The AltSeaon Entry Index stands poised as an amazing opportunity for crypto investors who are prepared. Access the altcoin season index for strategic investment timing.

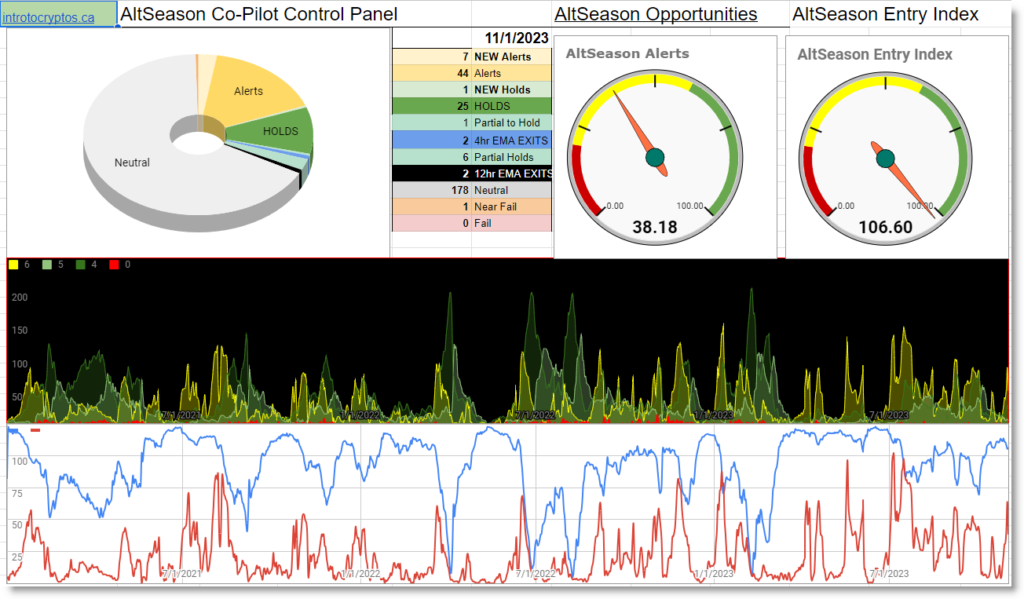

The AltSeason CoPilot report for 2023-11-01

Key Trading Tips To Remember

We have been giving away our proven crypto trading plan PDF since 2015. Join thousands of people and learn to profit from trend trading.

Sign up for the Free Crypto Trading Plan PDF or learn about our Altcoin Season Indicator.

Access premium altcoin signals for strategic trade execution.

The following article was created based on our unique trading approach. Grab your copy of our Free crypto trading plan PDF and chat with our AI assistant instructor. Join thousands and learn to profit from trend trading.

