Effective Crypto Trading Signals: The AltSeason Strategy That Actually Works

Key Takeaways:

- Effective crypto signals must be simple to follow and based on proven indicators

- Successful trading requires preparation before signals flash, not reactive trading

- The AltSeason TradingView Indicator helps identify early movers in crypto market cycles

- Risk management and position sizing are crucial components of profitable crypto trading

- Strategic profit-taking with partial exits helps protect gains while maintaining exposure

Crypto Signals That Work must satisfy two essential criteria to deliver consistent results:

- Trading signals must be straightforward to implement without complex interpretation

- Trading signals must align with a proven AltSeason TradingView Indicator system

Step-by-Step Breakdown of a Profitable Crypto Signal

Phase 1: Identifying the Strategic Entry Point

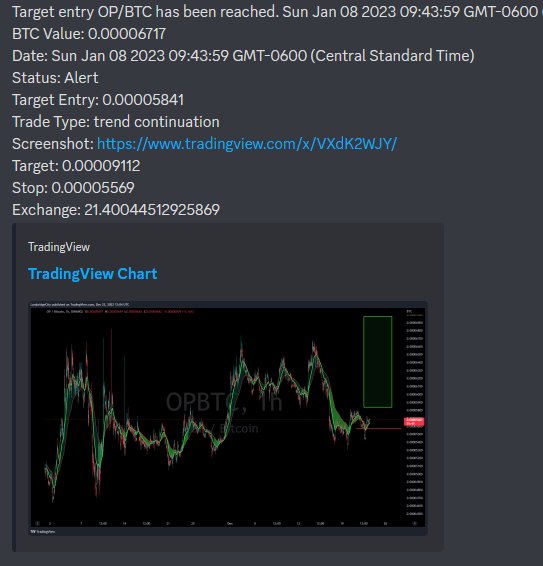

In late December we published the Signal ALERT for the OP/BTC chart, spotting a high-probability setup.

The price action clearly formed a 1-2-3 bottom pattern—a reliable technical formation signaling potential upward momentum.

For our premium members, we completed Stage 1 of our risk management framework, which includes defining exact entry points, profit targets, and stop-loss levels—all aligned with our tested trading methodology.

Phase 2: Alert Activation and Position Execution

When conditions met our criteria, our automated system sent immediate notifications to our Discord channel and updated the model portfolios.

Critical advantage: We prepare our trades in advance of pattern breakouts, allowing precise calculation of risk and position sizing before the trading signal activates. This preparation eliminates emotional decisions during price movement.

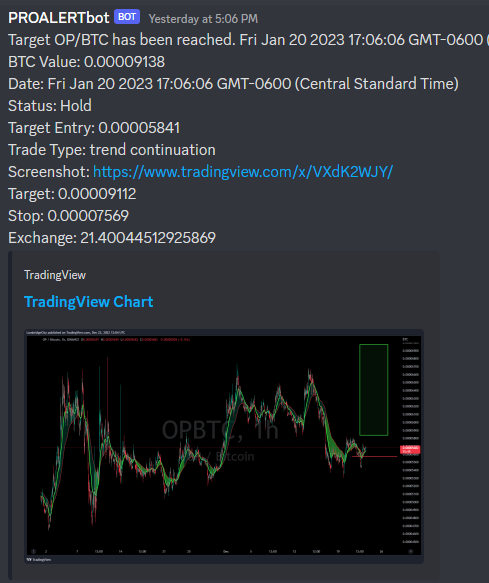

Phase 3: Strategic Profit Management

When price reaches our predetermined profit targets, we implement a structured exit strategy. One effective approach is taking partial profits to recover initial investment while maintaining market exposure. Alternatively, some traders prefer closing the entire position.

Our PRO ALERTS system maintains open positions to capture extended trends, utilizing trailing stops adjusted to the 12-hour EMA crossover signals for maximum gain potential.

In fact, with this particular setup, we anticipated a tactical pullback as an opportunity to increase our position in this proven performer at better price levels.

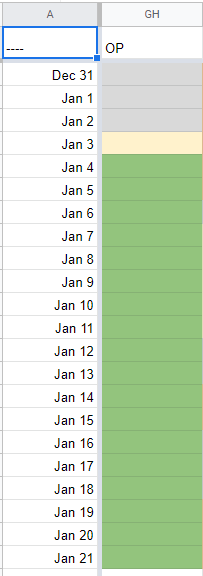

Live OP/BTC Price Chart Analysis for 2025

Mastering Altcoin Season: Your Systematic Approach to Market Cycles

Positioning your portfolio for explosive crypto growth requires timing market bottoms correctly while implementing strict risk management protocols. This balance is essential for long-term success.

While most cryptocurrencies move together during altcoin seasons, we consistently observe two distinct groups: early momentum leaders and late-cycle performers. The difference in returns between these groups can be substantial.

Since predicting the top performers is impossible, our strategy employs strategic diversification across tokens that trigger our proven crypto signal system, maximizing exposure to potential winners while controlling downside risk.

OP/BTC represents just one of 300+ tokens continuously monitored in the Crypto SmartWatch portfolio tracking system.

The Technical Edge: Our Proprietary AltSeason TradingView Indicator

We generate consistently profitable crypto signals through a proprietary methodology combining trendline analysis, chart pattern recognition, and our custom-developed PineScript TradingView indicator specifically engineered for cryptocurrency altcoin season trading. Our system plans entries and risk parameters methodically in advance—though your choice of exit strategy significantly impacts overall performance results.