I use 3commas trading bots and BitGet Copy Trading.

In uptrending, margin traded cryptocurrency markets, we can anticipate ‘the BOT SPIKE’ with a trailing buy order behind the price an up-trending market. Leaving a regular series of buy-orders far below the uptrending market is a good plan. These reverse spikes are sometimes referred to as ‘Institutional Stop Hunting’, and can happen on small time scale over small price ranges, or it can cascade into a much larger candle wick, similar to ‘The Popcorn Strategy’ but in reverse.

BOTS Can ‘See’ Big Data

Just as the markets are looking their very best, the bots all get together and they smash the price down – because they ‘SEE’. They literally see all the orders that are on the books – for all the various exchanges – all at the same time. They can ‘SEE’ when many people have long positions or short positions, and they can also see where the mass of stop-loss orders are set.

Coordinated Technology

When the timing is right, waves of fake news and social media promotion, and millions of dollars of orders come driving into the markets pushing it down – and at the same time, these bots will have placed orders below prices. Then they dump like crazy on all the markets, all at the same time, they break past everyone’s stop loss orders which drives the price down even more – right into the buy orders that the AI BOTS have placed.

Then the bots close their leveraged short positions and buy in again. Markets recover, different fake news is published and promoted via social media – and the trend continues. Thousands of small traders just transferred their coins and tokens to the AI BOTS, giving them more resources for the next opportunity.

Knowing about this pattern that is largely responsible for ‘Fakeout breakouts’, and ‘Bart Simpson Formations’, we can plan for it and use Rule #1 and Rule #2 to protect us against the negative effects, and by placing speculative orders to anticipate the timing of these sharp and very short term price manipulations.

