The AltSeason CoPilot report for 2023-10-26

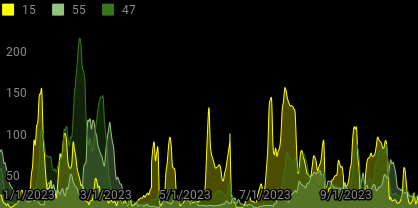

Bitcoin Dominance at a high while 3 Day RSI is peaking is a prime moment to watch for altcoins to start outperforming Bitcoin. (chart below)

We can trade crypto by the alt/usdt pairs. Sure.

But – when we review the ALT/USDT price chart against the BTC/USDT price chart, we can start to identify when it is better to hold Bitcoin, or when it is better to hold Altcoins.

And we can plot that data to SEE which coins we should be holding. As BTC Dominance tops out, cycle after cycle, the altcoins organize themselves for us.

We need only watch.

The following article was created based on our unique trading approach. Grab your copy of our Free crypto trading plan PDF and chat with our AI assistant instructor. Join thousands and learn to profit from trend trading.

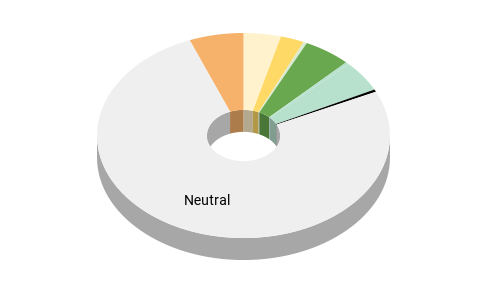

Sign up for the AltSeason CoPilot. Each day we manually review each altcoin/btc chart and we update the trade status as we rebalance our model portfolio from day to day. The pie char above is our Altseason Index.

The cryptocurrency market is an ever-evolving landscape, and as such, traders must stay on top of the latest trends and strategies to maximize their profits.

One of the most successful strategies is to

trade the ALT/BTC spread during altcoin seasons.

This is a period of time when the US Dollar value of altcoins, or cryptocurrencies other than Bitcoin, experience a surge in value and market capitalization at a faster pace than Bitcoin price. By trading the ALT/BTC spread during altcoin seasons, investors can take advantage of these price differences and increase their profits.

The AltSeason CoPilot is a powerful tool that traders can use to take advantage of altcoin seasons. Based on a proven crypto trading plan, the AltSeason CoPilot includes risk control strategies and focuses on identifying long-term trends for altcoins and taking advantage of portfolio diversification. It is designed to help traders maximize their profits by trading the ALT/BTC spread while minimizing risk.

By focusing on the ALT/BTC spread and taking advantage of

portfolio diversification, traders can

benefit from explosive moves in the hottest cryptocurrency markets

while minimizing risk in those coins that have not follow through.

The AltSeason CoPilot is based on the principle that altcoins tend to outperform Bitcoin during altcoin seasons.

⫸⫸ Live Bitcoin Dominance Chart

This is because a decrease in Bitcoin dominance, which means that Bitcoin’s market capitalization as a percentage of the total cryptocurrency market cap is declining, is often a sign of an altcoin season.

USDT Dominance Chart

Stable coins are also a key indicator of an altcoin season, as a decrease in stable coin dominance is bullish because it may suggest that investors are feeling more confident in the market and are willing to take on more risk by investing into crypto again.

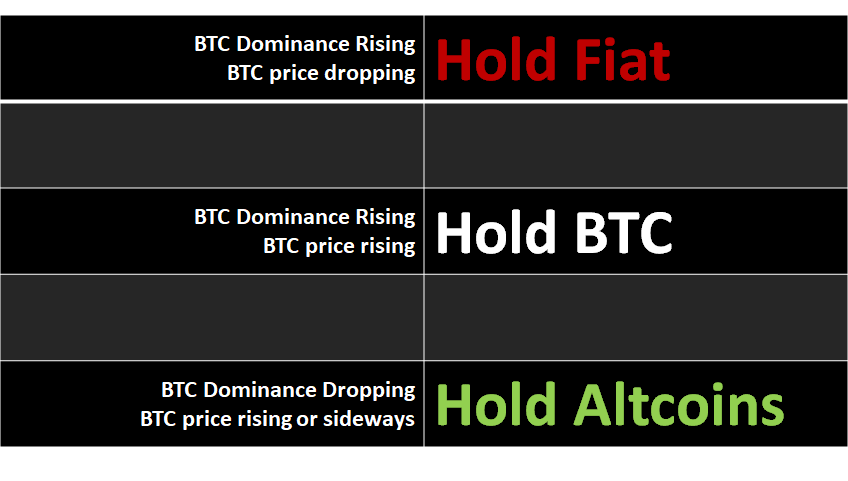

The AltSeason CoPilot also provides traders with a daily action matrix that helps them identify the best opportunities in the cryptocurrency market.

By focusing on the ALT/BTC spread, traders can take advantage of a wider range of opportunities while keeping risks low.

This is because traders can take smaller position sizes and spread their portfolio across multiple cryptocurrencies.

Overall, the AltSeason CoPilot is a powerful tool that traders can use to take advantage of altcoin seasons and maximize their profits. With the help of the AltSeason CoPilot, traders can stay ahead of the game and make the most out of their investments.

Frequently Asked Questions

Q: What is altcoin season and how does it impact cryptocurrency trading?

A: Altcoin season is a period in which the price of altcoins (such as Ethereum, Ripple, and Litecoin) tends to dramatically increase relative to Bitcoin (BTC) and the larger cryptocurrency market. At the same time, the volume of altcoin trading increases significantly as traders seek to capitalize on the opportunity. Altcoin season typically provides an opportunity for traders to profit from the price differences between altcoins and Bitcoin, as well as the spread between cryptocurrencies and tokens.

Q: How can I take advantage of the ALT/BTC spread in crypto trading?

A: During an altcoin season, traders can attempt to take advantage of the ALT/BTC spread by buying and selling altcoins and tokens on exchanges. This spread is created by the price differentials between Bitcoin and the various altcoins/tokens, and it allows investors to potentially capture gains when the price of the altcoin rises relative to Bitcoin. Additionally, traders can use limit orders to take advantage of intraday price movements.

Q: What are the risk control strategies I should consider when trading altcoins?

A: When trading altcoins, it is important for traders to employ risk control strategies to ensure that they do not overexpose themselves to the volatility associated with altcoin season. Strategies that should be considered include position sizing, stop-loss orders, entry/exit points, and risk diversification. Additionally, traders should only commit capital that they can afford to lose and should always assess each trade on a case-by-case basis before investing.

This post was created with Make.com automation. Our AI bot was created with GTP-Trainer.