Low Time Maintenance Crypto Investing Strategy for 2025: Maximize Returns While Minimizing Effort

Key Takeaways:

- Strategic timing of altcoin seasons can dramatically improve your crypto investment returns

- Setting up automated trades eliminates the need for constant chart watching

- Diversification across multiple cryptocurrencies significantly reduces risk while maximizing profit potential

- Implementing proper stop-loss orders protects your capital while keeping you positioned for substantial gains

- This approach consistently outperforms traditional dollar-cost averaging with less active management

A Low Time Maintenance Crypto Investing Strategy harnesses the predictable cycles of altcoin seasons to maximize your returns while minimizing your time investment. By understanding these market patterns, you can position yourself for substantial profits without the stress of constant monitoring.

When you assign your money the responsibility of monitoring cryptocurrency prices on your behalf through strategic trade setups, you transform market volatility into a powerful advantage. This approach ensures you’re positioned to capture significant profits without spending countless hours analyzing charts and market data. Once your trades are properly configured, you can step away from the screens and let your investment strategy work automatically.

Make Your Money Work For You 24/7 With Automated Crypto Investing

Trading cryptocurrencies with a well-structured strategic approach transforms your capital into a tireless worker that generates returns while you focus on other priorities in your life. The key is implementing the right system from the start.

STOP WATCHING THE CHARTS. This isn’t just advice—it’s a fundamental principle of sustainable cryptocurrency investing.

Our strategy focuses on deploying capital across carefully selected cryptocurrencies precisely when altcoin season begins and systematically exiting positions when our proprietary indicators signal market peaks. This automated approach to crypto trading eliminates emotional decision-making while maximizing profit potential.

Strategic Diversification: Timing Is Everything in Cryptocurrency Markets

A major advantage of our trend-following cryptocurrency approach is strategic portfolio diversification. Rather than concentrating your investment in a single digital asset, we distribute your capital across multiple promising cryptocurrencies—dramatically increasing your chances of capturing extraordinary price movements. This diversification strategy is particularly effective in cryptocurrency markets where price volatility creates unprecedented profit opportunities within compressed timeframes.

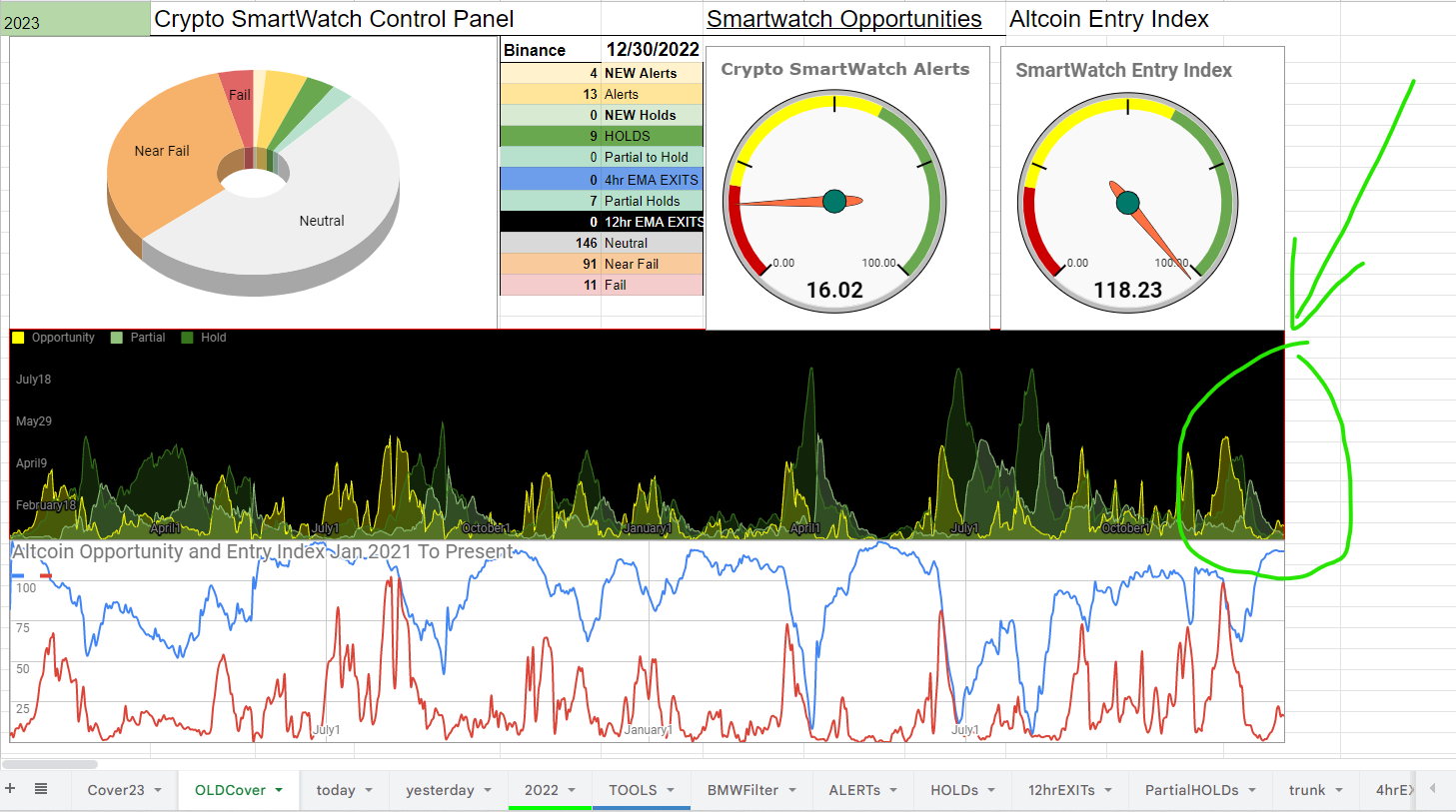

Altcoin Opportunities Index Rising

Risk Management: Limiting Downside While Maintaining Upside Potential

The cornerstone of successful cryptocurrency trading lies in managing the capital you’re willing to risk on each position. Think of this as purchasing an investment insurance policy—you’re protecting your overall portfolio while maintaining exposure to potential gains. By allocating only a small percentage of your total capital to any single cryptocurrency position, you create a balanced approach that minimizes risk while preserving your ability to capture substantial profits.

Implementing strategic stop-loss orders represents one of the most powerful risk management tools available to cryptocurrency investors. These automated sell triggers activate when a coin’s price drops below your predetermined threshold. Mastering this essential technique will transform your perspective on small losses, helping you recognize them as a reasonable insurance premium that keeps you positioned for the life-changing gains unique to cryptocurrency markets.

Strategic Altcoin Accumulation: Beyond Basic Dollar-Cost Averaging

Our Low Time Maintenance strategy significantly enhances traditional dollar-cost averaging by incorporating precise market cycle timing. This approach allows you to accumulate altcoins when market conditions are most favorable, dramatically improving your overall returns compared to blind periodic investing.

Maximizing Returns With Altcoin Season Timing and Automated Position Management

This systematic approach consistently outperforms traditional dollar-cost averaging by intelligently adapting to cryptocurrency market cycles. By understanding how Bitcoin dominance affects altcoin seasons, investors can strategically time their entry and exit points for maximum profitability while minimizing active management requirements.

The beauty of this methodology lies in its efficiency—your investment capital works continuously on your behalf, responding to market conditions according to your predetermined parameters. This allows you to capitalize on cryptocurrency volatility without the stress and time commitment typically associated with active trading, creating a sustainable approach to building wealth in digital assets.