Mastering Cryptocurrency Trading: A Complete Self-Learning Guide for 2025

Key Takeaways

- Understanding cryptocurrency market fundamentals is essential before risking real money

- Choose regulated, secure exchanges with competitive fees for your trading

- Follow a proven strategy with clear risk management rules

- Practice with demo accounts before committing actual capital

- Implement crucial risk control principles: diversification, position sizing, stop-losses, and profit targets

- Track all trades meticulously to improve skills and fulfill tax obligations

Looking to master cryptocurrency trading in 2025? You’re joining millions of traders in one of the most dynamic financial markets today. While crypto trading offers significant profit potential, it requires proper education, disciplined strategy, and effective risk management to succeed where 80% of beginners fail. This comprehensive guide provides actionable cryptocurrency trading techniques to help you develop the skills professional traders use daily.

- Master cryptocurrency fundamentals first

Before executing your first trade, build a solid foundation in cryptocurrency market mechanics. Learn about blockchain technology, different cryptocurrency types, tokenomics, market cycles, and the factors driving price action. Set up a comprehensive trading journal to document every decision, improve performance, and ensure accurate tax reporting. Supplement your knowledge with professional Bitcoin trading tutorials and reliable data sources like CoinMarketCap.com for real-time market information. Understanding how Bitcoin dominance affects altcoin seasons will give you a significant edge in timing market entries and exits.

- Select secure, regulated cryptocurrency exchanges

Your choice of trading platform directly impacts your security, trading costs, and available opportunities. Prioritize exchanges with regulatory compliance in your jurisdiction and established security protocols to protect your digital assets. Compare fee structures carefully, as these significantly impact profitability, especially for frequent traders. Consider trusted platforms like BitGet and SimpleFX alongside industry leaders Binance and Bitfinex. Each offers unique advantages for different trading styles and experience levels.

- Implement a verified cryptocurrency trading strategy

Successful trading requires more than instinct—it demands a methodical, tested approach. Partner with experienced traders who provide documented, long-term profitable strategies with clear documentation and video tutorials. Look for comprehensive guidance on realistic goal setting, specific risk management protocols, and systematic asset selection criteria. The most valuable mentors trade full-time with their own capital rather than relying primarily on content creation revenue. Join an active trading community where you can analyze market developments, refine strategies, and learn from both successes and failures of experienced traders implementing proven trading plans.

