Exactly because of the difficulties in the crypto financial sector, we believe regulations will bring a new boom to crypto.

We’ll explain why, and reveal cryptocurrency projects to watch in 2023 as key business sectors will be disrupted by the power of smart contract technology.

In the past year, the cryptocurrency financial sector has seen a series of catastrophic failures. As a result, the sector watchdogs have faced a fair share of criticism at their foot-dragging and lack of regulatory clarity and oversight. However, the implementation of regulations in the cryptocurrency financial sector is not a hindrance, but rather an opportunity for transparency that will permit healthy growth and trusted mainstream adoption.

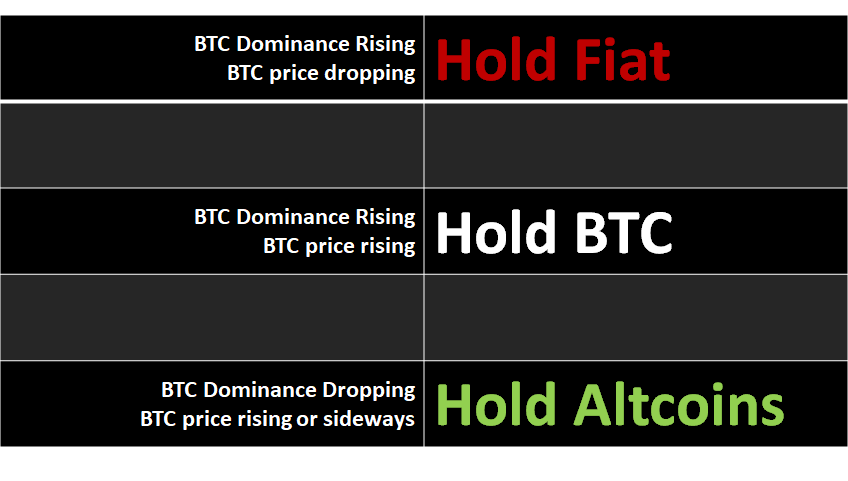

It is important to maintain a positive outlook, but this should be coupled with a clear crypto trading plan to manage risks and achieve success.

Crypto Goes Transparent

One of the main criticisms of the cryptocurrency financial sector is its lack of transparency and accountability. Without proper regulations, it can be difficult for investors to trust the integrity of cryptocurrency transactions and exchanges. This lack of trust has deterred many potential investors from entering the market.

On the other hand, the implementation of regulations can help to build trust and confidence in the cryptocurrency financial sector. By establishing clear guidelines and standards for cryptocurrency exchanges and transactions, regulators can provide a sense of security for investors. This, in turn, can attract a wider range of investors and bring new capital into the market.

In addition to increasing trust, regulations can also help to prevent fraudulent activity and protect consumers. The decentralized nature of cryptocurrencies makes it difficult to track and prosecute fraudulent activity. However, with the implementation of regulations, authorities can more easily identify and prosecute those who engage in fraudulent activity within the cryptocurrency financial sector.

Business Advantages

Another advantage of regulations is that they can encourage mainstream adoption of the advantages business efficiencies afforded by cryptocurrency technologies like Smart Contracts.

As more and more businesses and financial institutions begin to accept cryptocurrencies as a legitimate form of payment, the demand for cryptocurrencies will increase. This increased demand will lead to a boom in the cryptocurrency financial sector, as more people and businesses look to invest in and use cryptocurrencies.

Disruption To Invest In

So, what industries are likely to be disrupted by the adoption of cryptocurrency smart contracts? Here are three top contenders:

- Real Estate: Smart contracts have the potential to revolutionize the way we buy and sell real estate. Currently, the process of buying and selling real estate can be lengthy and complex, involving numerous intermediaries such as lawyers, brokers, and banks. With smart contracts, the process can be streamlined and made more efficient. Smart contracts can automate the transfer of ownership and facilitate the exchange of funds, making the process faster and more secure.

- Supply Chain Management: Smart contracts can also be used to improve the efficiency and transparency of supply chain management. By using smart contracts, businesses can track the movement of goods and ensure that all parties involved in the supply chain are fulfilling their obligations. This can help to reduce the risk of fraud and improve overall efficiency.

- Insurance: The insurance industry is another area that could be disrupted by the adoption of smart contracts. Smart contracts can be used to automate the claims process, making it faster and more efficient. They can also be used to ensure that policyholders receive the coverage they are entitled to in a timely manner. Overall, the adoption of smart contracts in the insurance industry has the potential to improve the customer experience and increase trust in the industry.

