Crypto Portfolio Rebalancing Tool: Optimize Your Altcoin Strategy in 2025

Key Takeaways:

- Timing is crucial: Our SmartWatch tool identifies the precise moment to enter the next Altcoin Season

- Objective data-driven approach: Uses moving average crossovers to filter early-moving cryptocurrencies

- Historical patterns show: Recent Altcoin Seasons have lasted between 2-8 weeks, offering strategic entry and exit points

- Risk management first: Focus on protecting your capital while positioning for potential altcoin growth

- Low maintenance investing: Save hours of research with automatic portfolio rebalancing signals

The Crypto SmartWatch portfolio rebalancing tool uses objective trend following indicators to identify optimal entry points for altcoin investing. Capitalize on the next Altcoin Season by diversifying into high-potential assets at precisely the right time—without constant market monitoring.

Strategic diversification remains the cornerstone of low-maintenance crypto investing in 2025. An effective crypto rebalancing tool does more than shuffle assets—it synchronizes your portfolio with current market cycles, particularly during the highly profitable Altcoin Season phases that repeat throughout market cycles.

A data-driven crypto portfolio rebalancing strategy can significantly outperform market averages and reduce emotional decision-making by implementing precise moving average crossover techniques that identify early-moving coins when Altcoin Season conditions are optimal.

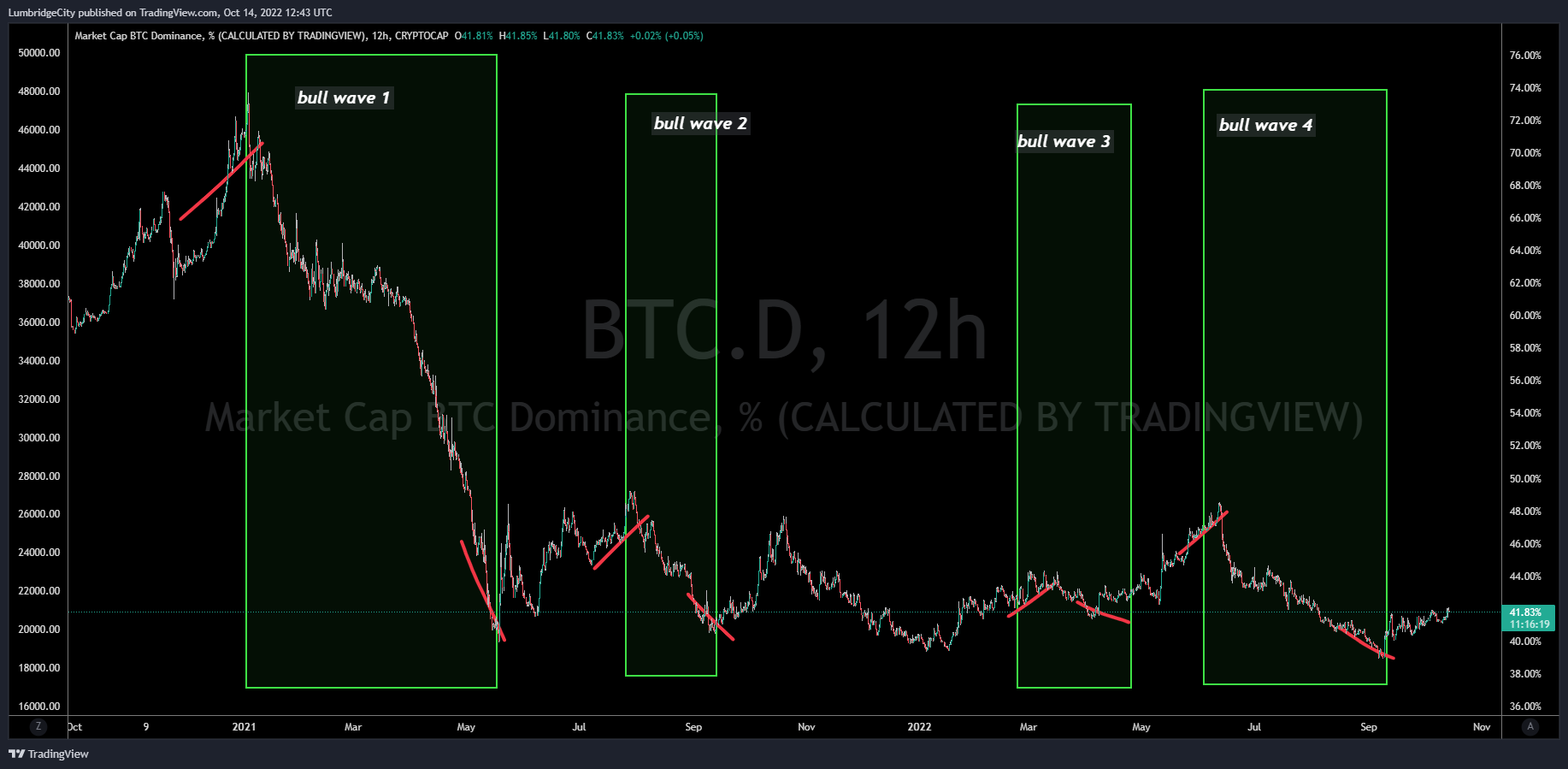

Detecting the Next Altcoin Season with Precision

Previously, investors struggled to accurately predict altcoin seasons using Bitcoin Dominance metrics alone. The signals were often murky and unreliable.

