Altcoin Season Analysis 2025: Strategic Investment Approach for Maximizing Crypto Returns

Key Takeaways:

- Bitcoin dominance is showing a top formation, signaling the start of altcoin season in 2025

- Our three-phase investment strategy adapts to market conditions: cash → Bitcoin → altcoins

- Focus on growing your Bitcoin holdings rather than dollar value for long-term wealth

- Diversification into carefully selected altcoins is recommended as dominance shifts

- Always evaluate altcoin performance against Bitcoin, not just against USD

In our latest Altcoin Season CoPilot analysis session on February 15, 2025, we examined critical market indicators signaling the emergence of altcoin season and what this means for cryptocurrency investors looking to optimize their portfolios. Our comprehensive data review reveals significant opportunities for strategic positioning in both Bitcoin and altcoins.

While the video recording encountered technical difficulties, we captured the complete audio to share our proven investment strategies for Bitcoin and altcoins. These insights will help you navigate the rapidly evolving cryptocurrency market landscape and position your assets for maximum growth potential during this critical market phase.

Current Altcoin Season Analysis: February 2025 Market Indicators

As of February 2025, our market analysis confirms that Bitcoin dominance has formed a clear topping pattern and is showing strong signals of an imminent decline. This technical formation historically precedes significant capital flow into the altcoin market.

Three Life-Changing Crypto Bull Markets: Historical Patterns Repeating

This dominance shift aligns perfectly with broader economic indicators we’re tracking in early 2025, including the sustained bull market in equities and precious metals, coupled with escalating U.S. national debt and persistent global inflation trends. These macroeconomic factors historically accelerate altcoin market performance.

Strategic Cryptocurrency Investment Framework for 2025

The cornerstone of our discussion focuses on our data-driven, trend-following methodology for cryptocurrency investing that has consistently outperformed market averages.

Our system implements a strategic three-phase approach:

- Preserving capital in cash positions when Bitcoin shows weakness or consolidation

- Concentrating investments in Bitcoin during periods of strength while dominance remains stable

- Strategically reallocating to carefully selected altcoins when Bitcoin dominance begins decreasing