Cryptocurrency Projects to Watch in 2023

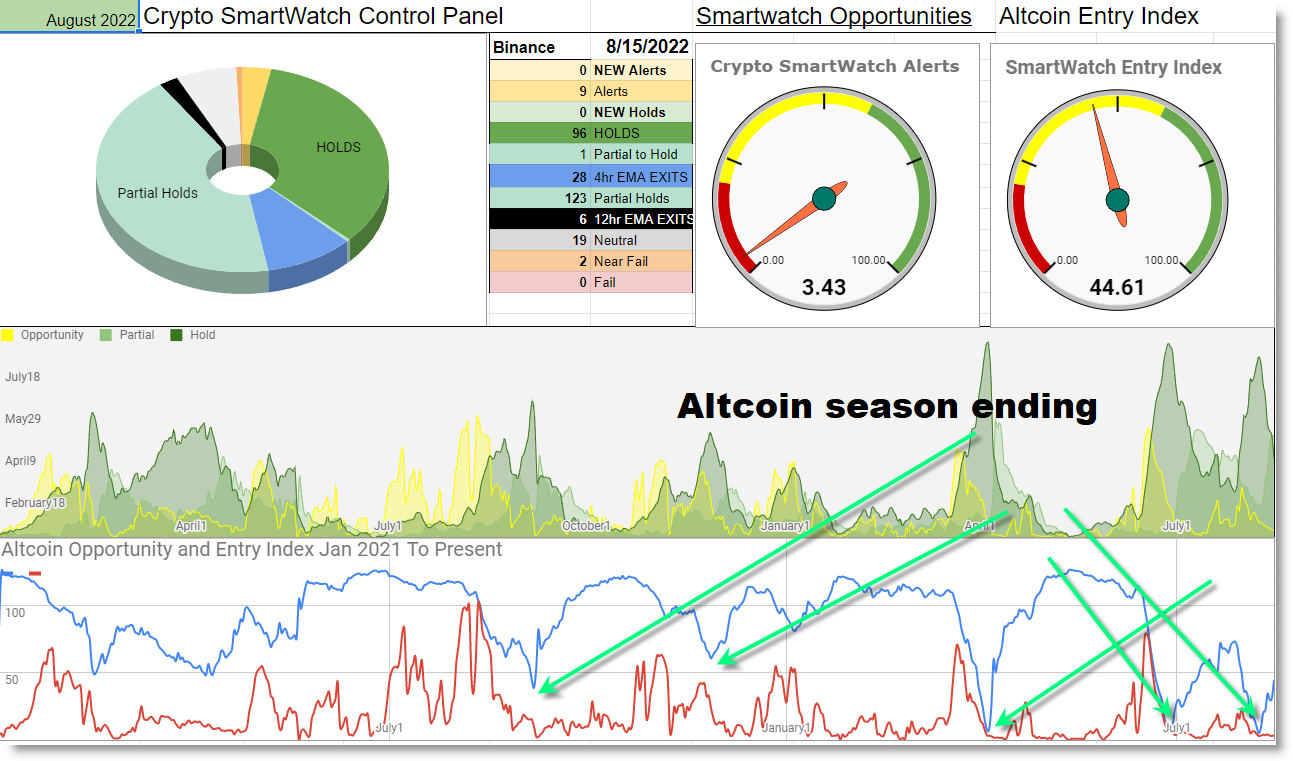

The Crypto SmartWatch monitors over 300 crypto currency price charts and the projects listed below may not be included in our data – but our trading plan can be applied to any market. Projects below are listed for reference to examples of potential industry disruptions and not as a recommendations for the potential of the specific projects.

Real Estate

Lets take a look at a few cryptocurrency projects in the real estate industry:

- Propy: Propy is a cryptocurrency project that is focused on revolutionizing the real estate industry. The platform allows users to buy and sell real estate properties using cryptocurrency and utilizes smart contracts to streamline the process.

- Find a list of projects in the Real Estate Industry

Supply Chain Management

Lets take a look at a few cryptocurrency projects in the supply chain management industry:

- VeChain: VeChain is a cryptocurrency project that utilizes blockchain technology to improve supply chain management. The platform allows businesses to track the movement of goods through the supply chain and ensure that all parties involved are fulfilling their obligations.

- Waltonchain: Waltonchain is a cryptocurrency project that utilizes a combination of blockchain technology and the Internet of Things (IoT) to improve supply chain management. The platform allows businesses to track the movement of goods in real-time and improve the efficiency of their supply chain operations.

Insurance

Lets take a look at a few cryptocurrency projects in the insurance industry:

- Etherisc: Etherisc is a cryptocurrency project that utilizes blockchain technology and smart contracts to improve the insurance industry. The platform allows users to purchase insurance policies and make claims using cryptocurrency. Etherisc aims to make the claims process faster and more efficient by automating the process using smart contracts.

- Nexus Mutual: Nexus Mutual is a decentralized insurance platform that utilizes smart contracts to provide coverage for Ethereum smart contracts. The platform allows users to purchase coverage for their smart contracts and make claims in the event that their smart contract experiences a failure or malfunction. Nexus Mutual aims to provide a more transparent and efficient alternative to traditional insurance, and has gained a reputation for being a reliable and trustworthy provider of smart contract insurance. Overall, Nexus Mutual is a solid cryptocurrency project that aims to disrupt the traditional insurance industry.

