategic pullbacks while simultaneously preparing appropriate exit strategies based on evolving market conditions.

Our systematic approach evaluates which Stage of the trade framework aligns with current market conditions…

We prepare for potential position expansion in Stage 4 while simultaneously planning exit strategies for Stage 5.

The 20-Minute Daily Crypto Positioning System

Step 1: Monitor AltSeason CoPilot indicators that historically identify periods of significant altcoin price movements relative to Bitcoin.

Step 2: Identify cryptocurrencies exhibiting our specific 1-2-3 pattern formation, diversifying across various market sectors and use cases.

Step 3: Implement strict position sizing protocols, establishing small initial allocations to manage risk effectively across the portfolio.

Step 4: Dedicate just 20 minutes daily to portfolio rebalancing as individual positions reach predefined stages within our trade management framework.

Step 5: Eliminate constant chart monitoring, allowing the positioning strategy to work while you focus on other priorities.

Developing Sustainable Cryptocurrency Investment Habits

- Can you recognize the substantial advantages of strategic positioning versus reactive trading?

- Would you prefer to conserve time and reduce stress rather than day trading the highly volatile cryptocurrency market with leverage?

- Consider how a 450% portfolio increase achieved with minimal daily time investment could transform your financial independence.

- How would your lifestyle change if you implemented a cryptocurrency strategy that eliminated constant chart monitoring?

The ultimate goal is generating cryptocurrency growth while focusing on what truly matters in your life.

A properly designed positioning system requires minimal time commitment and eliminates the need for constant chart monitoring or market analysis.

The Practical Value of Evidence-Based Methodology

My team and I have invested years of research, experienced countless hours of trial and error, and allocated substantial capital to develop and refine this positioning framework.

Yet these proven strategies provide no benefit if you continue following conventional approaches that keep you chained to charts.

The Hidden Cost of Outdated Investment Habits

What happens if you maintain your current approach – constantly watching charts and frequently entering and exiting positions based on short-term movements?

I want to help you avoid these pitfalls by offering complimentary 7-day access to my comprehensive course and proprietary market data tools.

You can unlock the full potential of this positioning strategy through committed learning and consistent application of these principles.

This methodical approach has the potential to transform not only your daily routine but potentially your long-term financial trajectory as well.