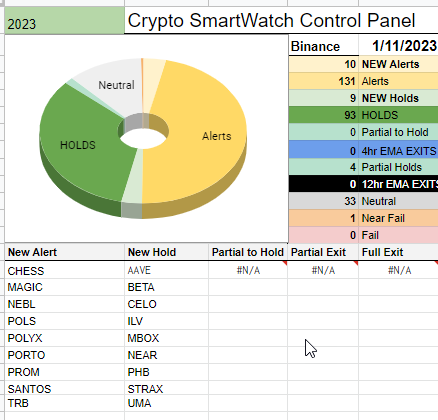

This challenge led to the development of our Crypto SmartWatch color-coded spreadsheet. It provides a clear visual framework that penetrates Bitcoin Dominance data, delivering specific timing indicators for the beginning of each Altcoin Season—removing guesswork from your investment strategy.

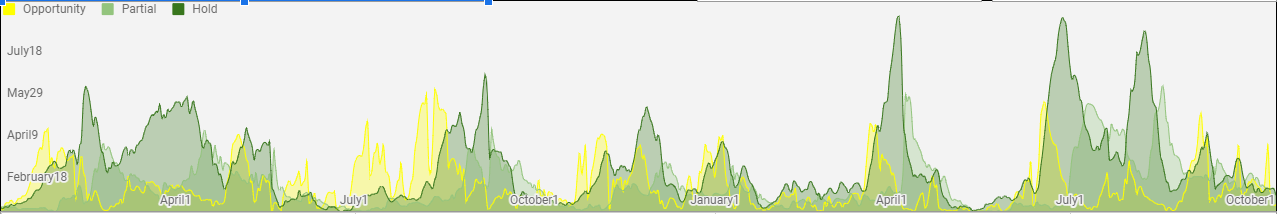

when to expect the next Altcoin Season

The Crypto SmartWatch enhances portfolio performance by applying advanced filtering techniques to thousands of digital assets, identifying those showing early momentum signals. By diversifying into these early-mover cryptocurrencies, you substantially increase your chances of capturing above-average returns across multiple market cycles.

Key Catalysts That Trigger Profitable Altcoin Seasons

Several fundamental factors typically initiate an ‘Altcoin Season’ or bull market in the cryptocurrency ecosystem:

- Regulatory clarity: When governments provide clear, favorable guidelines for cryptocurrency usage and trading, investor confidence surges, driving mainstream adoption and price appreciation.

- Institutional investment: With regulatory frameworks maturing, institutional capital from pension funds, hedge funds, and banks continues flowing into the cryptocurrency market in 2025, creating sustained bullish momentum.

- Practical adoption: As businesses increasingly implement cryptocurrency solutions that benefit customers, utility-driven demand rises naturally, creating upward price pressure.

- Macroeconomic conditions: Global economic factors including interest rates, currency valuations, and inflation rates directly influence cryptocurrency price trends and market cycles.

- Technological breakthroughs: Significant advancements in blockchain technology frequently trigger explosive price movements in specific cryptocurrencies, creating what traders call “Popcorn Moves”—rapid, unpredictable price surges that create profit opportunities.

