Watch the Feb 18/23 Members Video (login here) then return to this post.

In today’s 18 minute member video we cover more than twenty current examples of how to use support and resistance levels for Crypto Trading Risk Management.

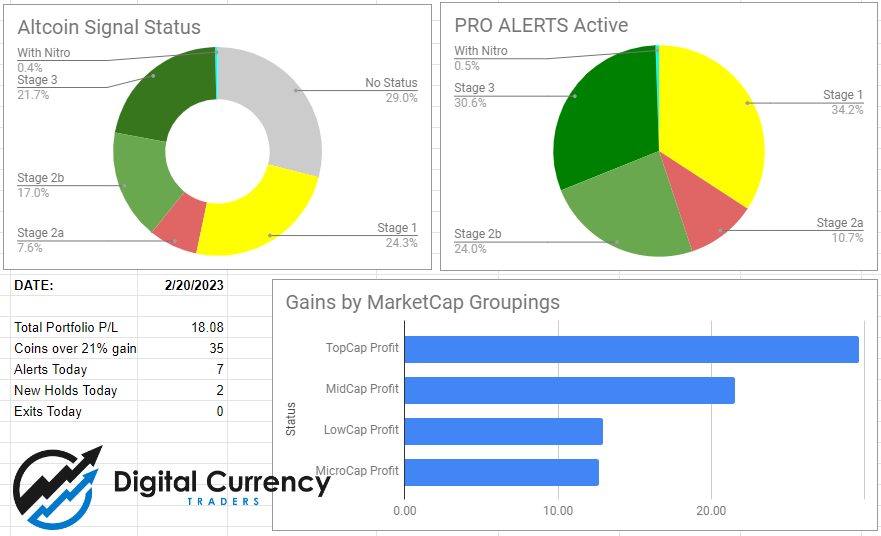

Our job is to manage risk as we transition our new positions from Stage 2 to Stage 3 of the Trade. Managing risk is a multi-layered approach. Today we check stop levels in the new positions and talk through the reasoning for moving up some stops for profitable positions (Stage 3) and why we are leaving some of the profitable trades with stops below our entry (Stage 2).

Read our research blog as we evaluate the fundamentals of top altcoin opportunities for 2023. We aim to make informed investment decisions and manage our risk. Find out what factors to consider when evaluating a project’s team, technology, and market potential. Stay informed about crypto market regulations and use this knowledge to manage your trading risk effectively.

Discover the benefits of diversifying your crypto portfolio for effective risk management.

Learn how to choose the right mix of cryptocurrencies to minimize risk and maximize returns.

Successful trading requires effective risk management and emotional control. In today’s member video, we talk about how to identify and manage risk through all five stages of the trade in order to stay calm and focused during volatile markets. Learn the best practices and tips for entering new trades and manage stop loss levels to minimize risk and leave room for the explosive opportunities in crypto. Discover the key factors to consider, understand the options and gain the confidence to execute trades without second-guessing and continual chart-watching.

Learn how to make your money work for you while YOU do other things! Leave your money to do the dreary job of watching crypto price charts.