Many traders in the cryptocurrency market focus on trading altcoins against the US dollar. However, by focusing solely on this approach, many traders may be missing out on valuable opportunities that trading the ALT/BTC price spreads can provide. Let’s explore how The Altseason Co-Pilot trades the ALT/BTC spread with a simple daily routine can help YOU achieve more success with your Cryptocurrency Portfolio Management in 2023.

Identifying Long-Term Trends for Altcoins

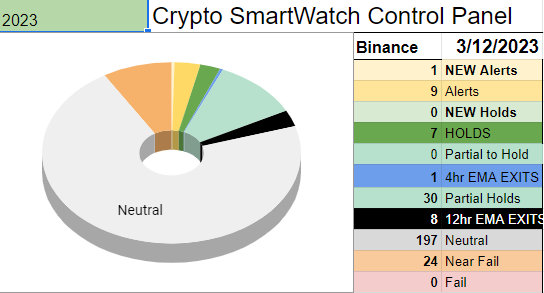

We analyze all of the ALT/BTC spreads each day so our traders can gain insight into long-term trend averages for altcoins. This data can provide traders with a broader perspective on market movements and help them identify when altcoin seasons may be approaching.

By staying current with these trends, a simple daily routine is all that is needed to position your money so it can capitalize on the insane pumps in crypto.

The AltSeason Co-Pilot, formerly known as the Crypto SmartWatch and the Crypto BullMarket Watch

Taking Advantage of Portfolio Diversification

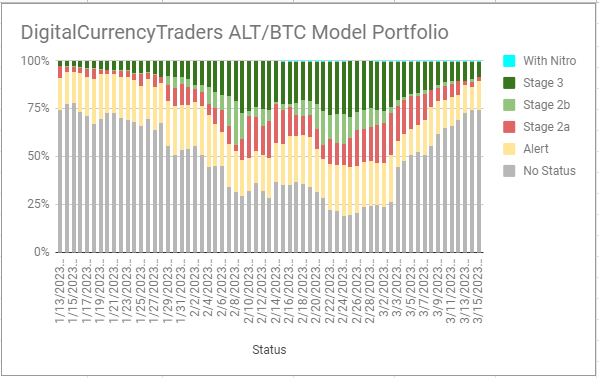

Another significant advantage of trading the ALT/BTC spread is that it allows traders to take smaller position sizes and spread their portfolio across multiple cryptocurrencies.

By diversifying their portfolio in this way, traders can potentially benefit from explosive moves in the hottest cryptocurrency markets while minimizing risk in those coins that have not follow through.

With this approach, traders can take advantage of a wider range of opportunities in the cryptocurrency market – while keeping risks low.

Diversify into the Altseason Co-Pilot Cryptocurrencies, based on trend following trading plan.

Exit and take profits when the trend is over.

Implementing Effective Trading Strategies

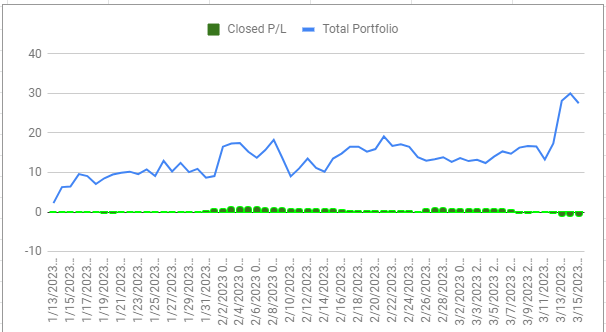

To achieve success in trading the ALT/BTC spread, traders must implement effective trading strategies that consider a variety of factors, including market volatility, technical analysis, and risk management. By focusing on these critical elements, traders can make informed decisions and minimize the risks associated with trading cryptocurrency.

The Altseason Co-Pilot for Cryptocurrency Portfolio Management

Since 2016 our focus has remained on trading the ALT/BTC spread. We want to trade altcoins only when they will grow the number of Bitcoin we have – because we believe Bitcoin will go very much higher in value, while the US dollar… will not.

To achieve success with this approach,

traders must manage risk until the trade is in Stage 3,

and then surrender the results to the market.

By doing so, our traders systematically keep their losses small,

and leave their winning trades to maximize their returns.

The AltSeason Co-Pilot can provide valuable opportunities for cryptocurrency traders who want to become crypto millionaires.

Stop over trading, and focus on identifying long-term trends for altcoins and taking advantage of portfolio diversification.