The AltSeason CoPilot reports a large divergence as Bitcoin Dominance Drops the past several days. This pattern of Bitcoin Dominance chart may indicate altcoin are going to out perform bitcoin prices – providing opportunity to trade the spread for profits!

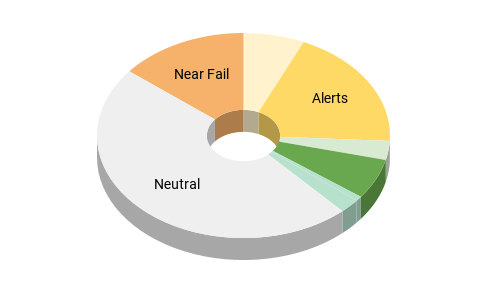

AltSeason CoPilot Pie Chart is showing a wide range of ALERT status coins as the ALT/BTC spread shows promise.

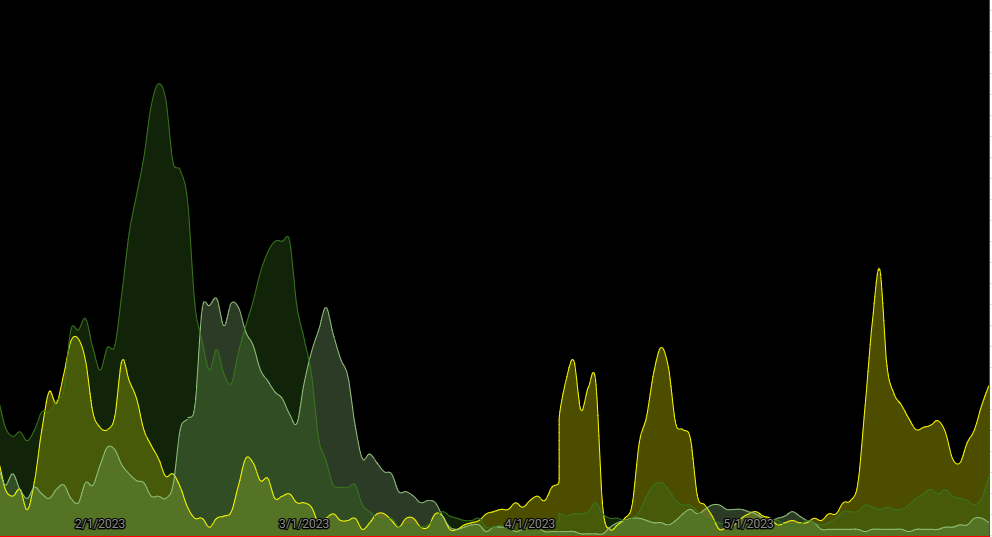

Plotting the change in ALERT and HOLD status coins over time, we can see this third wave of potential moves in 2023 now seems to have greater follow-through than we saw in January and February.

Sign up for the AltSeason CoPilot. Each day we manually review each altcoin/btc chart and we update the trade status as we rebalance our model portfolio from day to day. The pie char above is our Altseason Index.

Key Trading Tips To Remember

The following article was created based on our unique trading approach. We have been giving aways our proven crypto trading plan PDF since 2015. Join thousands of people and learn to profit from trend trading.

Enhancing Cryptocurrency Profits: Decoding Altcoin Season

The cryptocurrency market offers an expansive array of profit-making possibilities. Key among them is the altcoin season, a phase characterized by a marked surge in the US Dollar value of altcoins (cryptocurrencies other than Bitcoin). The altcoin season sees altcoins’ market capitalization skyrocket at a speedier rate than Bitcoin’s price, irrespective of whether the latter’s price is steady, escalating, or dwindling. This scenario provides a valuable trading opportunity: the ALT/BTC spread.

ALT/BTC Spread: An Opportune Investment Strategy

In the ALT/BTC spread trading during the altcoin season, investors can tap into the price disparities to amplify their profits. The AltSeason CoPilot trading system is an excellent tool in this regard, offering a proven crypto trading plan replete with risk control strategies. This system helps you optimally utilize the altcoin season to enhance your cryptocurrency profits.

