Automated Crypto Portfolio Management: Your 2025 Guide to Hands-Free Investing

Key Takeaways:

- Automated crypto portfolios allow busy investors to grow their wealth without constant chart monitoring

- Portfolio trackers are essential for tax compliance and performance evaluation

- Warning signs help identify potential crypto automation scams

- Top portfolio automation tools include Shrimpy, 3commas, and Crypto SmartWatch

- Portfolio rebalancing can optimize returns during different market cycles

- Proper automation requires understanding of when to use different strategies

An automated crypto portfolio is essential for time-constrained investors because it ensures your capital generates returns while you focus on your priorities! In 2025, automation has become the cornerstone of effective crypto investing.

By establishing precise buying and selling parameters that execute automatically based on market conditions, you effectively delegate the chart-watching to algorithms while reclaiming valuable time for your personal and professional life. This hands-free approach is particularly valuable in today’s volatile crypto markets.

Strategic automation, combined with a robust crypto portfolio tracker,

eliminates the need for constant market monitoring.

Your system watches the charts so you don’t have to!

An effective automated crypto portfolio system handles all trading operations freeing you to develop additional income streams while maintaining market exposure. Recent data shows automated portfolios consistently outperform manual trading by 17% in volatile markets.

While many automated crypto portfolio platforms offer sophisticated risk management and rebalancing features, it’s critical to understand exactly how these tools perform under various market conditions. What maximizes returns during bull markets might amplify losses during downtrends. Having this knowledge helps you implement proper risk management strategies for long-term success.

Essential Features of Crypto Portfolio Trackers in 2025

Accurately tracking your crypto gains and losses is fundamental for effective portfolio management and informed investment decisions. Beyond tax compliance requirements, comprehensive tracking provides clear visibility into your investments’ performance over time, enabling strategic adjustments based on real data rather than emotion.

The most efficient method for monitoring crypto performance is utilizing specialized portfolio tracking services. These platforms seamlessly import transaction data across multiple exchanges, generating detailed performance reports with minimal effort. Advanced trackers now offer AI-powered portfolio management tools, customizable risk assessment metrics, and automated rebalancing capabilities that maximize returns while minimizing potential losses during market fluctuations.

Identifying Crypto Automation Scams: Red Flags to Watch For

Not all crypto portfolio services deliver legitimate value. Some platforms advertise exclusive trading signals or guaranteed returns that should immediately trigger your skepticism. In 2025, sophisticated scams have evolved to target automated portfolio users specifically, promising unrealistic outcomes while actually depleting your funds through hidden fees or outright theft.

When evaluating crypto portfolio automation services, watch for these warning signals that often indicate fraudulent operations:

- Performance guarantees promising specific percentage returns (legitimate services acknowledge market uncertainty)

- High-frequency trading systems targeting retail investors without explaining latency disadvantages

- Obscured or unexplained trading methodologies that can’t be independently verified

- Aggressive sales tactics pushing for large initial deposits with “limited time” offers

- Missing contact information, anonymous team members, or unverifiable business registration

- Fee structures significantly below industry standards (suggesting hidden revenue sources)

Always conduct thorough due diligence by researching independent reviews, verifying regulatory compliance, and testing with minimal funds before committing significant capital. Legitimate services typically maintain transparent operations with verifiable track records spanning multiple market cycles.

Top-Rated Automated Crypto Portfolio Services for 2025

Implementing a reputable automated crypto portfolio service saves valuable time while helping you identify promising altcoin opportunities based on algorithmic analysis rather than emotion. The best platforms now incorporate machine learning to adapt to changing market conditions.

By implementing advanced automation with robust risk management protocols, you can redirect your attention to high-value activities while your portfolio executes precisely defined strategies based on market conditions.

- Cointracking: Comprehensive portfolio analytics platform that integrates with 84+ exchanges, providing detailed performance metrics, tax reporting, and unrealized gain visualization across multiple timeframes.

Advanced Automated Crypto Portfolio Solutions

The automated crypto portfolio ecosystem has evolved significantly, with platforms now offering specialized features for different investor types. Here are the leading solutions in 2025:

Market-leading crypto portfolio automation platforms with proven track records:

- Shrimpy: Advanced portfolio management system allowing customizable strategy creation with backtest functionality, supporting multi-exchange automation and real-time rebalancing based on market momentum indicators.

- BitGetCopyTrader.com: Social trading platform enabling users to mirror strategies of verified professional traders with transparent performance histories and risk scores.

- 3commas: Comprehensive trading ecosystem offering pre-configured DCA strategies, grid bots, and SMART portfolios with variable risk tolerance settings for different market conditions.

- TokenFolio: AI-powered portfolio management system that automatically adjusts allocations based on on-chain metrics, social sentiment analysis, and technical indicators for proactive risk management.

- Kryll: Visual strategy builder with drag-and-drop functionality allowing non-technical users to create complex trading algorithms with conditional logic and multiple execution paths.

