In our video call this morning, November 13 2023, we Altcoin Season CoPilots reviewed the data for the onset of altcoin season and its implications on the price of tokens in the cryptocurrency market.

The video from the call did not record but we did get the audio so we can share some of our strategies for investment in Bitcoin and altcoins, addressing the dynamic nature of the crypto market and how one can maximize their assets.

Altcoin Season and Market Dynamics

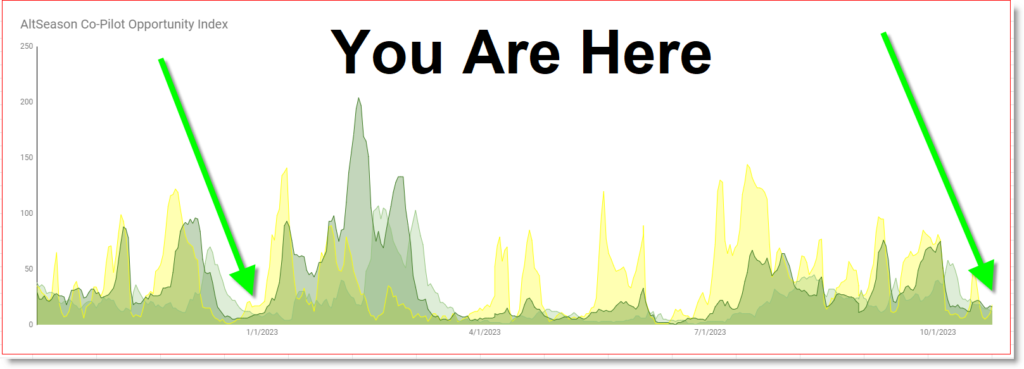

It is November 13th, and the emerging altcoin season suggests that Bitcoin dominance is showing a top formation and might soon decrease.

Three Life-Changing Crypto Bull Markets

This is seen as a sign of capital flowing into altcoins at a faster rate than into Bitcoin. This matches my understanding of the broader economic context, because of the ongoing bull market in stocks and precious metals, alongside increasing U.S. debt and global inflation.

Investment Strategy in Cryptocurrency

A key focus of the discussion is our trend following strategy for investing in cryptocurrencies.

Our system has three phases:

- Holding cash unless Bitcoin’s value is increasing.

- Investing in Bitcoin unless its dominance is dropping.

- Shifting to altcoins when Bitcoin dominance decreases.

Already Into Position Before Dominance Tops

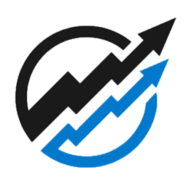

Here is a screenshot from our Oct 23 notification.

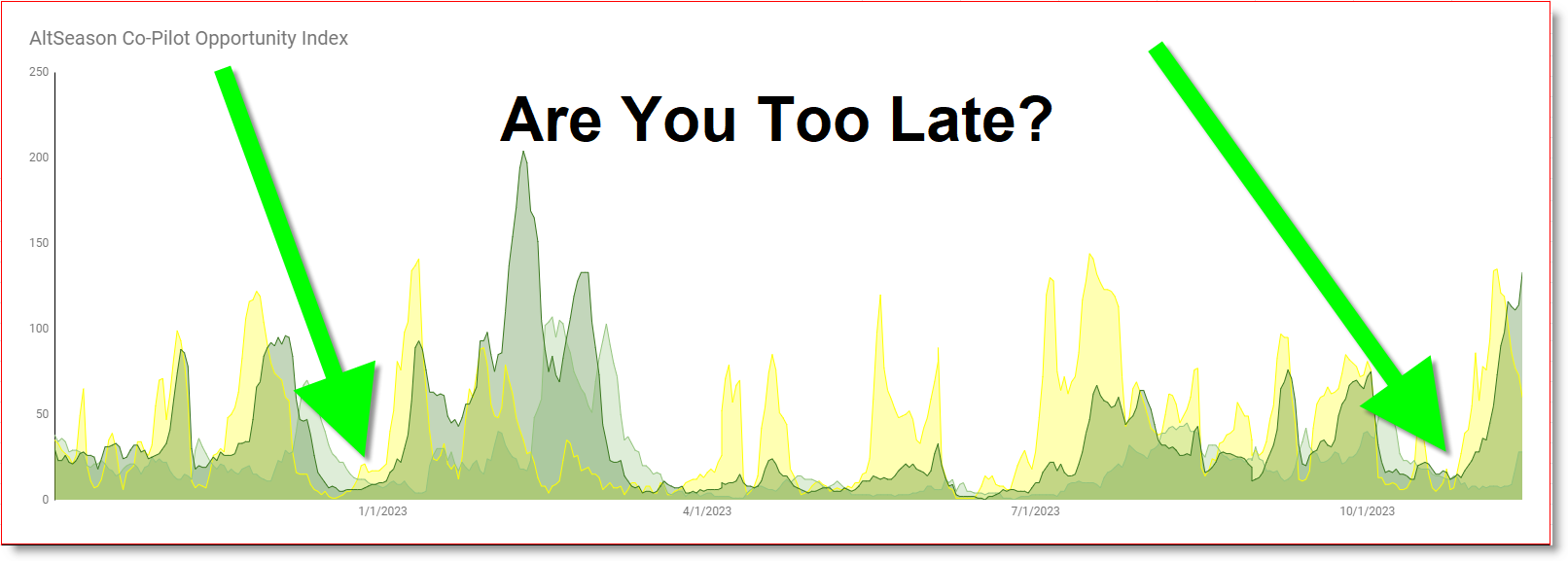

Here is the same Altcoin Season Momentum chart for November 13:

The current market conditions are passing our entry signals for small diversified investments in altcoins.

However, the general strategy emphasizes staying mostly in Bitcoin and only shifting into altcoins as the alt/btc spread changes as noted above.

Trading Perspective and Diversification

Addressing a hypothetical scenario, the our system advise an individual with $1,000 in USDT (Tether) on how to approach the current market.

The recommendation is to look through all the charts to find entry patterns that match our trading plan, diversify directly into different cryptocurrencies rather than converting to Bitcoin first. This approach aims to maximize the number of Bitcoins held rather than focusing on dollar value.

Our system emphasizes the goal of growing Bitcoin holdings, the number of satoshi we own rather than the number of dollars we own, on the premise that Bitcoin’s value will significantly outpace that of the dollar.

Altcoin vs. Bitcoin Performance

The AltSeason CoPilot spreadsheet addresses the importance of choosing altcoins that are likely to increase in value against Bitcoin, rather than just against the US dollar.

As a recent example, while the US dollar value of Litecoin might have shown some profit recently…

…its performance against Bitcoin shows that holding Bitcoin would have been more profitable – and Litecoin now flags itself as a chart formation to watch for our signal to set up in the near future!

Conclusion

I want to finish this brief update with an emphasis on measuring success in terms of Satoshi, the smallest unit of Bitcoin, rather than in US dollars.

Focusing on strategies that grow Bitcoin holdings, stay focused the long-term potential of Bitcoin compared to traditional debt-backed fiat currencies.