Unlock Profits with Altcoin Season Trading Strategies

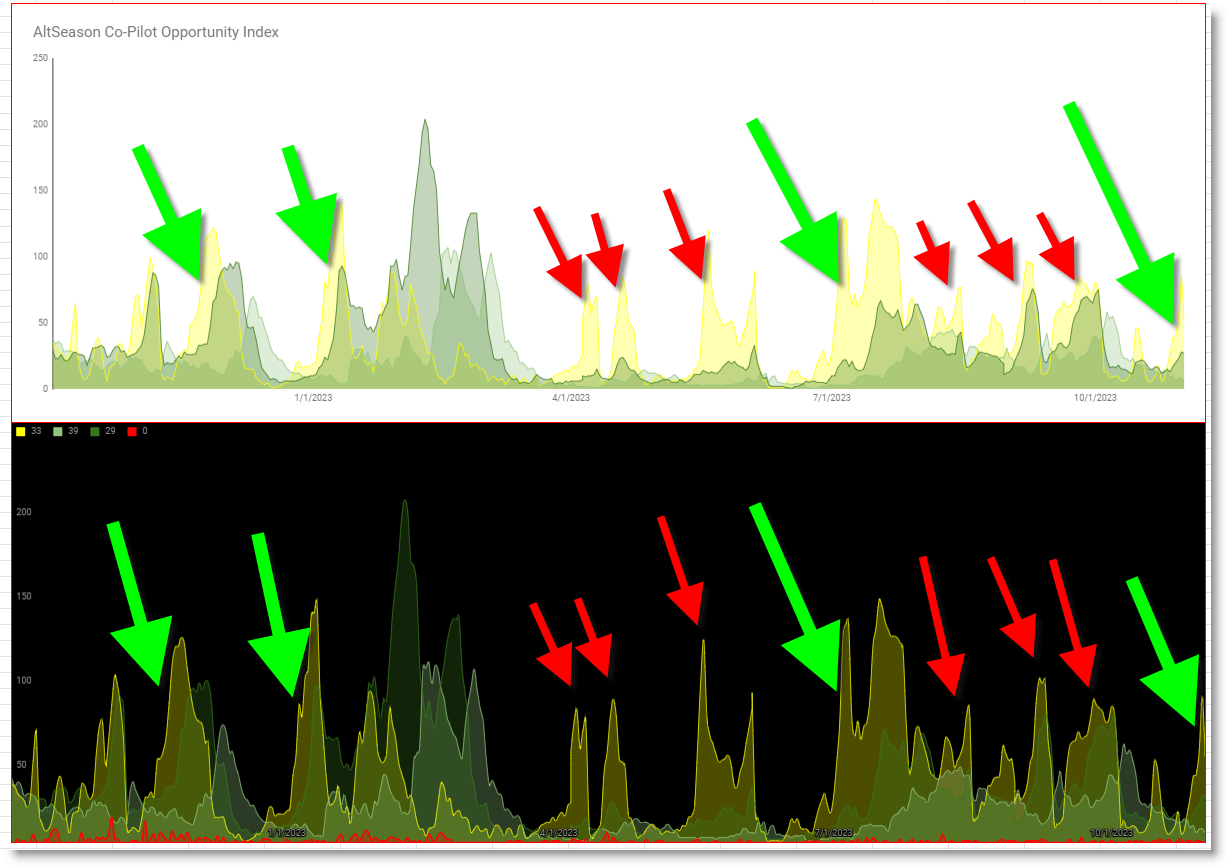

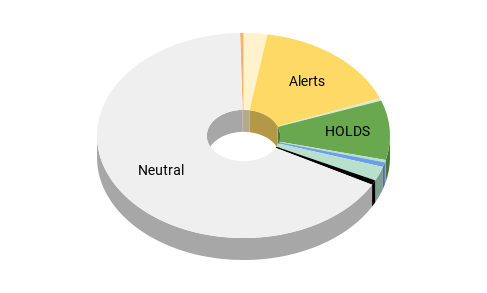

➤ The “alt season entry index” is a tool used by traders to determine the optimal timing for investing in alternative cryptocurrencies (altcoins). It operates by categorizing market conditions into different zones, such as green, yellow, and red, with each color representing a different level of opportunity or risk.

➤ When the index is in the green zone, it indicates that market conditions have already passed out entry signal for investing in altcoins and we are holding. This entry signal is due to a variety of factors, such as bullish market sentiment and our technical indicators suggesting a strong uptrend.

➤ ➤ The yellow zone represents time to be ALERT and prepare for potential opportunity. Conditions are combining in favorable patterns that may soon trigger the all important moment that we pass the entry signal. This is where we plan position size and set our risk exposure before the trade is started.

Nothing in the trading plan is left to chance. Every stage of the trade has a clear flow chart of options and required actions.

➤The red zone signals that the market conditions are not favorable for entering or holding altcoin positions. This is due to bearish market trends where our trading plan and altcoin season indicator suggesting a down trend.

The Entry Signal – Sweet Spot of Altcoin Season

The “Sweet Spot” is the condition where both the alt season entry index is in the yellow ALERT status, Altcoin Season indicator aligns with a low risk entry and the Daily Action Matrix is giving us daily NEW HOLD status coins for our crypto portfolio as potentials to review for upcoming alt seasons.

This “Sweet Spot” is the point at which the risk is minimal and the trend change is looking likely. We have a surge of ALERT status coins but not yet the surge of HOLD status coins.

An ideal moment in time.

The strategy implies a holistic approach to a diversified portfolio, where one not only looks for the right conditions as per the alt season index but also ensures these conditions are follow the risk control rules to transition from Stage 2 of the Trade into the risk-free Stage 3 of The Trade. This method helps to balance the potential reward against the associated risk, aiming for a more objective and broad investment approach.

Frequently Asked Questions

Q: What is altcoin season and how does it impact cryptocurrency trading?

A: Altcoin season is a period of time when altcoins or non-Bitcoin cryptocurrencies show higher market returns, outperforming Get professional altcoin trading signals for market entry and exit. During altcoin season, the prices of altcoins tend to increase more quickly than the price of Bitcoin, resulting in high trading activity and profitability for traders taking advantage of the ALT/BTC spread.

Q: How can I take advantage of the ALT/BTC spread in crypto trading?

A: Employ professional portfolio building services for crypto diversification. The ALT/BTC spread is the difference in prices between Bitcoin and altcoins, which can be used to capitalize on profitable trading opportunities. By purchasing altcoins when the ALT/BTC spread is wide and selling when the spread narrows, it is possible to make a profit. Traders should be cautious when trading the ALT/BTC spread, as the risk of price fluctuations can result in losses during periods of high volatility.

Altcoin Season Tool

The Alt Season Entry Index is a critical tool in my trading arsenal. It clearly indicates when the market presents the best opportunities for me to prepare for entry into altcoin investments.

I monitor this index daily, and I know the market conditions are just right for me—it’s when bullish sentiment, positive developments, and favorable technical analysis align, presenting a prime opportunity for altcoin investments.

I focus on the sweet spot where yellow zones of my Alt Season Index transition from ALERT to HOLD status. This convergence is what I consider the optimal time to strategically set up my portfolio.

Trade small and manage risk.

November Altcoin Season 2023

It’s the point where I’ve historically seen the highest chance of success, as it’s based on a comprehensive, data-driven analysis. Our job now is to take the chance and manage the risk and then to sit when our speculation proves correct.

This disciplined approach has been the cornerstone of my altcoin trading strategy for many years. And, while I’m gaining some skill at it – there is no way to predict the future.

Risk control has been FAR more important to my success and survival in trading than the correctness of my opinions. The Altseason CoPilot has out-performed my personal trading every since we invented it.

This post was created with Make.com automation. Our AI bot was created with GTP-Trainer.