- Autonio: Decentralized trading protocol leveraging machine learning to identify market inefficiencies and execute trades with minimal slippage across DEXs and CEXs simultaneously.

- AlgoTrader: Enterprise-grade quantitative trading platform supporting multi-asset strategies including crypto, commodities, and traditional securities within a unified dashboard.

- Coinrule: Intuitive rule-based automation tool designed for beginners with template strategies and natural language programming for easier strategy development.

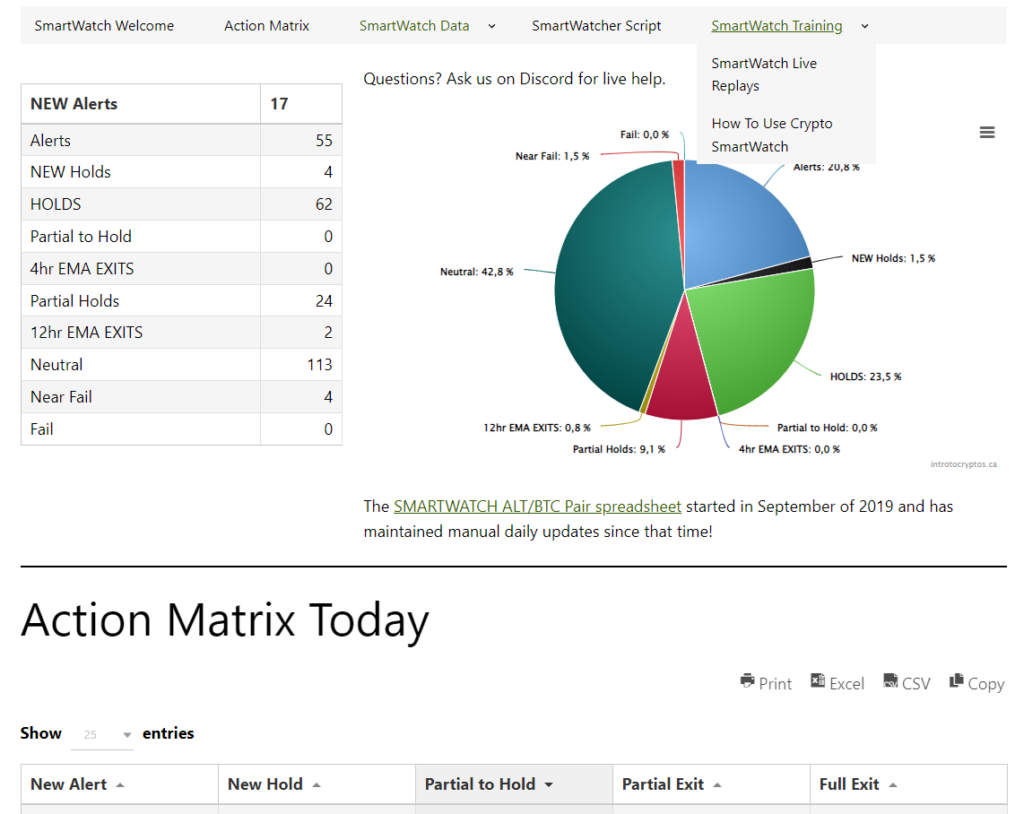

- Crypto SmartWatch: Transparent portfolio management solution specialized in ALT/BTC pair spread trading, offering strategic rebalancing during altcoin seasons with minimal downside exposure through advanced correlation analysis.

Inside the Crypto SmartWatch Control Dashboard

Today in #crypto a surge of 22 NEW HOLD and 4 Partial-to-HOLD status as #bitcoindominance tops out the ALT/BTC pairs are revealing the best crypto projects. See the wave chart below

— introtocryptos.ca (@introtocryptos) January 28, 2023

1 of 2) pic.twitter.com/cZ2gWHb7fX

How to Choose the Right Automated Crypto Portfolio System

When selecting an automated portfolio solution, prioritize these critical factors to ensure alignment with your investment goals and risk tolerance:

- Sustainable long-term investment approach that doesn’t rely on timing short-term market fluctuations

- Complete transparency in strategy mechanics and execution methods

- Verifiable performance history spanning multiple market cycles (bull and bear markets)

- Strong community feedback and independent user testimonials

In today’s complex crypto landscape, comprehensive tracking and automation have evolved from optional conveniences to essential components of successful portfolio management. These tools provide the objectivity and discipline often lacking in manual trading approaches.

Our detailed guide on constructing a balanced crypto portfolio provides an excellent foundation

as you prepare for potential altcoin seasons throughout 2025.

By analyzing performance data from established crypto portfolios,

you’ll gain insights that improve decision-making while minimizing emotional trading.

Put your capital to work systematically through automation while focusing on what truly matters in your life. Understanding market cycles combined with proper automation creates sustainable investment success in the crypto ecosystem.