Deciphering Market Trends: Bitcoin and Stable Coin Dominance

A crucial indicator of the altcoin season is a reduction in Bitcoin dominance, which signifies a decrease in Bitcoin’s market capitalization as a fraction of the total cryptocurrency market cap. This signals a shift in investor focus from Bitcoin to other cryptocurrencies.

Conversely, an uptick in stable coin dominance – with stable coins serving as value stores and a medium for secure monetary transactions in the market – can be bearish for altcoins. It might denote that investors are contemplating withdrawing money from the market or safeguarding their investments against volatility.

However, a decrease in stable coin dominance is bullish, hinting at an increased investor confidence in the market and their readiness to undertake higher risk by reinvesting in cryptocurrencies.

The Power of Diversification: Navigating the Altcoin Market

While it’s true that these market trends often signify the onset of the altcoin season, the real winners within the group of altcoins might be elusive. The daily action matrix from the AltSeason CoPilot can be a reliable tool for assessing the performance of individual coins.

Moreover, an increase in stable coin usage may not always point to market insecurity. It could also reflect a heightened adoption and demand for stable coins as a store of value. Therefore, understanding these complex interrelations is vital for successful trading.

ALT/BTC Spread Trading: A Richer Portfolio

Most cryptocurrency traders concentrate on trading altcoins against the US dollar, potentially overlooking the lucrative opportunities that the ALT/BTC price spreads can present. Trading the ALT/BTC spread offers the significant benefit of enabling traders to take smaller position sizes and distribute their portfolio across multiple cryptocurrencies. This diversification strategy can help traders benefit from substantial movements in the most promising cryptocurrency markets while mitigating risks associated with non-performing coins.

Conclusion: Unlocking Cryptocurrency Profits with AltSeason CoPilot

If your aim is to unlock substantial profits from the cryptocurrency market, the AltSeason CoPilot system is your ideal ally. With its proven crypto trading plan and risk control strategies, it allows you to benefit from the altcoin season optimally. By trading the ALT/BTC spread during altcoin seasons and diversifying your portfolio, you can embrace a wide array of opportunities in the cryptocurrency market while keeping risks at bay. Always remember, focusing on long-term altcoin trends and effective portfolio diversification can be a winning strategy during the altcoin season.

Frequently Asked Questions

Q. What is altcoin season and how does it impact cryptocurrency trading?

A. Altcoin season is a period when altcoins outperform Bitcoin in terms of market capitalization and profitability. During altcoin season, it is often possible to take advantage of the ALT/BTC spread to make significant profits through crypto trading. Altcoins tend to be more volatile than Bitcoin and can be traded on both the long and short sides, enabling traders to potentially benefit from price movements in both directions.

Q. How can I take advantage of the ALT/BTC spread in crypto trading?

A. By studying the trading patterns of both Bitcoin and altcoins, it is possible to identify trading opportunities to make profits from the ALT/BTC spread. By setting entry and exit points, traders can make small profits by taking advantage of the price differences between Bitcoin and altcoins.

Q. What are the risk control strategies I should consider when trading altcoins?

A. When trading altcoins, it is important to employ risk control strategies to minimise potential losses. This includes setting appropriate entry and exit points, limiting exposure to risk and using tools such as stop-loss orders and trailing stops. It is also important to closely monitor the markets and diversify your portfolio to reduce risk.

Q. Why do altcoins tend to outperform Bitcoin during altcoin seasons?

A. During altcoin seasons, there is often a flight to safety in the cryptocurrency markets. This results in traders switching from Bitcoin to altcoins in order to benefit from the higher price movements. Furthermore, altcoins are generally more volatile than Bitcoin, making them attractive to short-term investors.

Q. What are the signs of an upcoming altcoin season?

A. There are several indicators that can signal when an altcoin season is about to begin. These include a drop in Bitcoin dominance as altcoins gain more traction, an increase in volume across exchanges, and a general market sentiment that is bullish towards altcoins.