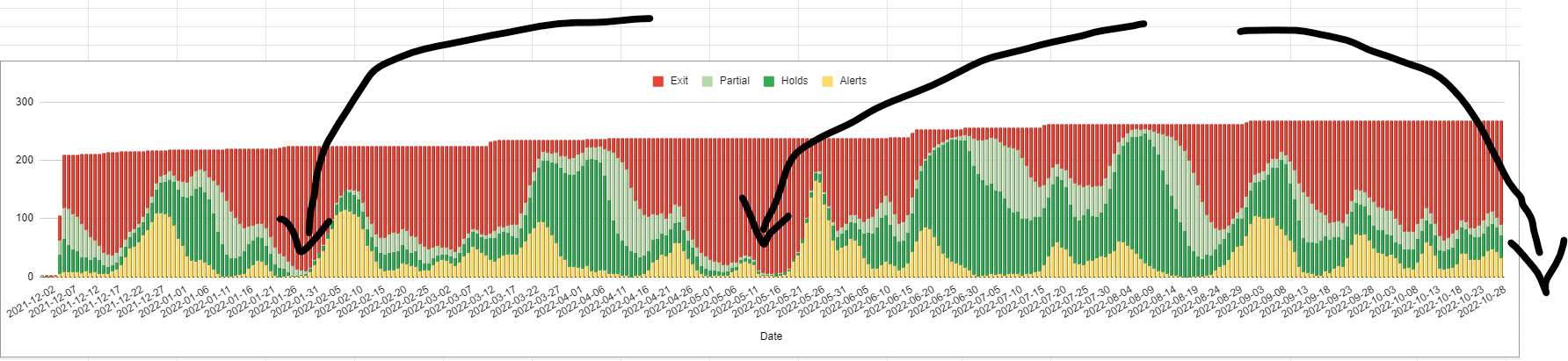

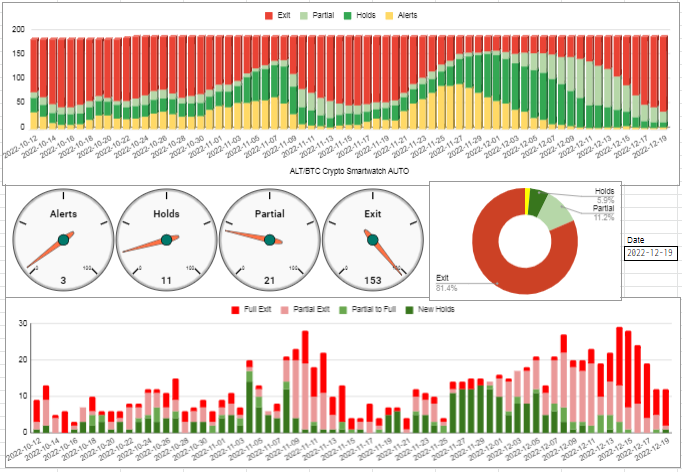

Quantifiable Methods for Measuring Altcoin Season Progress

- We analyze each cryptocurrency using standardized technical indicators that signal potential trend changes.

- Our system tallies coins at each stage of the trading cycle, generating a comprehensive Daily Action Matrix.

- By plotting these daily totals chronologically, we create a visual roadmap of altcoin season trends, allowing for strategic portfolio positioning.

Advanced Portfolio Rebalancing Technology for 2025’s Market Conditions

Consider this practical example: our moving average crossover system monitors two distinct moving averages to generate precise entry and exit signals. A buy signal activates when a short-term moving average (typically 20-period) crosses above a longer-term moving average (typically 60-period). Conversely, a sell signal triggers when the short-term average drops below the long-term average—providing clear, emotionless trading directives.

Real-World Before and After Results

By systematically eliminating assets that fail to meet our crossover criteria, you can concentrate your capital in cryptocurrencies demonstrating confirmed uptrend potential, avoiding those still in downtrends or consolidation phases.

The moving average crossover example above represents just one component of our comprehensive analytical framework.

The Crypto SmartWatch portfolio rebalancing tool operates on a transparent, replicable trading methodology that our team implements daily. We integrate trendline analysis, technical chart patterns, and our proprietary Exponential Moving Average crossover indicator to systematically evaluate buy and sell signals for each cryptocurrency in our tracking universe.

Actionable Altcoin Signals for Practical Portfolio Management

Altcoin Season Duration: Critical Timing for Maximum Returns

Historical analysis of 2021-2022 market cycles reveals that individual altcoin seasons typically lasted between two weeks and eight weeks—creating defined windows for strategic entry and exit.

While past performance cannot guarantee future results, and no investment strategy eliminates risk entirely, strategic positioning during these concentrated growth periods can dramatically accelerate wealth creation. Many investors are exploring how automated crypto portfolio management can help capture these time-sensitive opportunities while maintaining strict risk parameters.

Historical Altcoin Season Data: Learning from Market Cycles

The Crypto SmartWatch historical database has documented numerous false starts and premature altcoin seasons. Successful investors must develop strategies to distinguish between temporary “fakeout” rallies and genuine bull market opportunities to maximize returns in 2025 and beyond.

The Crypto SmartWatch rebalancing system delivers exceptional time efficiency for investors, eliminating countless hours spent analyzing altcoin season timing. This systematic approach can substantially enhance your cryptocurrency portfolio performance through multiple market cycles.

By leveraging the SmartWatch to identify and diversify into high-potential assets at the earliest stages of altcoin season, investors can focus their attention on proper position sizing and risk management—the two factors most critical for sustainable success.

Our comprehensive three-week intensive course and crypto trade alerts integrate multiple technical indicators—including RSI oscillators, MACD momentum readings, Ichimoku Cloud trend analysis, and Bollinger Band reversal signals—across various timeframes to create robust, multi-layered portfolio strategies.

However, no single indicator or strategy guarantees success in the volatile cryptocurrency markets of 2025. Effective risk control protocols that safeguard your capital must remain your primary focus regardless of which analytical tools you employ. A professional trader’s primary responsibility is strategic positioning and disciplined risk management—when executed correctly, market movements naturally deliver the corresponding results.

Start using our Crypto Portfolio Rebalancing Tool today to implement an objective, trend-following strategy that systematically identifies diversification opportunities during Altcoin Seasons—without requiring advanced technical knowledge or constant market monitoring.