Positioning Before Dominance Peaks: Getting Ahead of the Market

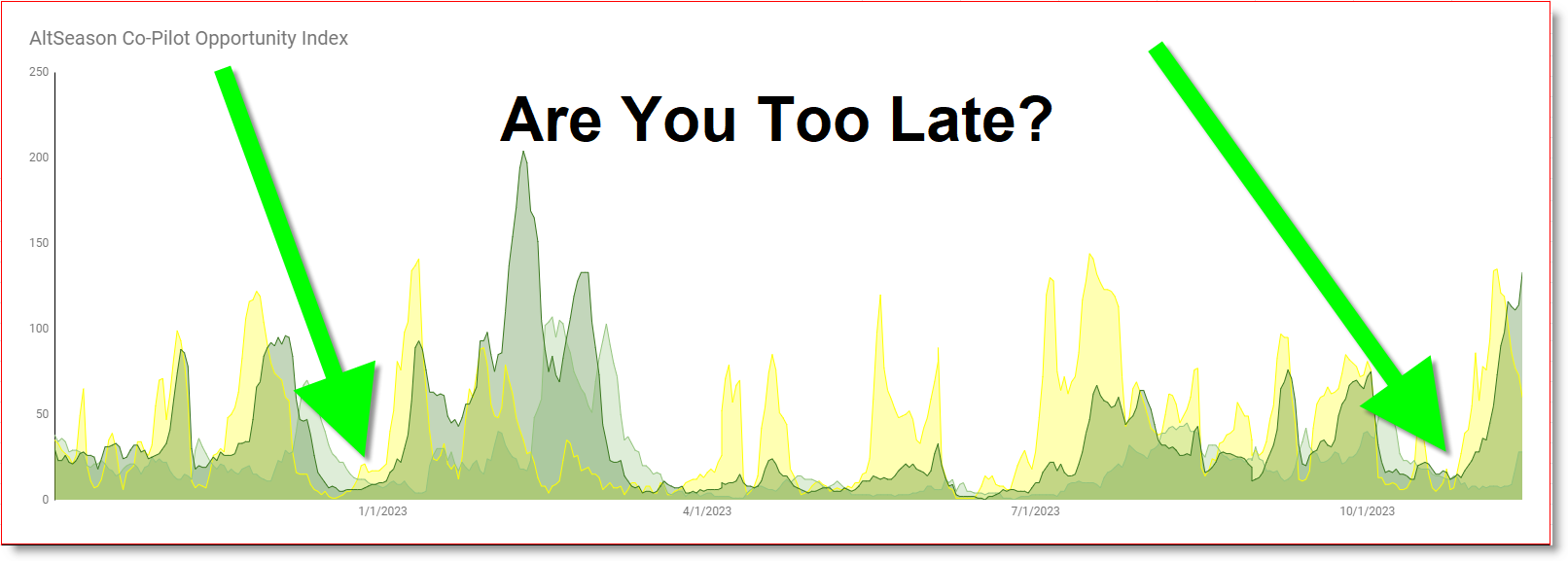

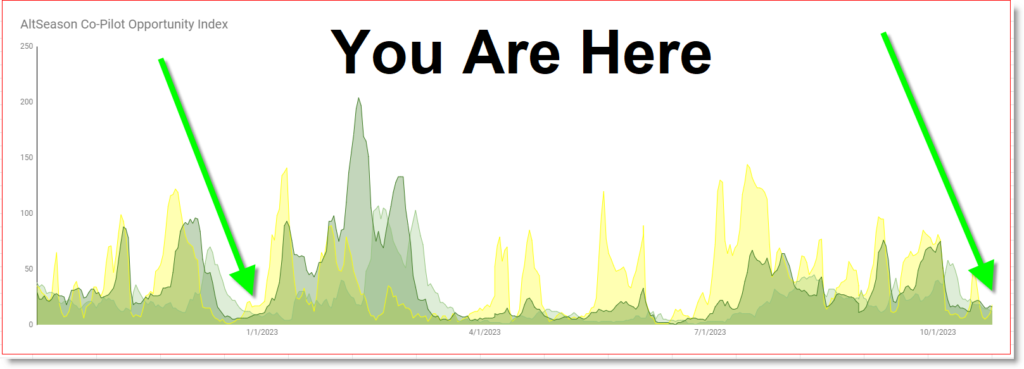

Below is our historical signal notification from October 2023, showing how early positioning before dominance shifts creates optimal entry points:

For comparison, here’s the updated Altcoin Season Momentum chart for February 2025:

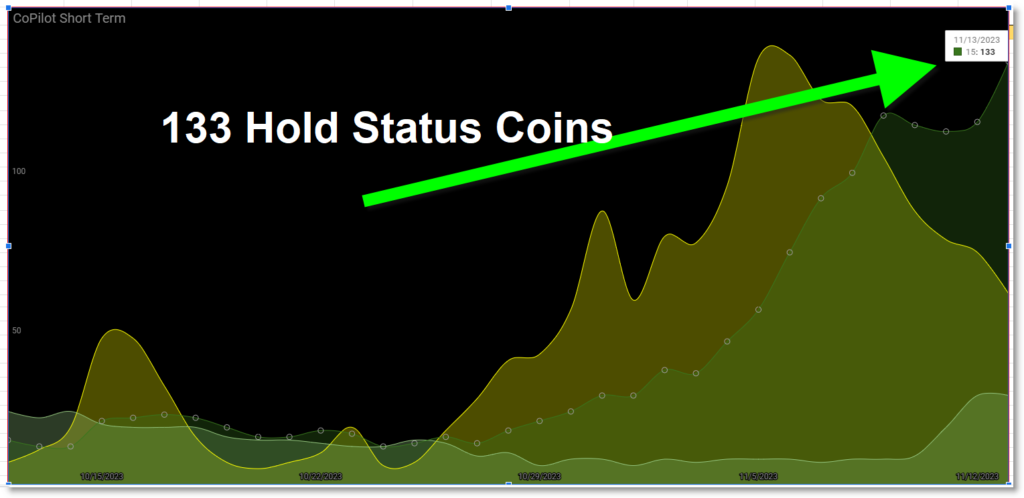

Current market conditions are triggering our entry signals for strategic, diversified altcoin investments. Our proprietary indicators suggest this is an optimal time for calculated exposure to select altcoin positions.

However, our core strategy emphasizes maintaining substantial Bitcoin holdings while gradually increasing altcoin allocation as the alt/BTC spread widens according to our momentum indicators. This measured approach maximizes upside potential while controlling downside risk.

Portfolio Diversification Strategy for Maximum Returns

For practical application, consider how we’d advise an investor with $1,000 in USDT stablecoins looking to capitalize on current market conditions. Our altcoin season indicators suggest a strategic approach.

Rather than converting to Bitcoin first, we recommend analyzing technical patterns across multiple cryptocurrencies to identify those displaying our specific entry criteria, then diversifying directly into these selected assets. This targeted approach focuses on maximizing Bitcoin-denominated returns rather than USD value.

Our methodology consistently emphasizes growing your Bitcoin holdings (measured in satoshis) rather than dollar value, based on Bitcoin’s fundamental value proposition and long-term performance against fiat currencies.

Measuring Altcoin Performance Against Bitcoin: The Critical Metric

The AltSeason CoPilot analysis tool highlights a fundamental but often overlooked concept: the importance of selecting altcoins that demonstrate strength against Bitcoin, not just against the US dollar.

Take Litecoin as an instructive example. While its USD value may show nominal gains in recent market activity…

…its performance against Bitcoin reveals that maintaining Bitcoin positions would have delivered superior returns. Interestingly, Litecoin’s current chart formation now signals a potential setup opportunity based on our technical criteria.

Conclusion: Measuring Success in Satoshis, Not Dollars

To conclude this market update, we emphasize our foundational principle: measure your cryptocurrency investment success in Satoshis (the smallest unit of Bitcoin) rather than in depreciating fiat currencies.

By implementing strategies specifically designed to increase your Bitcoin holdings, you position yourself to benefit from both Bitcoin’s strength against fiat and strategic altcoin outperformance during specific market cycles. For personalized guidance on implementing these strategies, learn about our risk-managed approach to cryptocurrency investing.