- Infinity Project: INFINITY PROJECT is a cryptocurrency project that aims to provide insurance for crypto portfolios. The platform utilizes smart contracts and artificial intelligence to assess the risk of crypto portfolio investments and offer customized insurance coverage. INFINITY PROJECT aims to provide peace of mind for crypto investors by offering a safety net in the event of unexpected market fluctuations

Regulations will bring a new boom to crypto

In conclusion, the implementation of regulations in the cryptocurrency financial sector is not a hindrance, but rather an opportunity for growth and mainstream adoption. Regulations can increase trust and confidence in the market, prevent fraudulent activity, and encourage mainstream adoption. Additionally, cryptocurrency smart contracts have the potential to disrupt a number of industries, including real estate, supply chain management, and insurance. As the adoption of cryptocurrencies and smart contracts continues to grow, we can expect to see a new boom in the cryptocurrency financial sector.

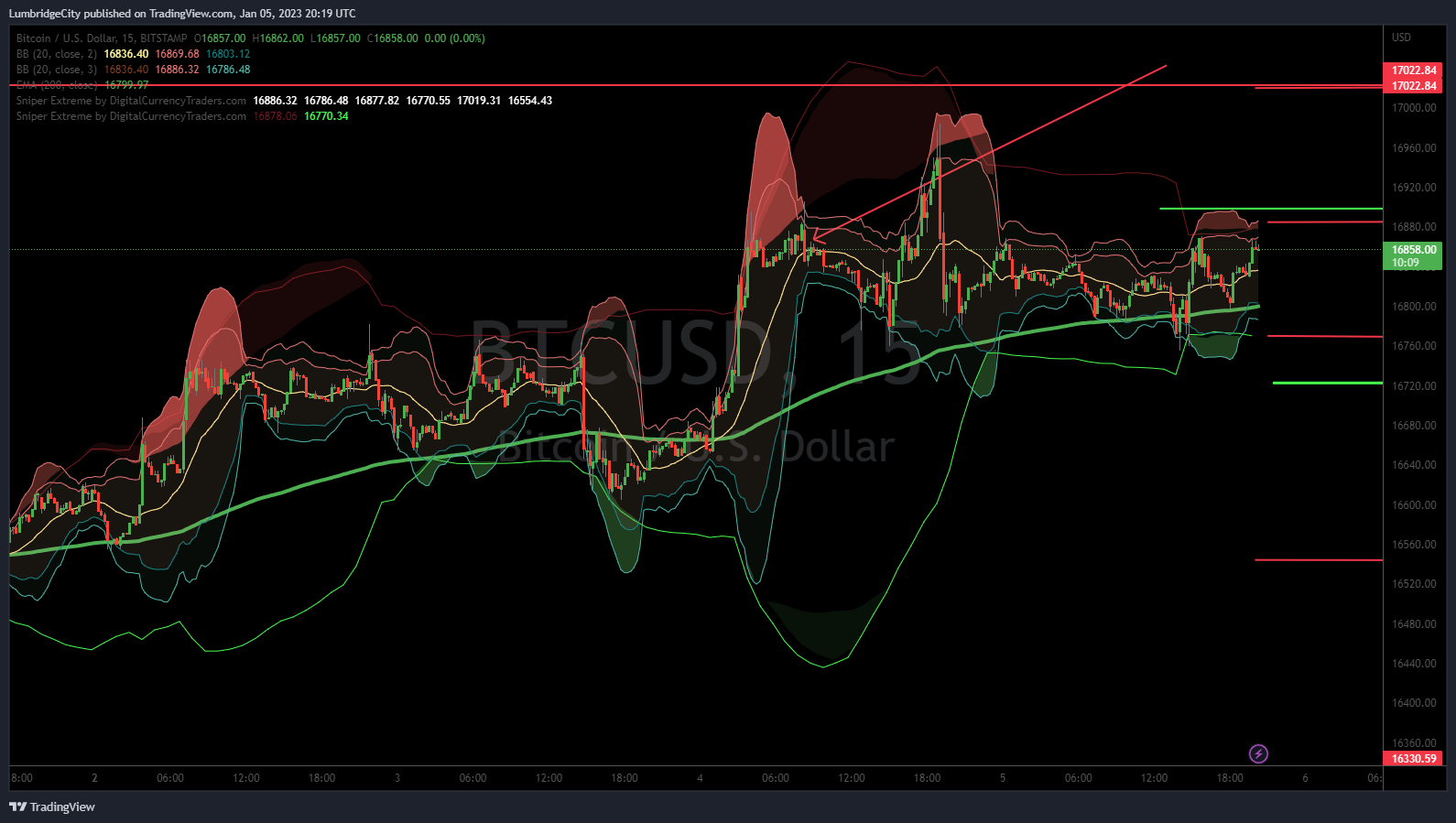

While a healthy dose of optimism can be a valuable asset, it should not be a substitute for a clear plan for investing in crypto. Optimism alone is not enough to ensure success. Without a clear plan for the correct time to invest in any crypto project, like our proven Crypto SmartWatch, it is difficult to set specific goals, measure progress, and make informed decisions. A clear trading plan helps to provide a roadmap for success and good risk control rules can help to reduce the size of setbacks and pitfalls.

With a plan like the Crypto SmartWatch, it is easy to learn crypto trading on your own and remain on focus and to keep sight of the end goal.