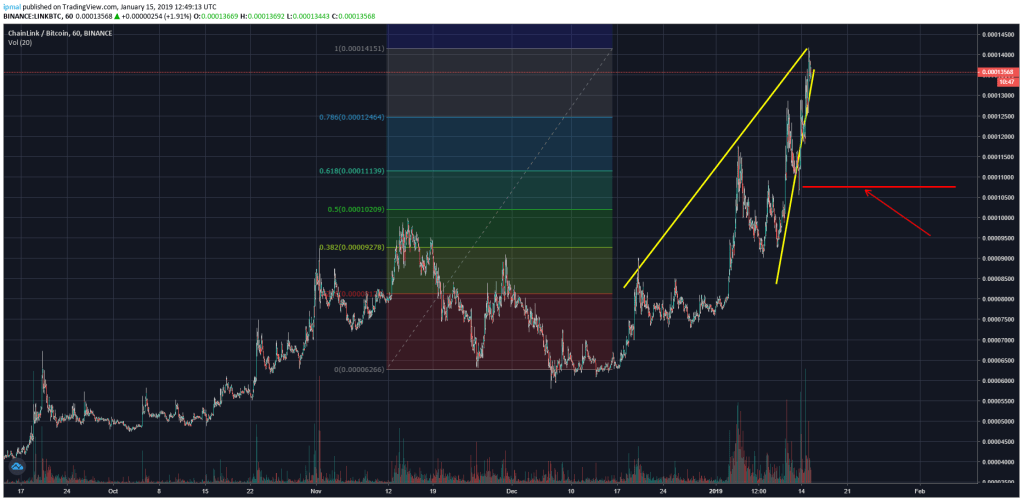

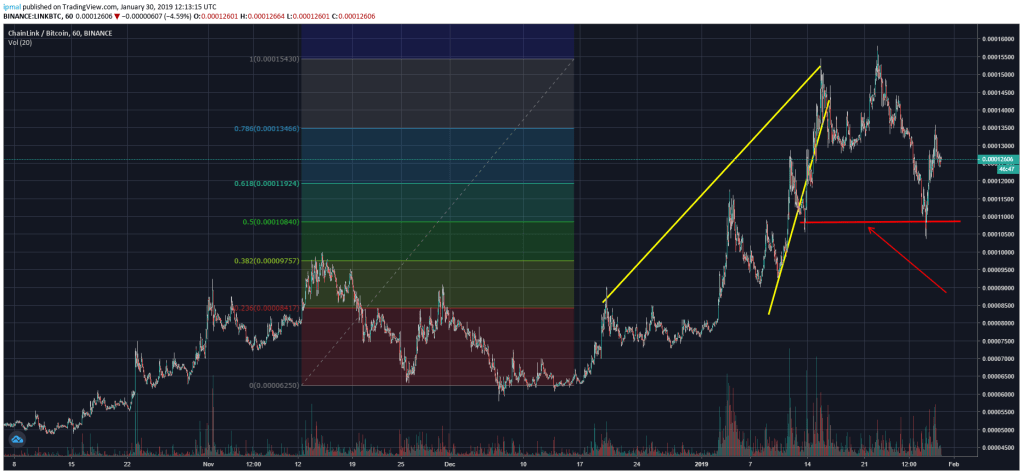

Slow Time Frame Example

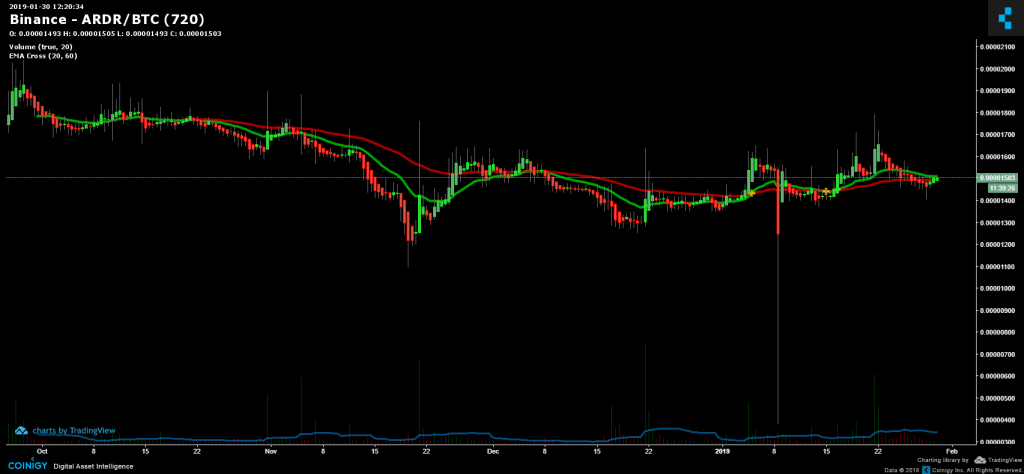

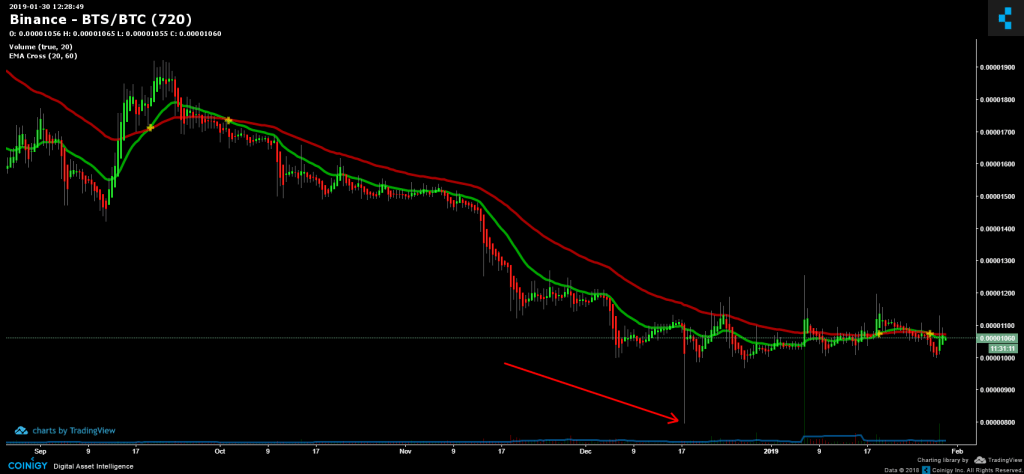

MORE Binance Manipulation in 2019

Below we can see NINE examples that were a relatively new pattern at that time.

Deep candle wicks down in prices have been observed in several markets on Binance, while other trading exchanges are not reporting these massive spikes downward at the same moment.

Why Binance? Isn’t it one of the highest volume exchanges?

The reason Binance is a good target for this reverse popcorn trading strategy, is because they limit the range of possible buy and sell orders. This makes it easy to calculate JUST how much is needed to break the market… and with BOT technology, one can act quickly enough to place new buy orders below previous restrictions as prices crash… soaking up all the stop loss and panic selling.