- Develop skills through demo trading

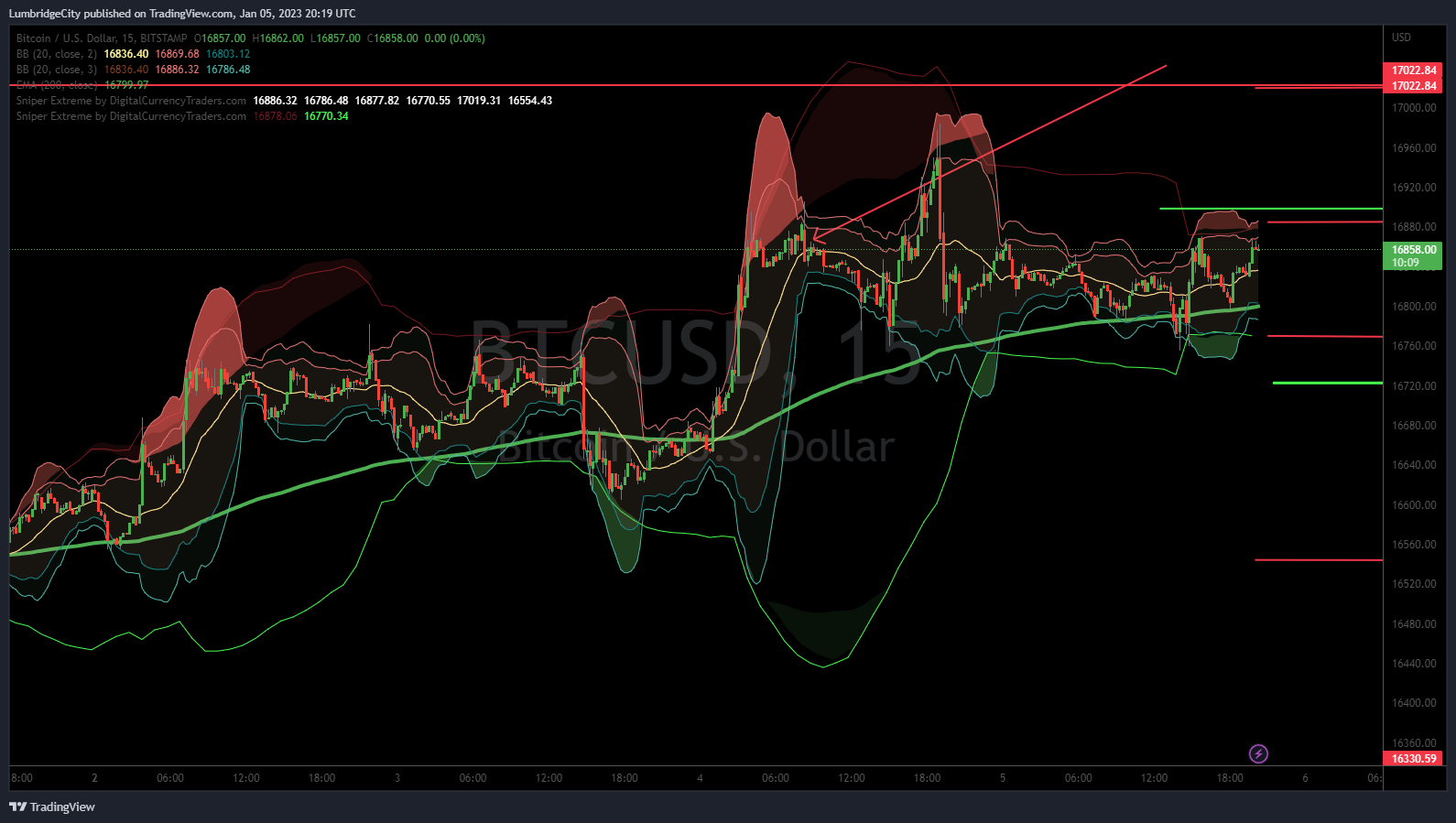

Most reputable exchanges offer paper trading accounts that simulate real market conditions without financial risk. These platforms are invaluable for mastering exchange interfaces, testing trading strategies, and developing essential chart pattern recognition skills. Rather than simply tracking trades in spreadsheets, use professional demo environments to build the psychological discipline and daily routines that successful trading requires. Practice identifying key technical setups, managing positions, setting proper stop-losses, and executing your trading plan under various market conditions BEFORE risking actual capital.

Five Essential Cryptocurrency Risk Management Principles for Sustainable Profits

- Strategic portfolio diversification

Professional crypto traders rarely concentrate their capital in just one or two assets. Develop a strategic approach to portfolio allocation across different cryptocurrency categories, market caps, and use cases. Pay particular attention to identifying optimal entry points during altcoin seasons when smaller projects typically outperform Bitcoin. This balanced approach prevents catastrophic losses from single-asset failures while capturing gains across various market segments.

- Calculate position size before market entry

The foundation of effective risk management is appropriate position sizing based on account equity. Start with smaller allocations and scale into winning positions only after your trade thesis is confirmed by price action. By waiting for confirmation before establishing full positions, you dramatically reduce risk while maintaining exposure to significant upside potential, tilting the risk-reward ratio firmly in your favor.

- Implement technical-based stop-loss orders

Stop-loss orders are non-negotiable components of professional trading strategies. Like learning to use brakes before driving, mastering stop placement is essential before risking real capital. Determine stop levels based on significant technical support levels, not arbitrary percentages. Your position size should be calculated backward from your stop level to ensure any potential loss remains within your predetermined risk tolerance, typically 1-2% of total trading capital per position. This systematic approach prevents emotional decision-making during market volatility.

- Establish profit targets before trade execution

The cryptocurrency market’s extreme volatility creates both opportunity and danger. Before entering any position, define specific technical conditions or price levels for taking profits. This pre-commitment strategy prevents the common mistake of holding winning positions too long and watching profits evaporate. Professional traders understand that their job is methodical risk management, not prediction. By establishing clear exit criteria in advance, you remove emotion from the profit-taking process and maintain consistent trading discipline through all market conditions.

- Incorporate market intelligence into trading decisions

Cryptocurrency markets respond to multiple influences including regulatory developments, technological advancements, macroeconomic trends, and security incidents. Maintaining rigorous risk control parameters protects your capital from unexpected adverse events. Simultaneously, staying informed allows you to capitalize on emerging opportunities by strategically adding to correctly positioned trades. This balanced approach of defensive positioning with selective aggression characterizes successful long-term crypto traders who survive bear markets while maximizing bull market gains.

Remember that 80% of new cryptocurrency traders lose money and abandon trading within their first year. Learning to trade profitably requires education, practice, and perseverance. Like mastering any complex skill, working with an experienced cryptocurrency trading coach who demonstrates consistent results significantly accelerates your learning curve and helps avoid costly mistakes.

Five tips for teaching yourself how to trade cryptocurrency with five important principles for risk control and keeping profits!https://t.co/C6qL80HIWh#cryptotrader #cryptotrading #CryptoInvestor

— introtocryptos.ca (@introtocryptos) January 16, 2023

Maintain detailed records, document every trade, and journal your decision-making process consistently. This practice will help you identify patterns in your trading behavior, recognize recurring mistakes, and systematically improve your trading performance over time. By combining strategic education with disciplined execution, you can join the minority of cryptocurrency traders who achieve sustainable profitability.