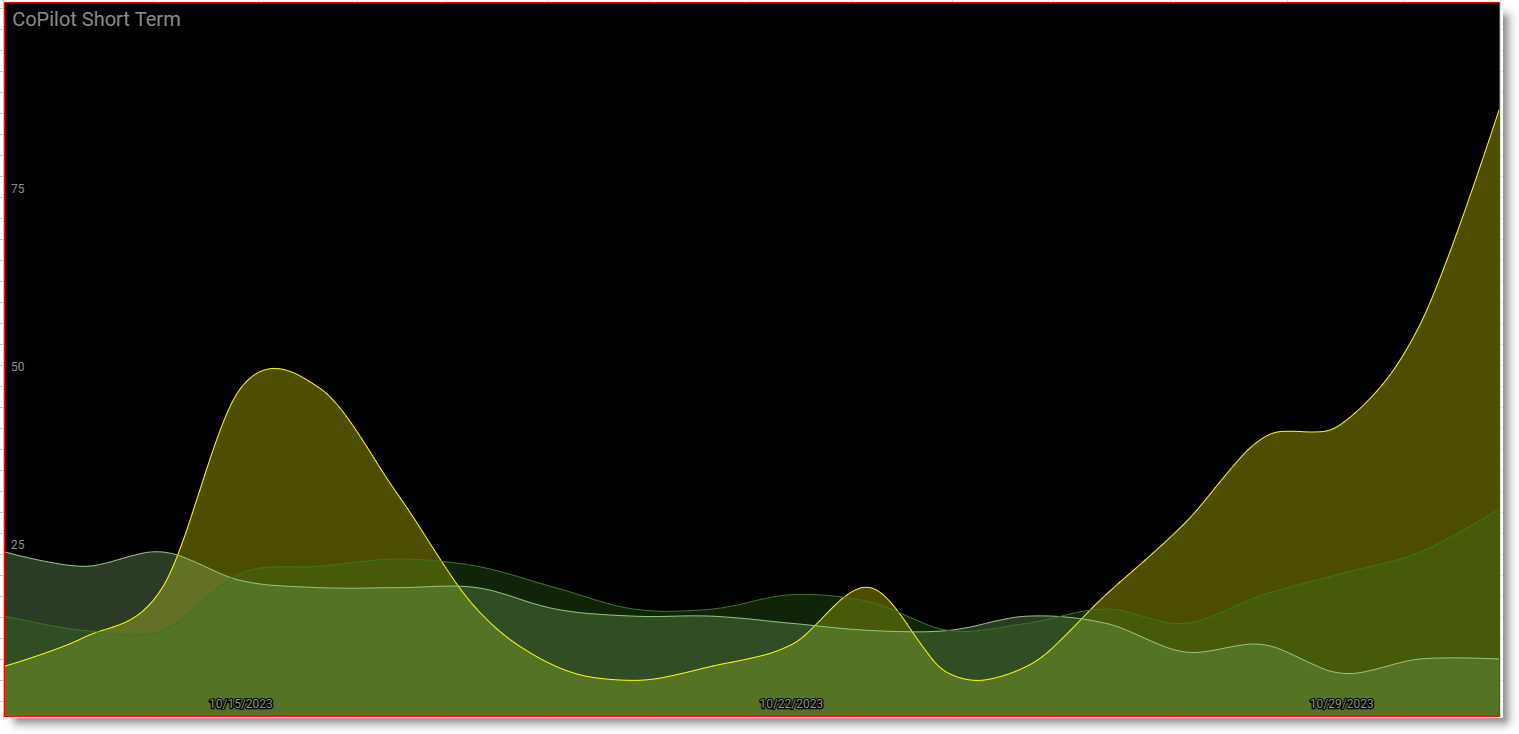

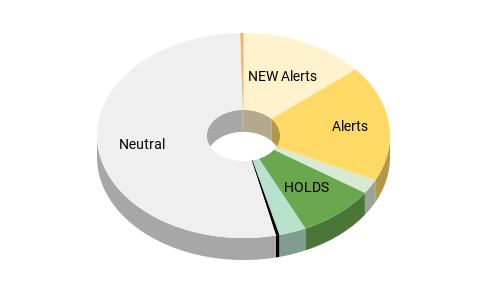

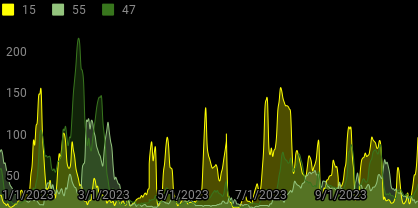

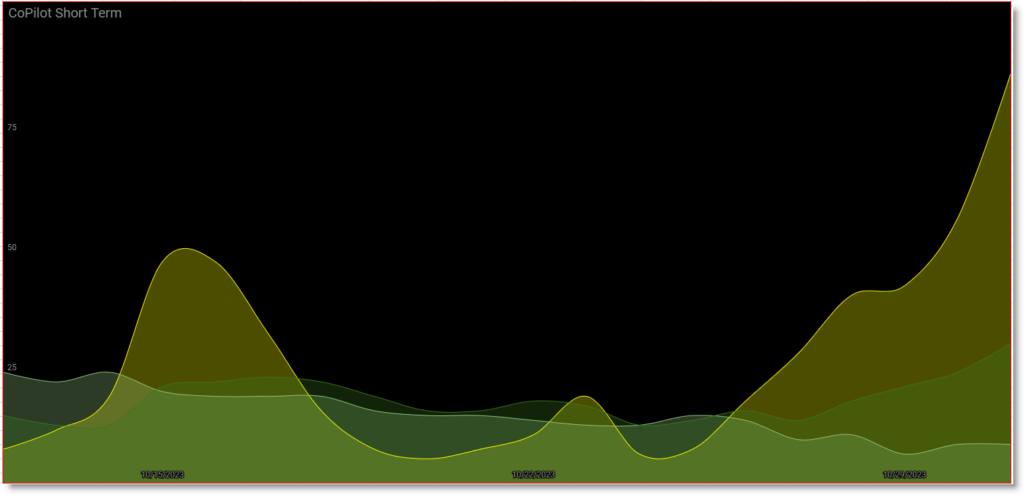

The AltSeason CoPilot reports a dramatic surge in ALERT status coins with several ALT/BTC pairs moving into HOLD Status. Trading Planning for potential Popcorn Trading Strategy moves and Risk Management is the order of the day.

Sign up for the AltSeason CoPilot. Each day we manually review each altcoin/btc chart and we update the trade status as we rebalance our model portfolio from day to day. Our Altseason Index is flashing important signals.

Members Update

Key Trading Tips To Remember

The following article was created based on our unique trading approach. Grab your copy of our Free crypto trading plan PDF and chat with our AI assistant instructor. Join thousands and learn to profit from trend trading.

Unlock Profits with Altcoin Season Trading Strategies

Cryptocurrency trading can be a lucrative way to make money, but it is important to understand the risks associated with it. During an altcoin season, investors can take advantage of the price differences between Bitcoin and altcoins, and increase their profits. However, it is important to understand the indicators of an altseason, such as a decrease in Bitcoin dominance and an increase in stable coin dominance.

Investors should always remember to manage their risk exposure and be aware of common trading mistakes. By taking advantage of the AltSeason CoPilot, investors can maximize their profits and take advantage of the opportunities that the cryptocurrency market provides.

Frequently Asked Questions

Q: What are the risk control strategies I should consider when trading altcoins?

A: As with any investment, risk management is essential when trading altcoins. It is important to utilize a combination of strategies that can limit one’s exposure to risk.

This can include diversifying one’s portfolio across different currencies, setting stop-losses to limit losses and tracking market trends to identify potential trading opportunities.

It is important to take into account the news events and news sources impacting the cryptocurrency market. By monitoring these events, traders can mitigate the risk of making decisions based on incomplete information or incorrect assumptions.

This post was created with Make.com automation. Our AI bot was created with GTP-Trainer.